1. Form EA

Annual income statement prepared by company to employees for tax submission purpose

Deadline: 28.02.2025

2. CP 58

Commission / fees statement prepared by company to agents, dealers & distributors

Deadline: 31.03.2025

3. Form E

Form used by company to declare employees status and their salary details to LHDN

Deadline: 31.03.2025 (30.04.2025 for e-filing)

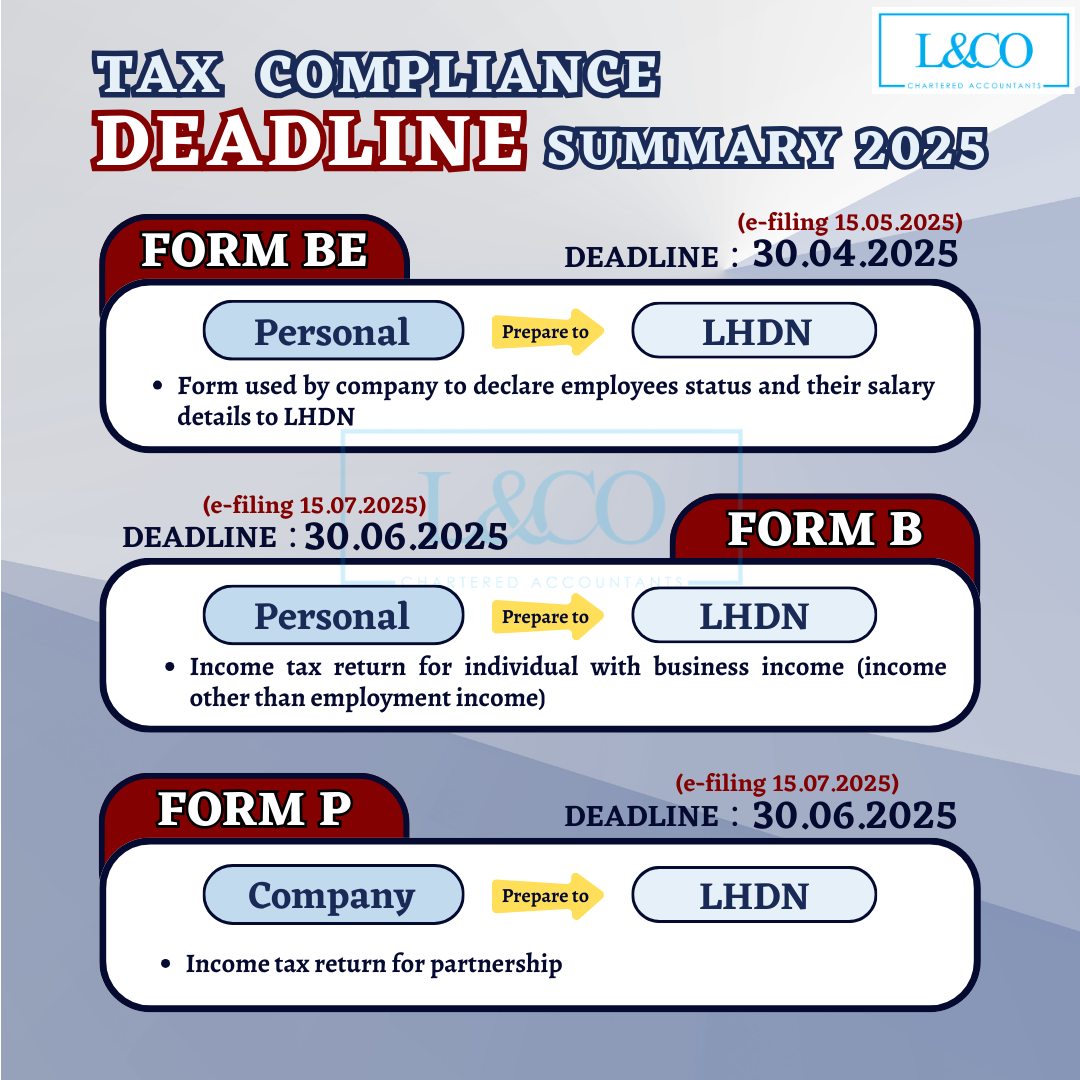

4. Form BE

Income tax return for individual who only received employment income

Deadline: 30.04.2025 (15.05.2025 for e-filing)

5. Form B

Income tax return for individual with business income (income other than employment income)

Deadline: 30.06.2025 (15.07.2025 for e-filing)

6. Form P

Income tax return for partnership

Deadline: 30.06.2025 (15.07.2025 for e-filing)

7. Form C

Income tax return for companies

Deadline: 7 months after financial year end (8 months for e-filing)

8. Form PT

Income tax return for LLP

Deadline: 7 months after financial year end (8 months for e-filing)

FAQs for Malaysia Income Tax Submission

Yes, we advise you to declare 𝐍𝐢𝐥 income in Malaysia (𝑒𝑠𝑝𝑒𝑐𝑖𝑎𝑙𝑙𝑦 𝑓𝑜𝑟 𝑡ℎ𝑜𝑠𝑒 𝑤ℎ𝑜 𝑟𝑒𝑔𝑖𝑠𝑡𝑒𝑟𝑒𝑑 𝑤𝑖𝑡ℎ 𝐿𝐻𝐷𝑁)

Exemption of foreign sourced income for individual taxpayers will be implemented until 2026.

If you stay for more than 182 days in Malaysia (Malaysia tax resident),

- Submit Form BE if you have employment income only

- Submit Form B if you have business income

- If you stay for less than 182 days in Malaysia (Non Malaysia tax resident), Submit Form M

- Employment income / director fee

- Business income

- Rental income

- Any income generated from Malaysia

You need to submit 𝐅𝐨𝐫𝐦 𝐁, and include both source of income.

Cannot, as Form P is for partnership income declaration but the income tax for each partners will be charged under Form B based on profit received.

If you received salary from Sdn Bhd, submit Form BE. Dividend will be taxed under company tax

Dividend will be taxed under company tax

Contact LHDN / do amendment via mytax.

Cannot, tax submission is on yearly basis, you might be imposed penalty if there is late submission/payment.

You may refer to this article for the LHDN Penalty Details

(201706002678 & AF 002133)

(201706002678 & AF 002133)