,

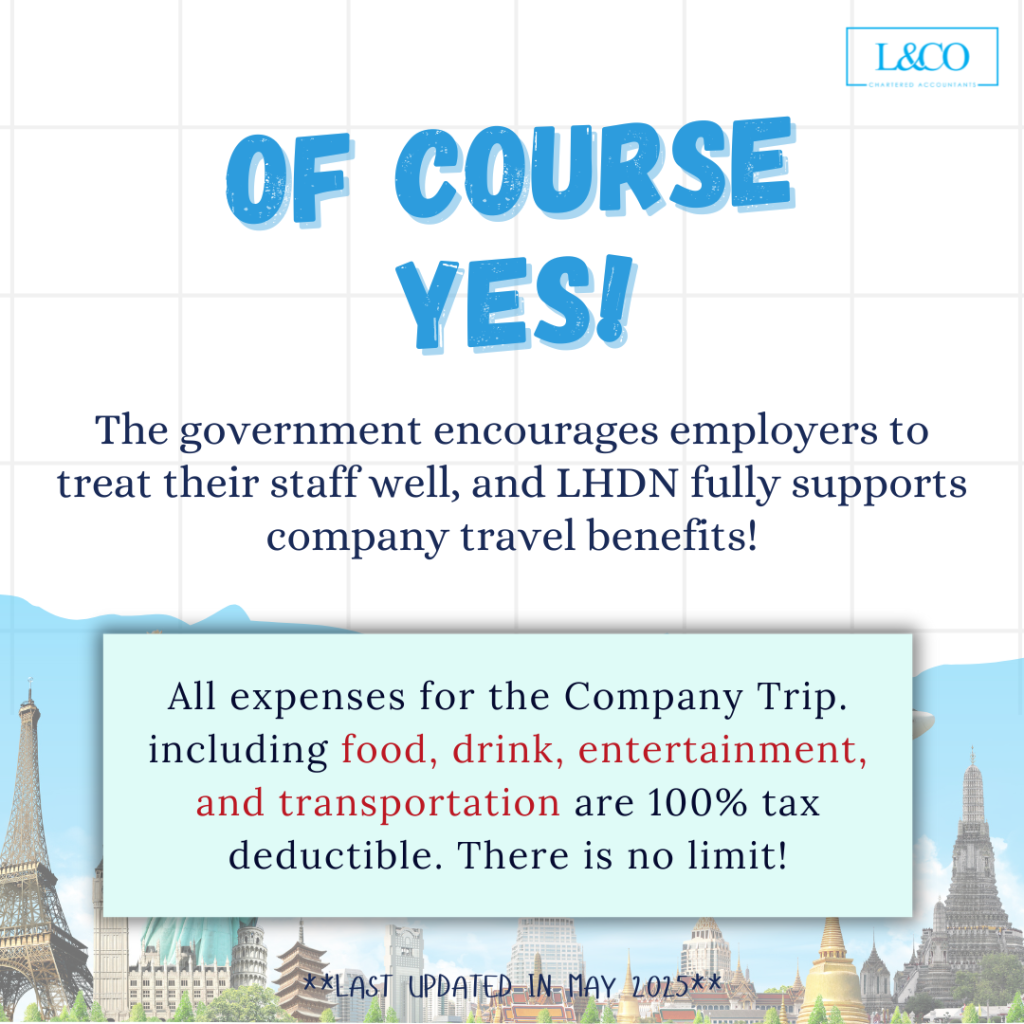

Good news! Taking your employees on local trips—food, fun, and transport included—can be 100% tax deductible.

The government encourages employers to treat their staff well, and LHDN fully supports company travel benefits!

Here’s some tax deduction information for company trip expenses:

Just meet these 3 conditions to enjoy 100% tax deduction:

1️⃣ Once a year only

2️⃣ Destination must be within Malaysia

3️⃣ Costs must be reasonable, not excessive

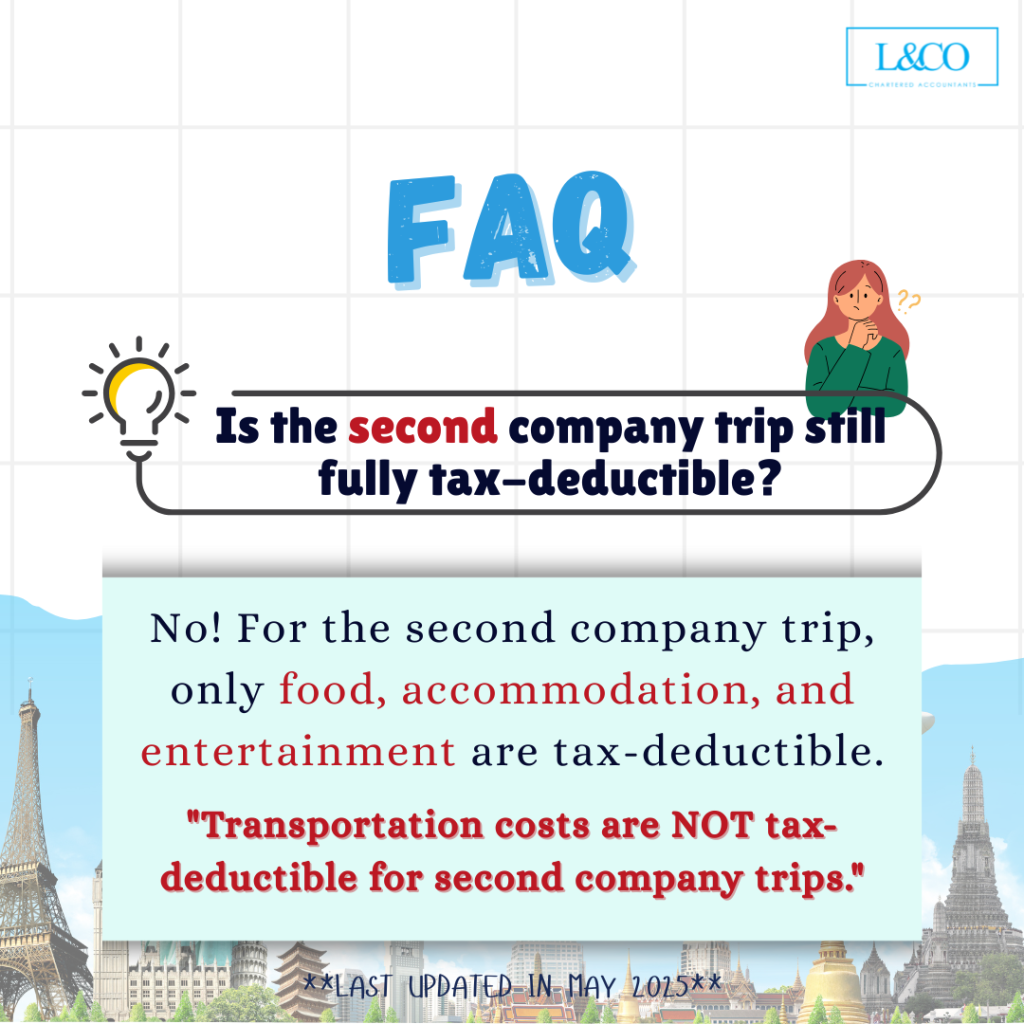

Second local trip: ❌ Transport not deductible, ✅ meals, accommodations & entertainments still count!

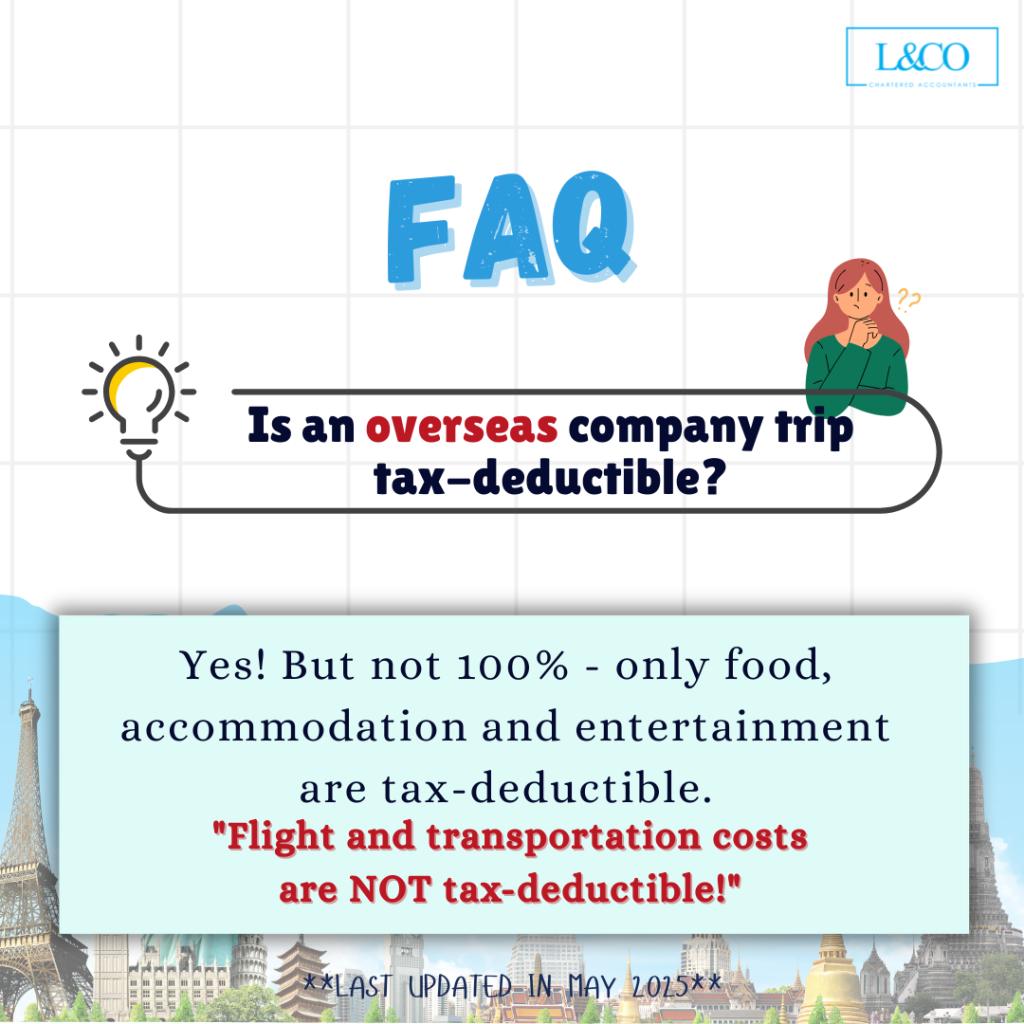

Overseas team building: ❌ Flights & transport not deductible, ✅ meals, accommodations & entertainments still count!

🔹 Use training as a purpose: Link the itinerary to skill development and business goals

🔹 Spend wisely: Avoid unnecessary expenses, keep all receipts

🔹 Consult a pro: Let our tax consultants guide you—no worries about LHDN audits!

✔️ Create a clear team-building plan with links to business objectives

✔️ Keep all receipts & activity records for future reference

✔️ Planning a large or complex trip? Consult first—save on tax and avoid hassle!

**Last Updated in May 2025**

(201706002678 & AF 002133)

(201706002678 & AF 002133)