𝐖𝐡𝐚𝐭’𝐬 𝐧𝐞𝐰 𝐢𝐧 𝐭𝐡𝐞 𝐥𝐚𝐭𝐞𝐬𝐭 𝐠𝐮𝐢𝐝𝐞𝐥𝐢𝐧𝐞 𝐮𝐩𝐝𝐚𝐭𝐞? 𝐋𝐞𝐭’𝐬 𝐟𝐢𝐧𝐝 𝐨𝐮𝐭 👇

e-Invoice changes implementation date again and again?! On June 16, 2025, LHDN released the latest e-Invoice guidelines, bringing relief to many SMEs! Let’s take a look at what’s new in the latest version of the guidelines!

𝐅𝐫𝐞𝐪𝐮𝐞𝐧𝐭 𝐀𝐬𝐤𝐞𝐝 𝐐𝐮𝐞𝐬𝐭𝐢𝐨𝐧𝐬

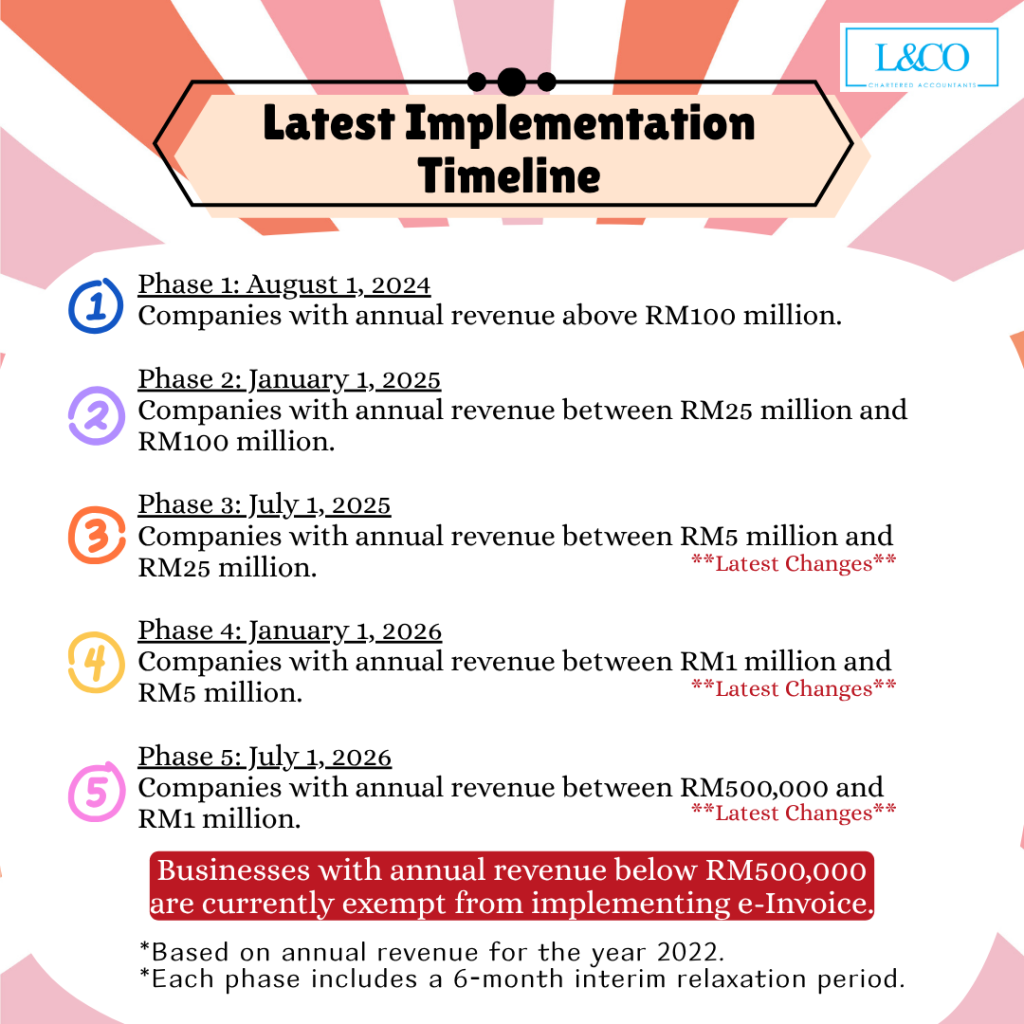

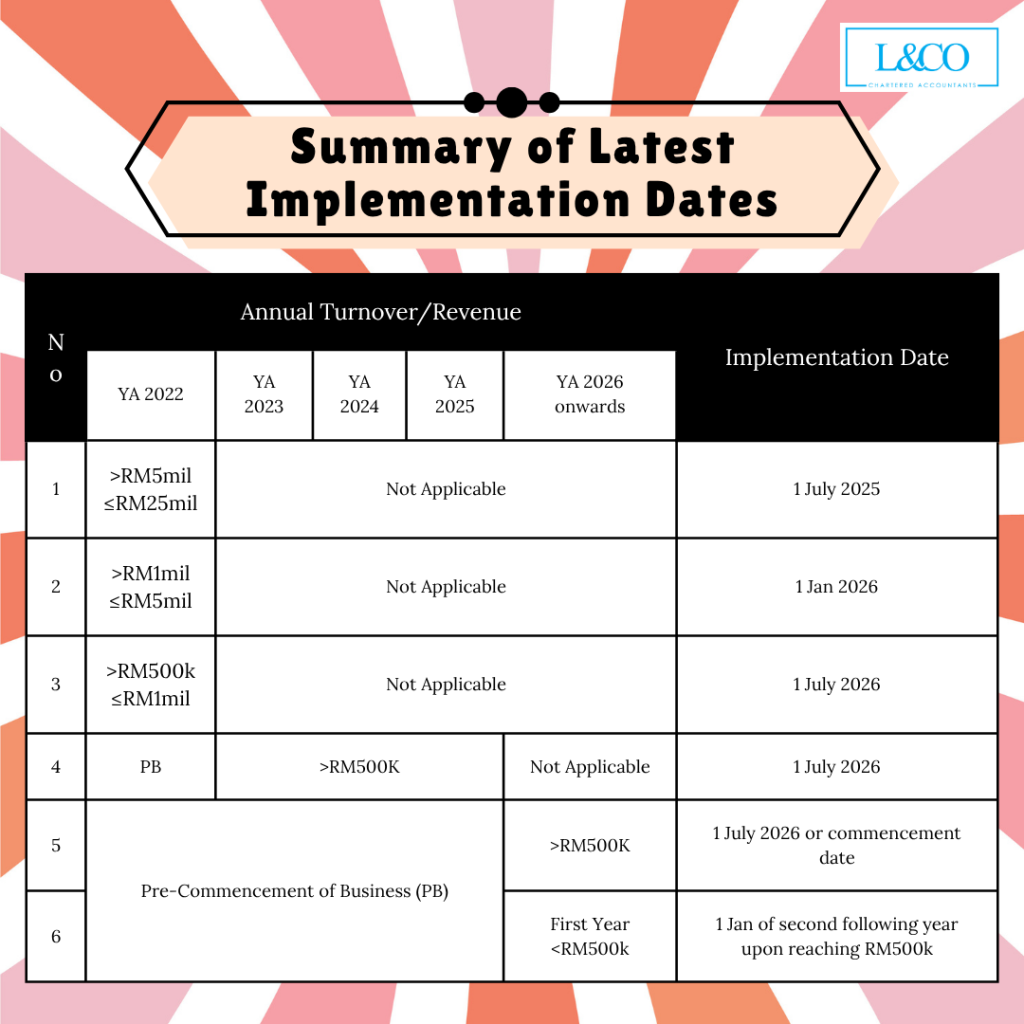

Phase 1: August 1, 2024

Companies with annual revenue above RM100 million.

.

Phase 2: January 1, 2025

Companies with annual revenue between RM25 million and RM100 million.

.

Phase 3: July 1, 2025

Companies with annual revenue between RM5 million and RM25 million.

.

Phase 4: January 1, 2026

Companies with annual revenue between RM1 million and RM5 million.

.

Phase 5: July 1, 2026

Companies with annual revenue between RM500,000 and RM1 million.

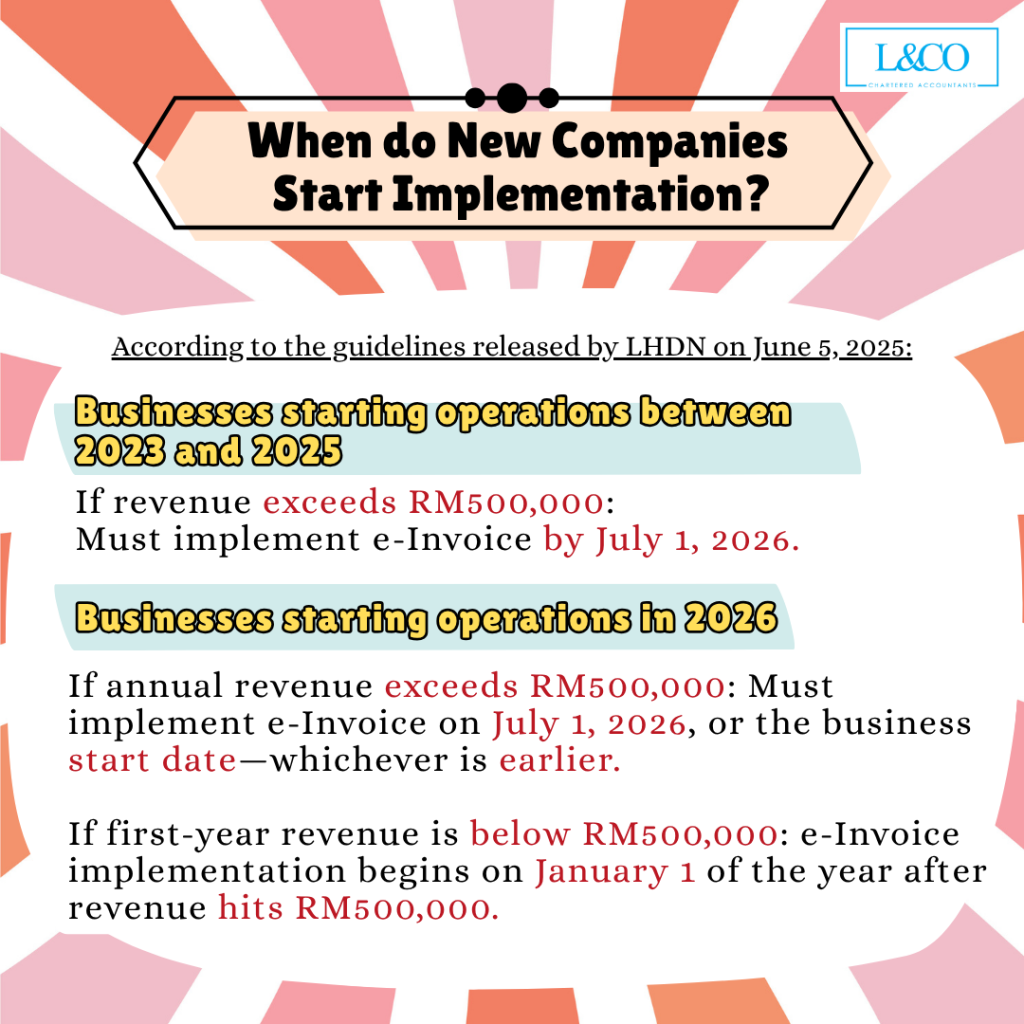

According to the guidelines released by LHDN on June 5, 2025:

Businesses starting operations between 2023 and 2025:

If annual revenue exceeds RM500,000: Must implement e-Invoice by July 1, 2026.

.

Businesses starting operations in 2026:

– If annual revenue exceeds RM500,000: Must implement e-Invoice on July 1, 2026, or the business start date—whichever is earlier.

– If first-year revenue is below RM500,000: e-Invoice implementation begins on January 1 of the year after revenue hits RM500,000.

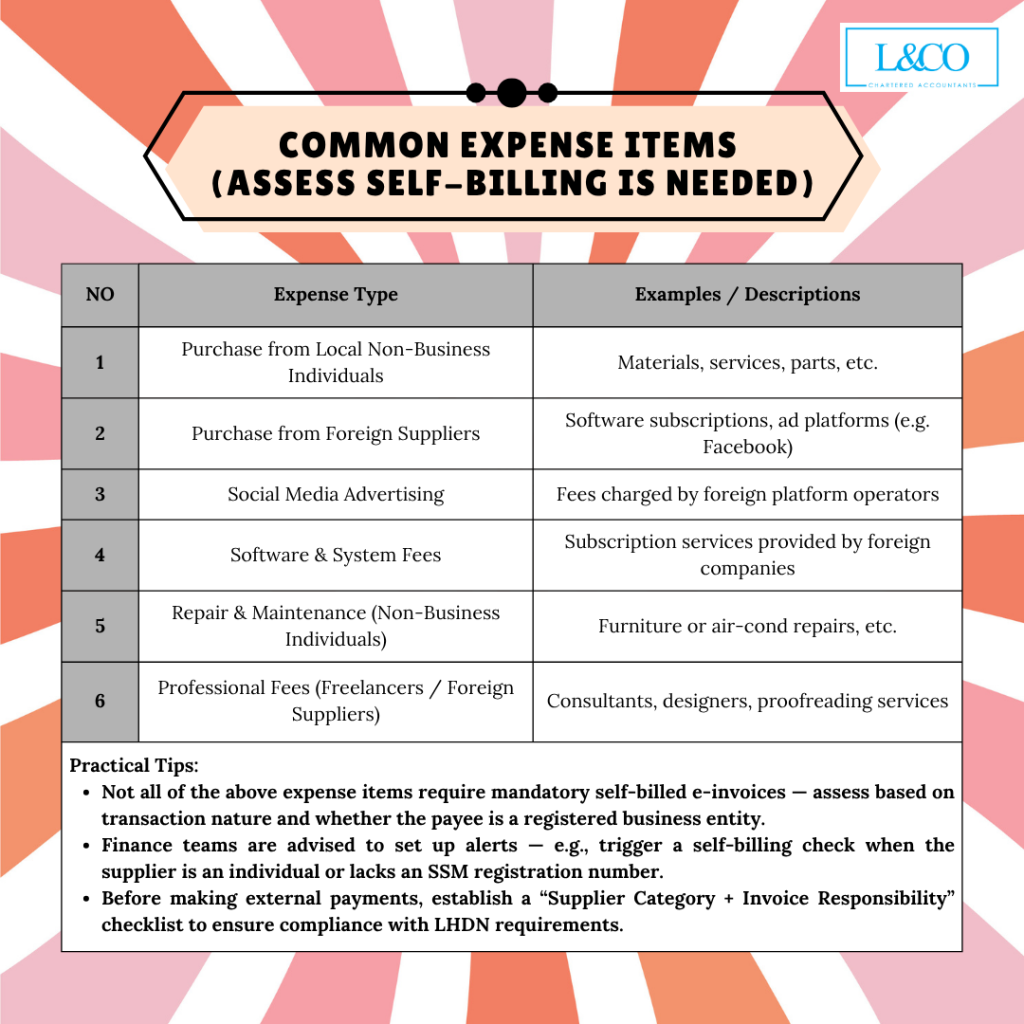

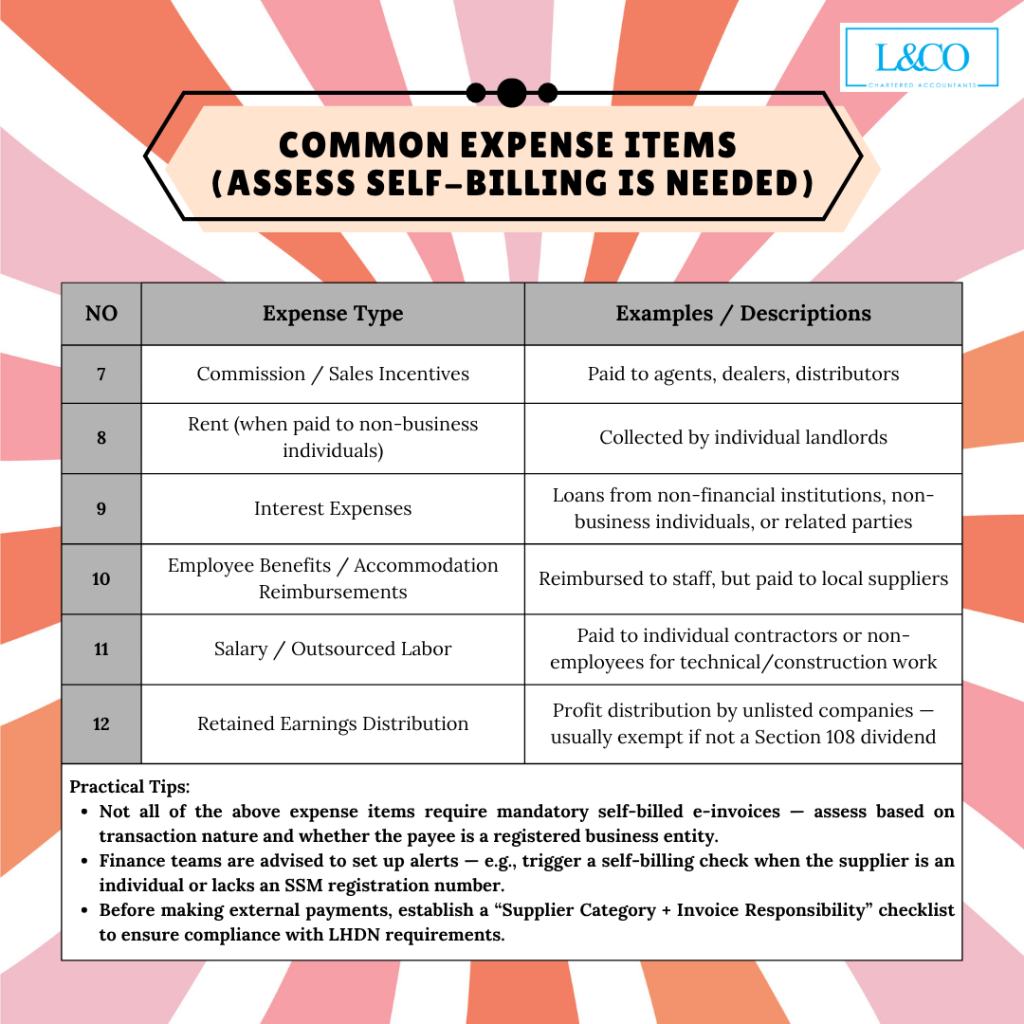

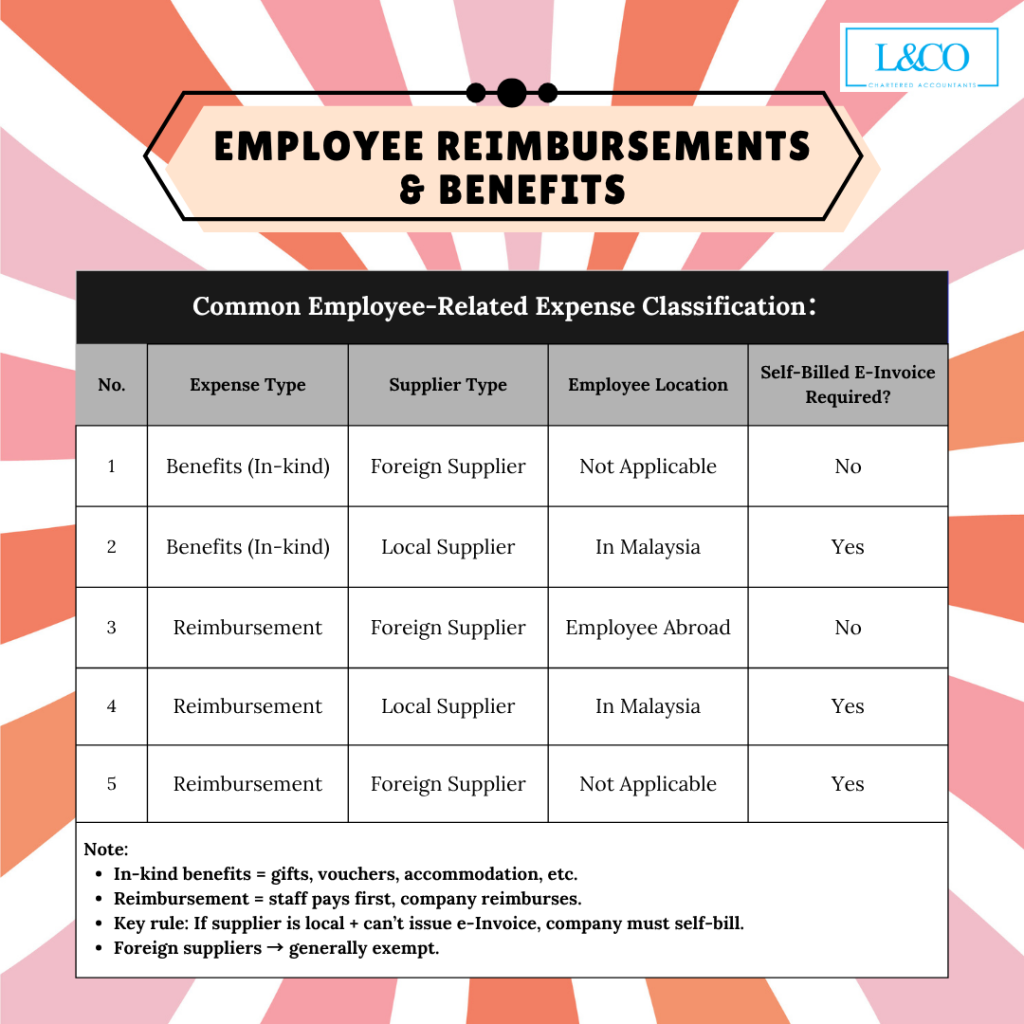

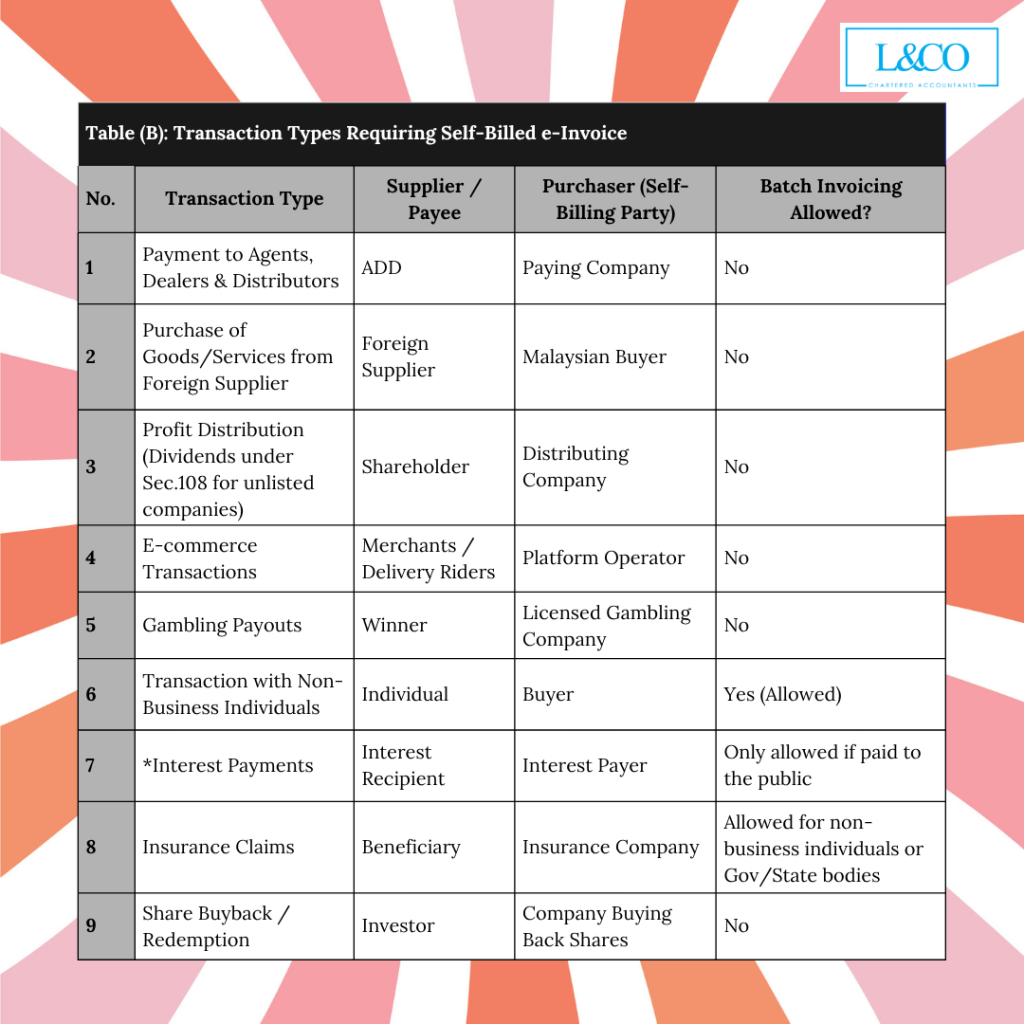

According to LHDN’s e-Invoice Guidelines, when the supplier is unable or unwilling to issue an e-Invoice, the buyer (i.e. the business) is required to submit a Self-Billed e-Invoice.

Below are common expense categories that often require self-billed e-Invoices — finance teams are advised to pay close attention:

According to LHDN’s e-Invoice Guidelines, when the supplier is unable or unwilling to issue an e-Invoice, the buyer (i.e. the business) is required to submit a Self-Billed e-Invoice.

Below are common expense categories that often require self-billed e-Invoices — finance teams are advised to pay close attention:

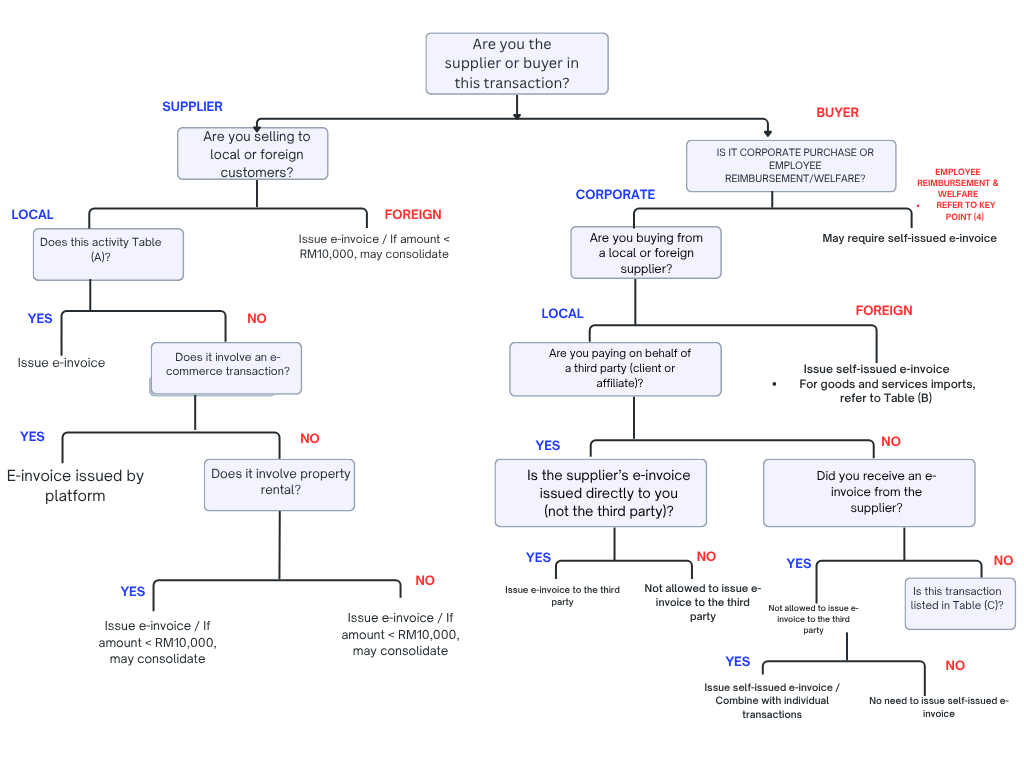

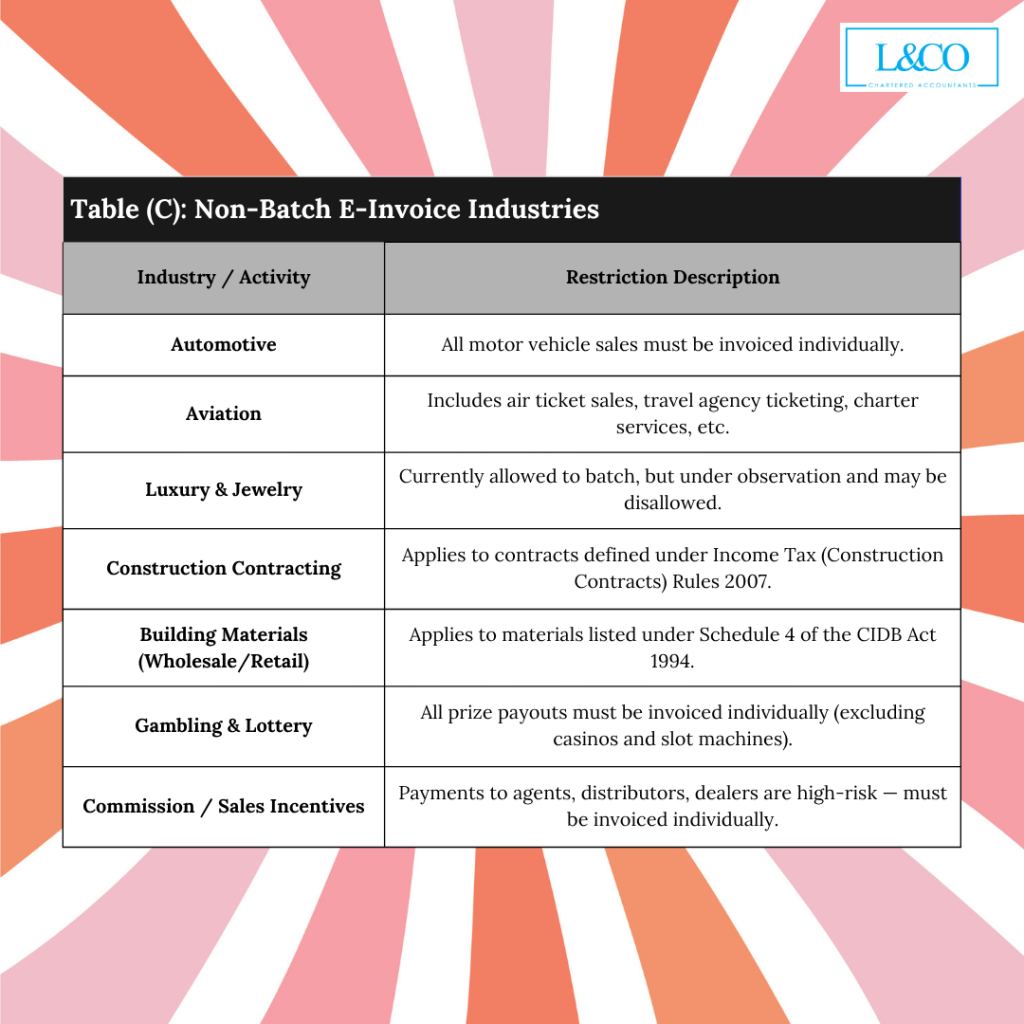

To help businesses quickly determine whether to issue or self-issue an e-Invoice, the following flowchart serves as a reference for procurement, finance, and admin teams..

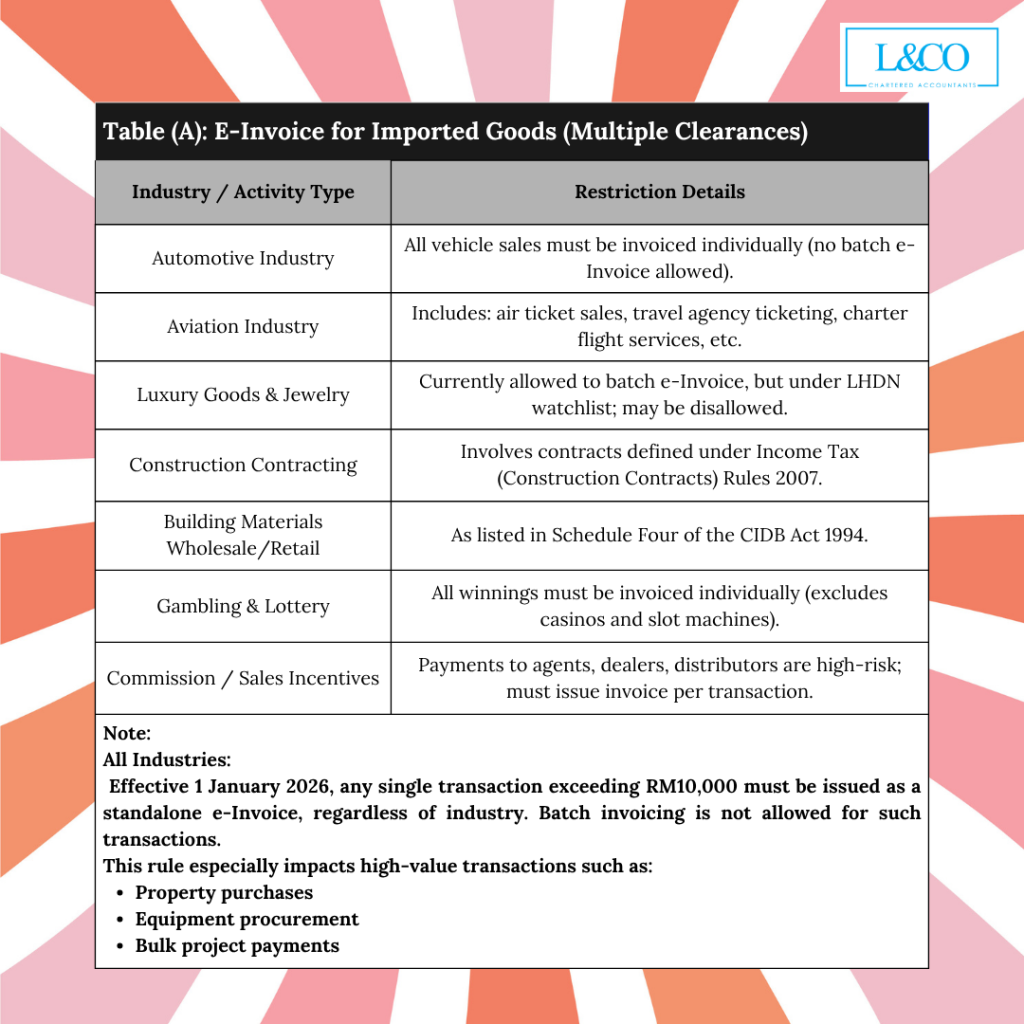

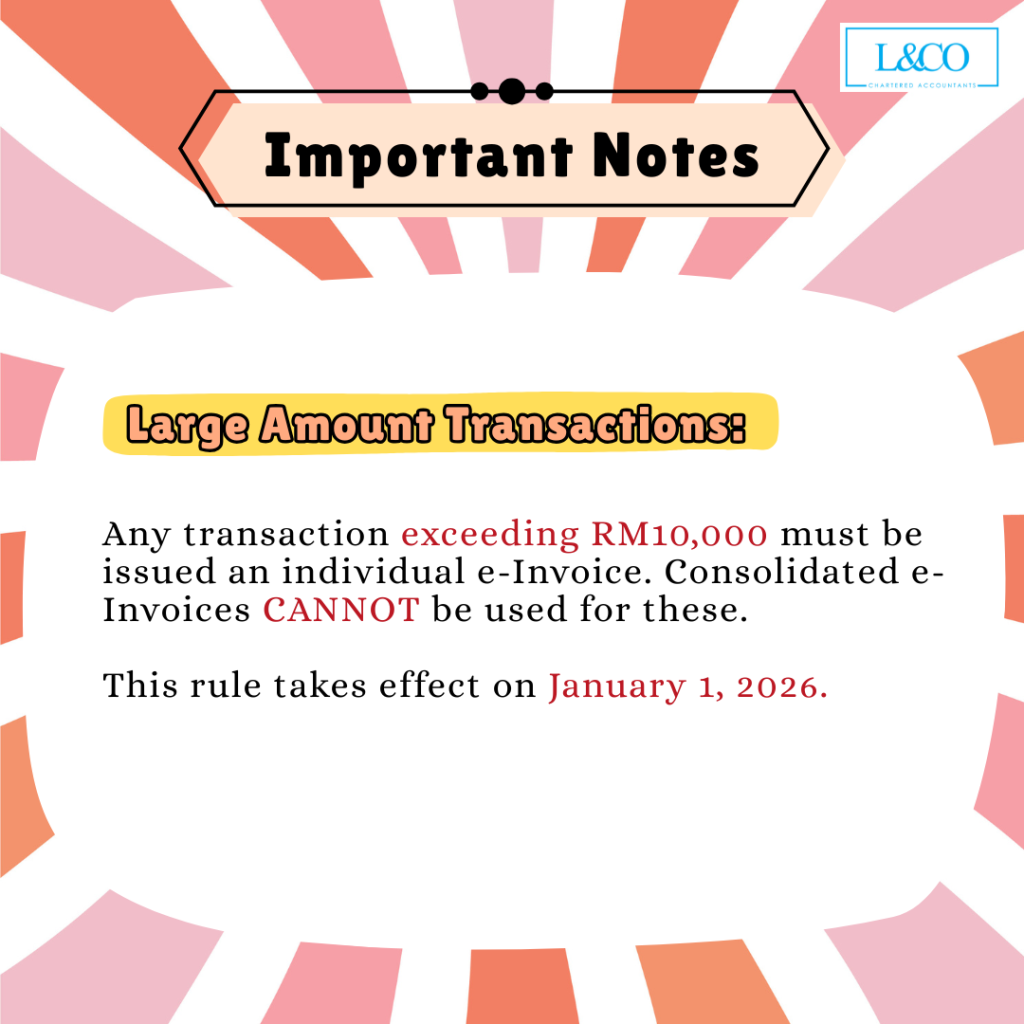

Any transaction exceeding RM10,000 must be issued an individual e-Invoice. Consolidated e-Invoices CANNOT be used for these.

This rule takes effect on January 1, 2026.

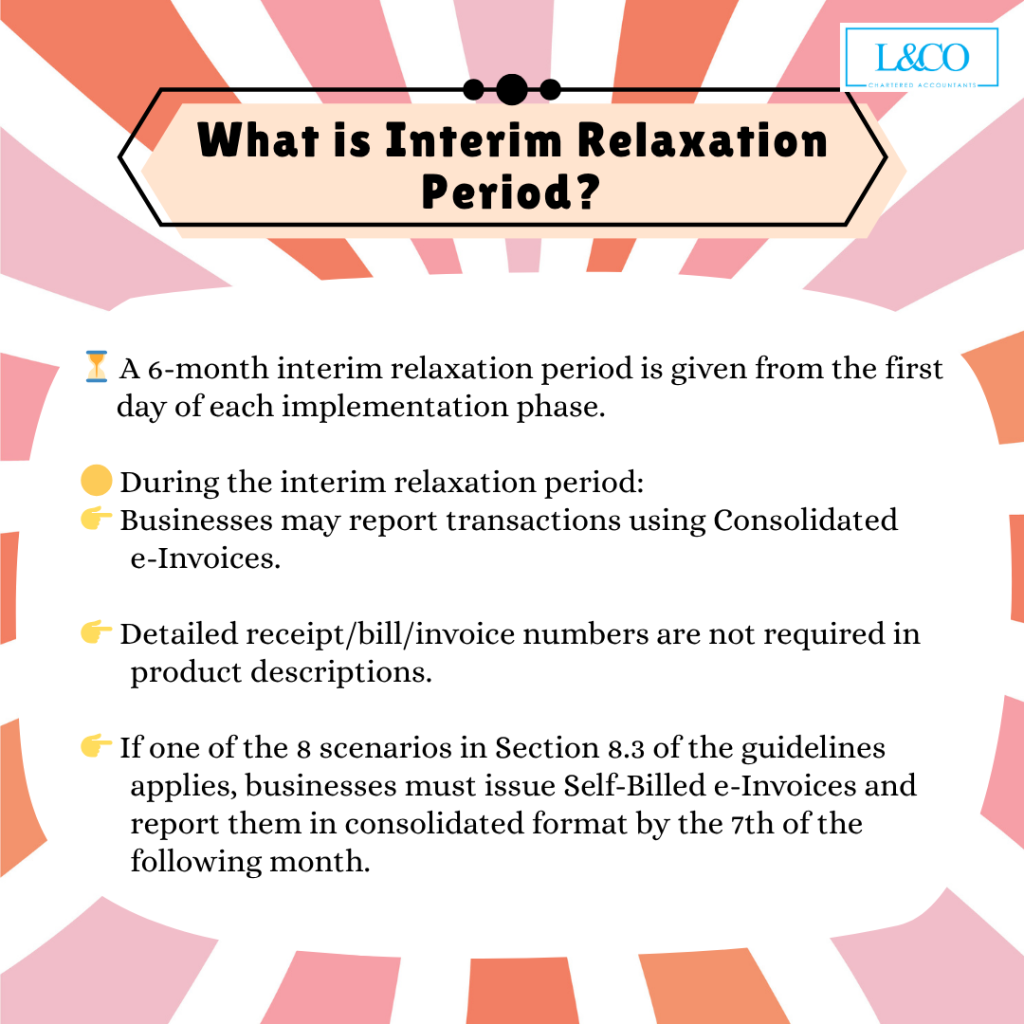

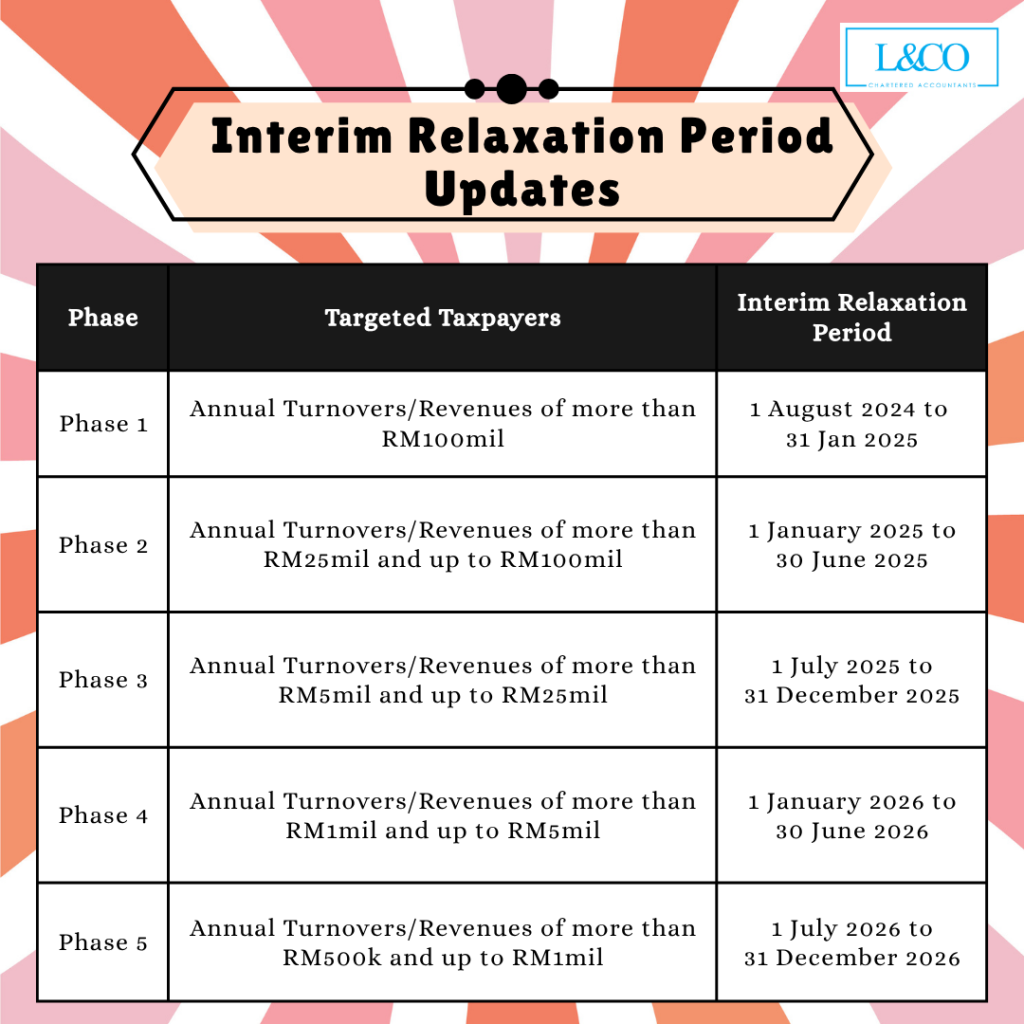

A 6-month interim relaxation period is given from the first day of each implementation phase.

During the interim relaxation period:

👉 Businesses may report transactions using Consolidated e-Invoices.

👉 Detailed receipt/bill/invoice numbers are not required in product descriptions.

👉 If one of the 8 scenarios in Section 8.3 of the guidelines applies, businesses must issue Self-Billed e-Invoices and report them in consolidated format by the 7th of the following month.

Phase 1 (Annual revenue > RM100 million):

Interim Relaxation Period: Aug 1, 2024 – Jan 31, 2025

.

Phase 2 (Annual revenue > RM25 million):

Interim Relaxation Period: Jan 1, 2025 – Jun 30, 2025

.

Phase 3 (Annual revenue > RM5 million):

Interim Relaxation Period: Jul 1, 2025 – Dec 31, 2025

.

Phase 4 (Annual revenue > RM1 million):

Interim Relaxation Period: Jan 1, 2026 – Jun 30, 2026

.

Phase 5 (Annual revenue ≤ RM1 million):

Interim Relaxation Period: Jul 1, 2026 – Dec 31, 2026

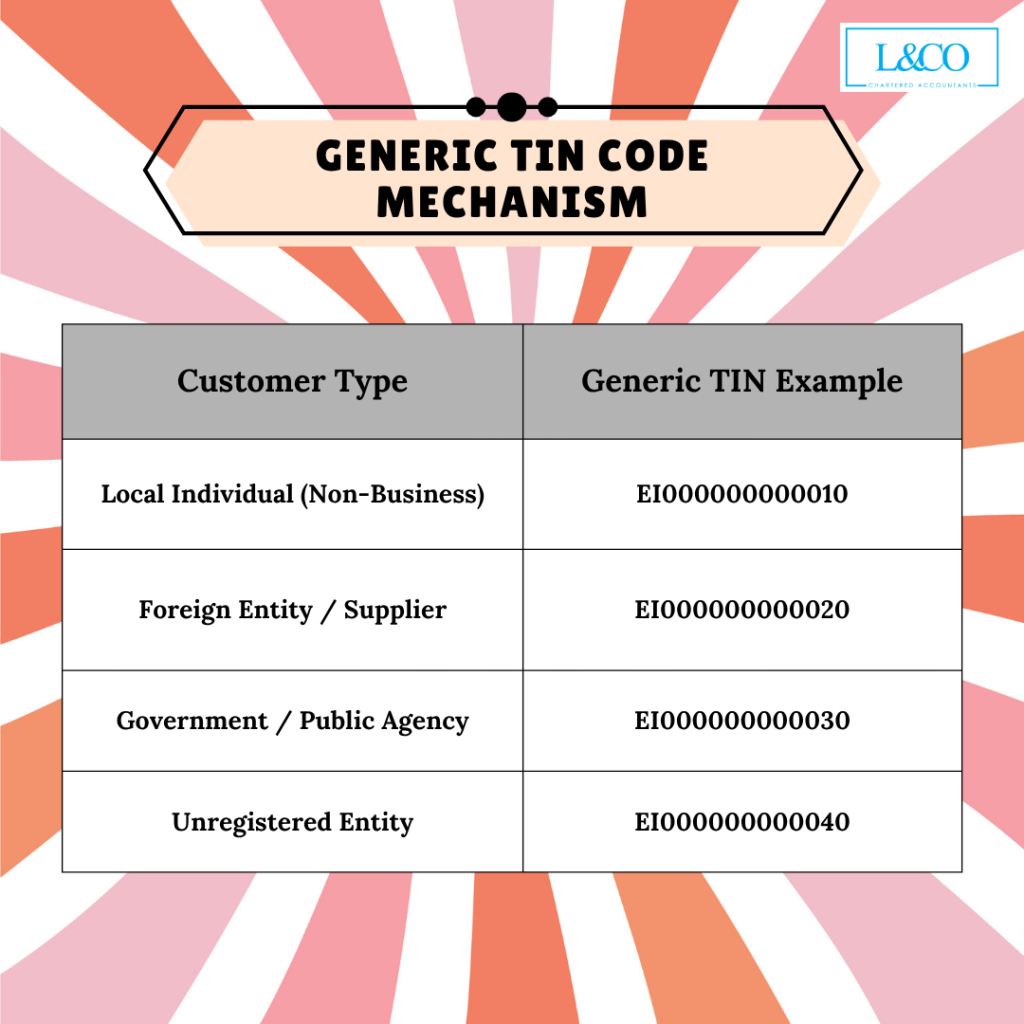

Businesses may encounter customers without a TIN, especially in the case of: Individual consumers, foreign entities, government bodies, or unregistered organizations.

To handle this, LHDN has introduced a “Generic TIN Code” system, which allows sellers to issue e-Invoices under these scenarios.

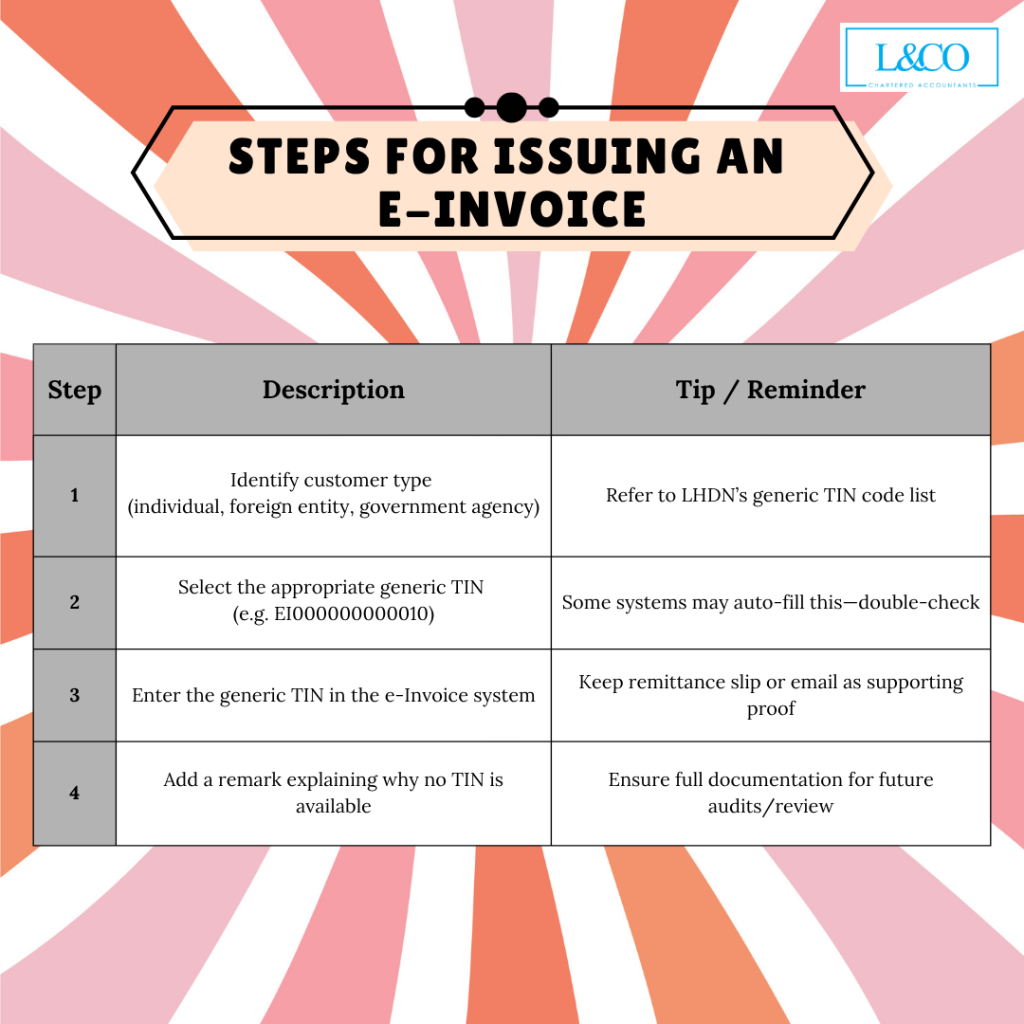

If You’re Unsure How to Issue an E-Invoice, Please Refer to the Quick Guide Below

**Last Updated on 09.06.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)