【𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝 𝐈𝐭 𝐢𝐧 𝟏 𝐌𝐢𝐧𝐮𝐭𝐞】𝐒𝐭𝐞𝐩-𝐛𝐲-𝐒𝐭𝐞𝐩 𝐆𝐮𝐢𝐝𝐞 𝐭𝐨 𝐒𝐒𝐓 𝐎𝐧𝐥𝐢𝐧𝐞 𝐑𝐞𝐭𝐮𝐫𝐧 & 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐒𝐮𝐛𝐦𝐢𝐬𝐬𝐢𝐨𝐧

Master your MySST tax submission in just 6 simple steps — from login to payment, all in one go!

Submission Steps

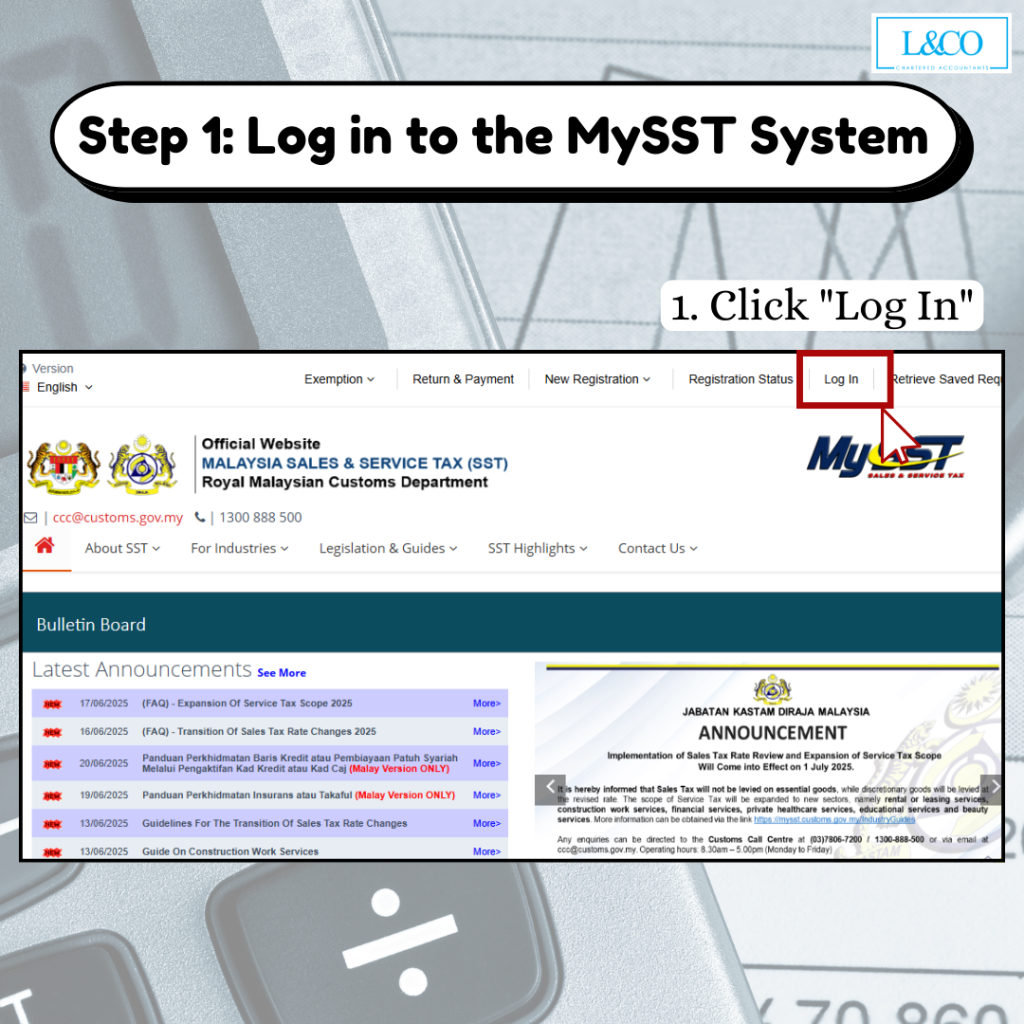

Step 1: Log in to the MySST System

- Click on “Log In”

- Enter your account information to log in

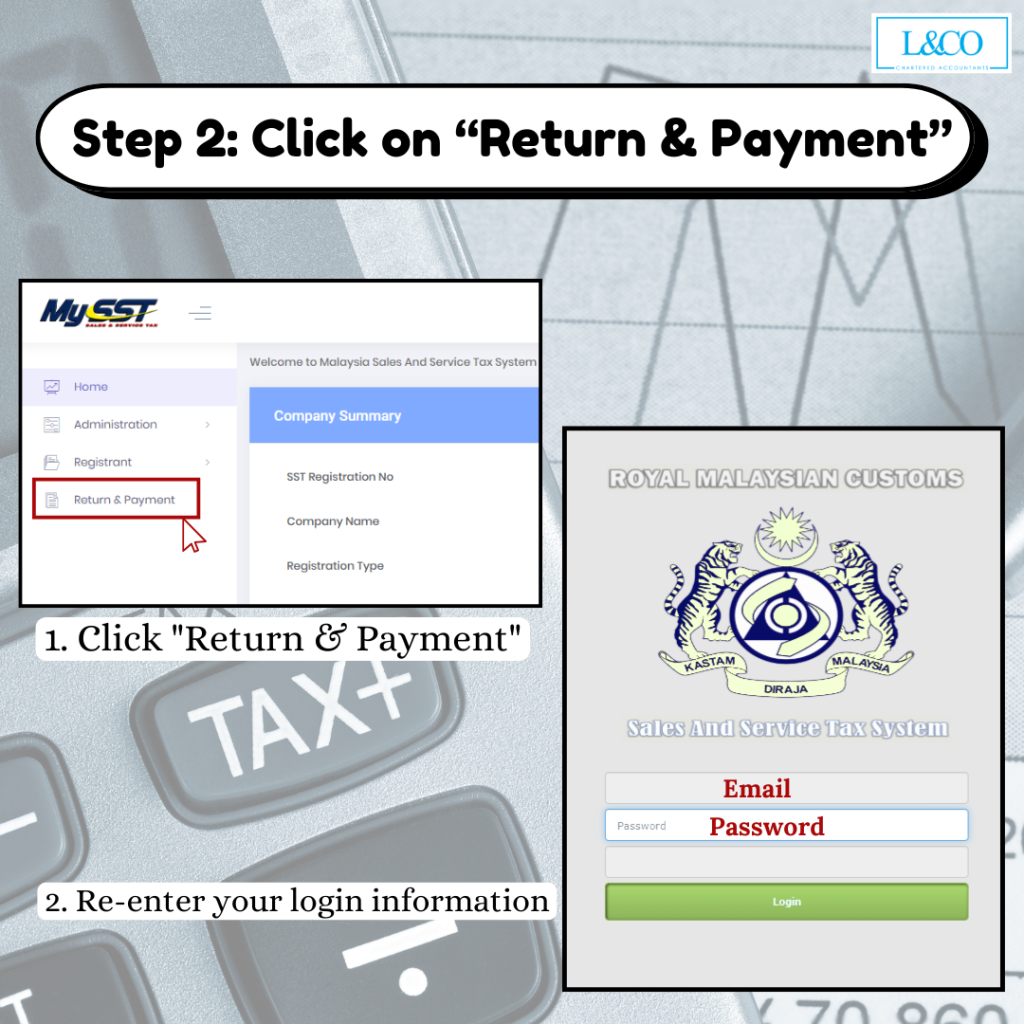

Step 2:Click on “Return & Payment”

- Re-enter your login information to proceed.

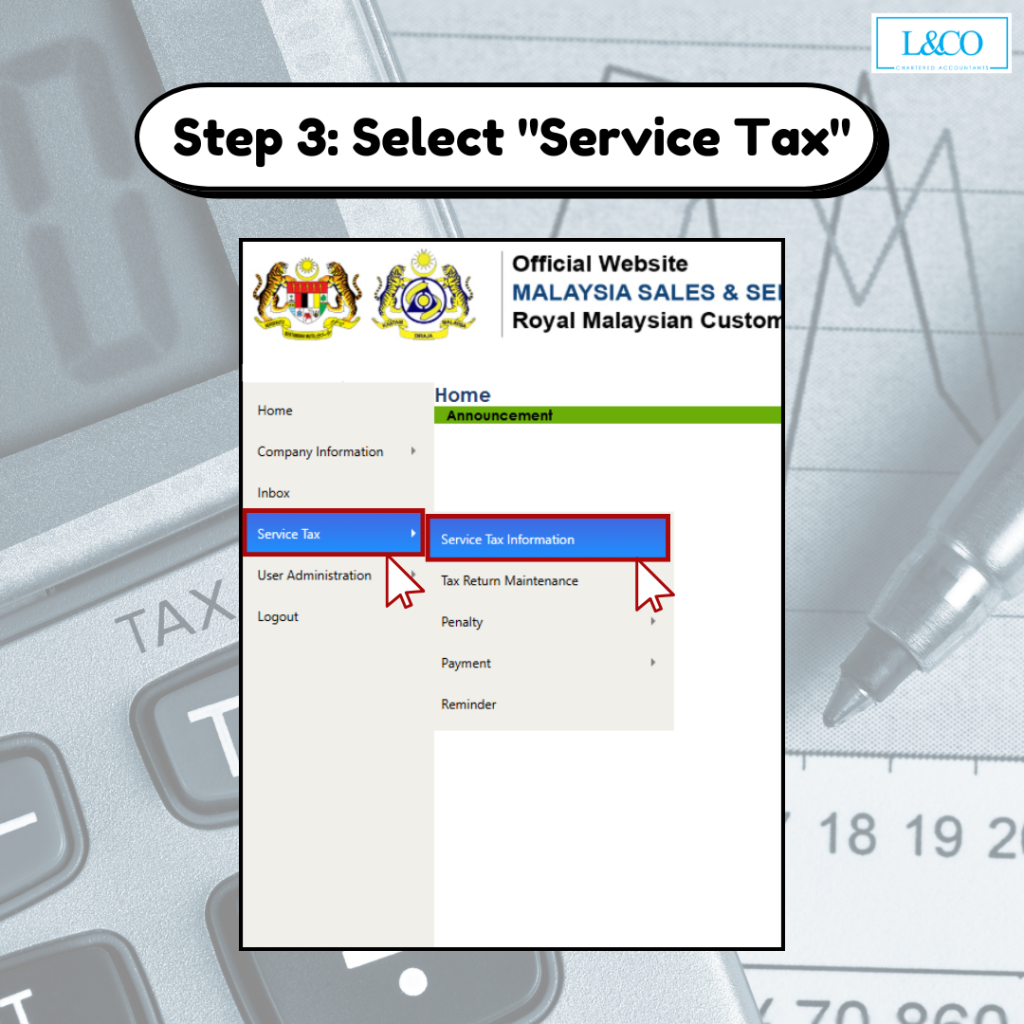

Step 3:Select “Service Tax”

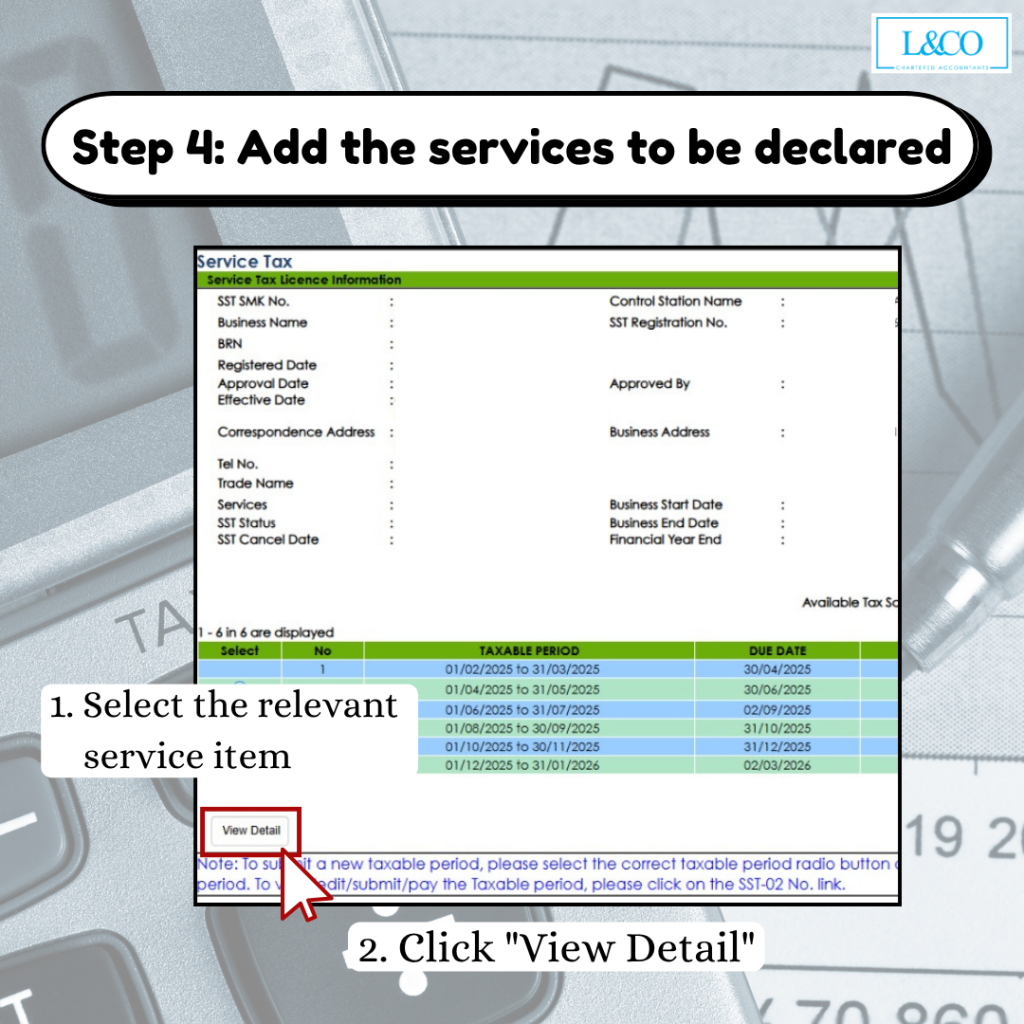

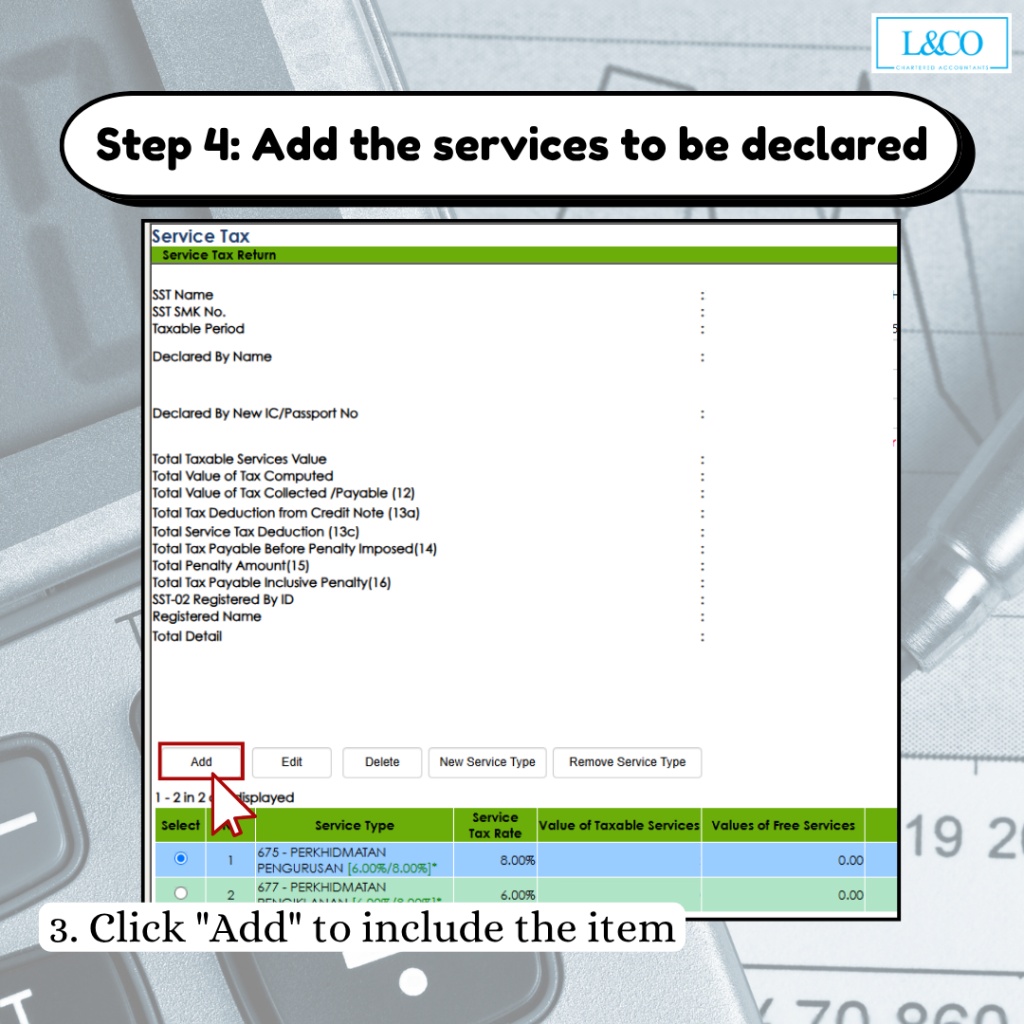

Step 4:Add the services to be declared

- Select the relevant service item

- Click “View Detail”

- Then click “Add” to include the item

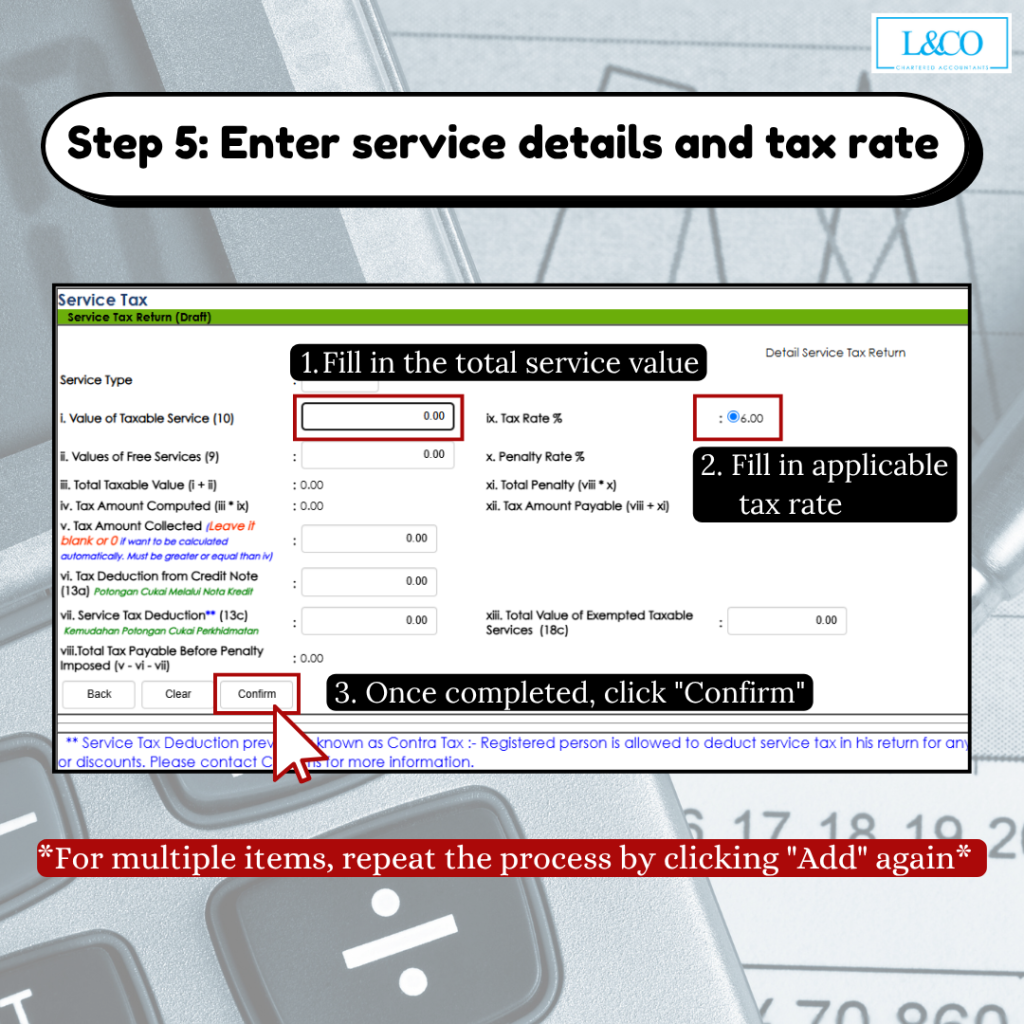

Step 5: Enter service details and tax rate

- Fill in the total service value and applicable tax rate

- Once completed, click “Confirm”

- For multiple items, repeat the process by clicking “Add” again

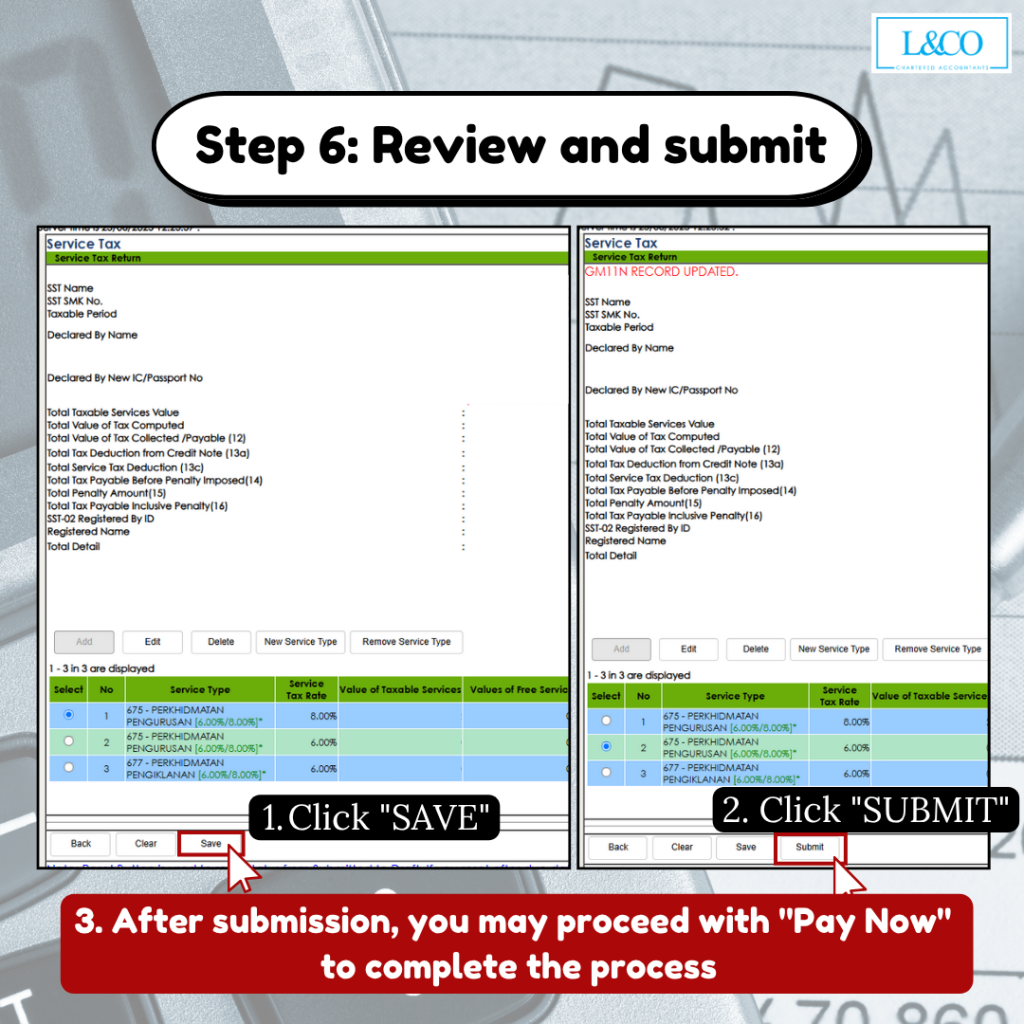

Step 6:Review and Submit

- Click “Save”, then click “Submit”

- After submission, you may proceed with “Pay Now” to complete the process

**Last Updated on 24.06.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)