A comprehensive guide outlining e-invoicing requirements for both local and overseas expenses, clearly distinguishing between different supplier types and invoicing obligations to help employees process claims accurately.

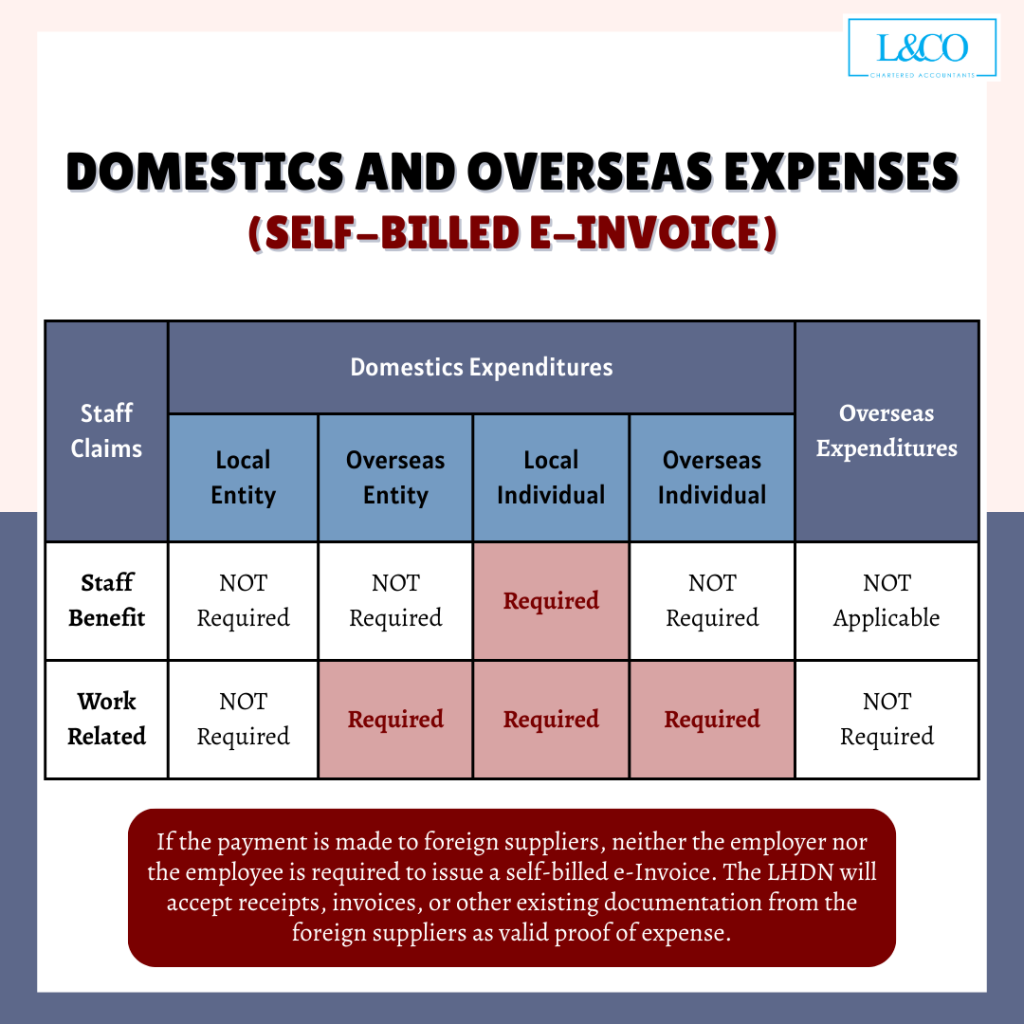

Domestics and Overseas Expenses (self-billed e-Invoice)

| Staff Claims |

Domestics Expenditures |

Overseas Expenditures | |||

| Local Entity | Overseas Entity | Local Individual | Foreign Individual | ||

| Staff Benefit | Not Required | Not Required | Required | Not Required | NA |

| Work Related | Not Required | Required | Required | Required | Not Required |

If the payment is made to foreign suppliers, neither the employer nor the employee is required to issue a self-billed e-Invoice. The LHDN will accept receipts, invoices, or other existing documentation from the foreign suppliers as valid proof of expense.

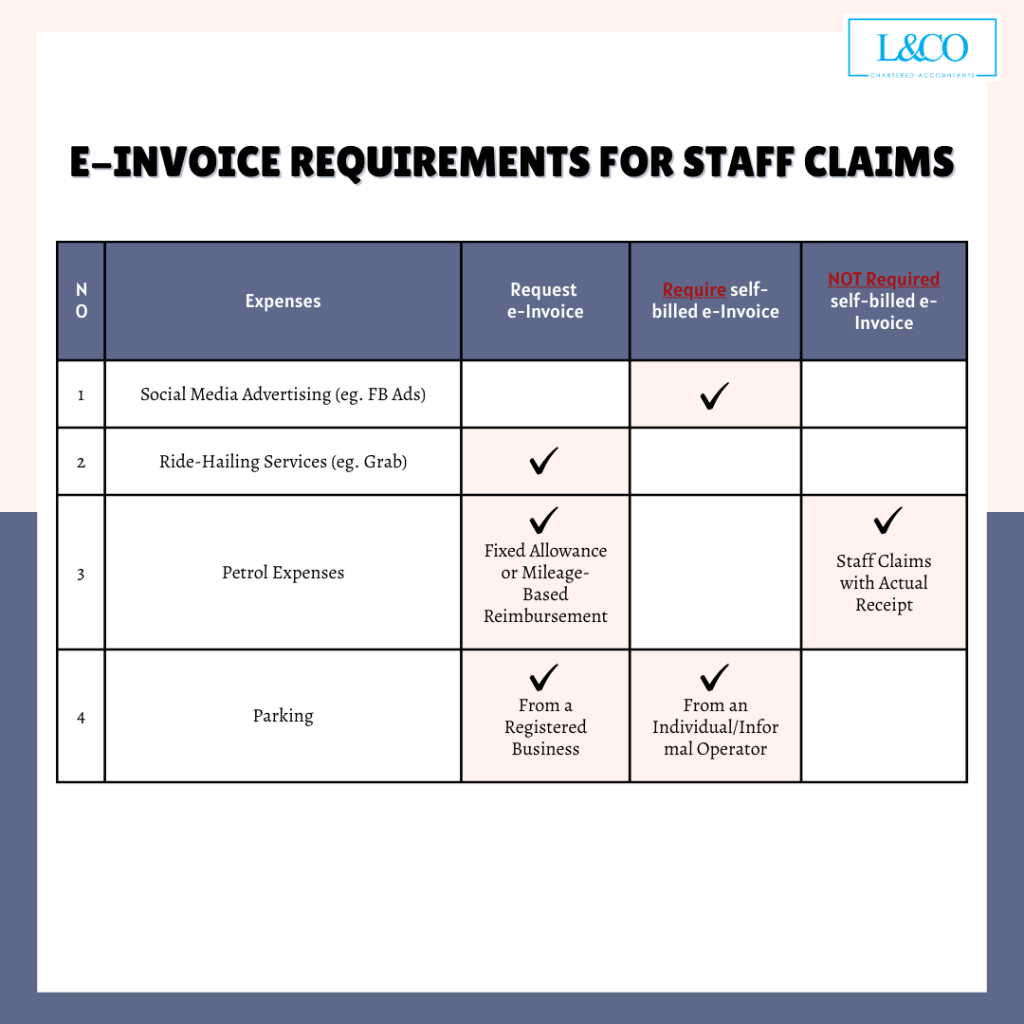

e-Invoice Requirements for Staff Claims

| No | Expenses | Request e-Invoice | Required Self-billed e-Invoice | NOT Required Self-billed e-Invoice |

|---|---|---|---|---|

| 1 | Social Media Advertising (eg. FB Ads) | Required | ||

| 2 | Ride-Hailing Service (eg. Grab) | NOT Required | ||

| 3 | Petrol Expenses | |||

|

NOT Required | |||

|

Required | |||

| 4 | Parking | |||

|

Required | |||

|

Required | |||

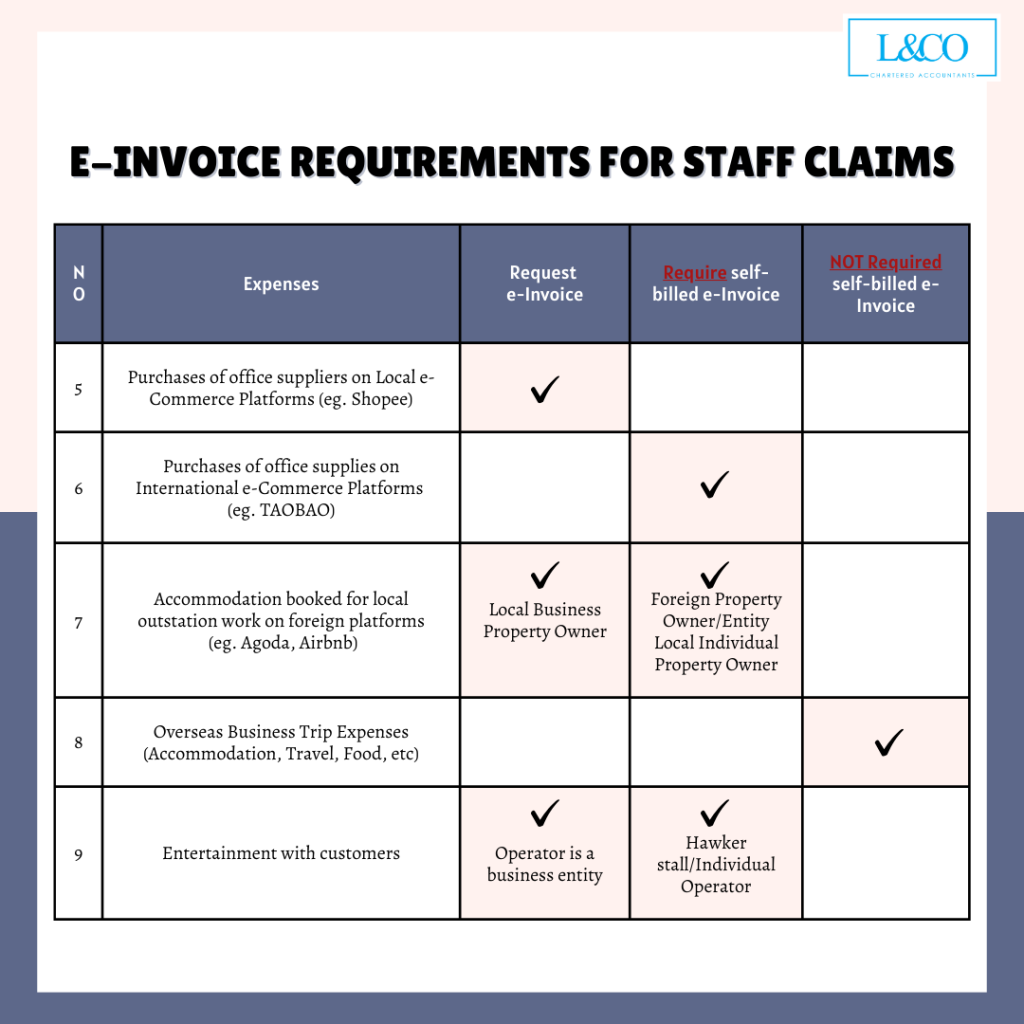

| 5 | Purchases of office supplies on Local e-Commerce Platforms (eg. Shopee) | Required | ||

| 6 | Purchases of office supplies on International e-Commerce Platforms (eg. TAOBAO) | Required | ||

| 7 | Accommodation booked for local outstation work on foreign platforms (eg. Agoda, Airbnb) | |||

|

Required | |||

|

Required | |||

|

Required | |||

| 8 | Overseas Business Trip Expenses (accommodation, travel, food, etc.) | NOT Required | ||

| 9 | Entertainment with customers | |||

|

Required | |||

|

Required |

**If invoices or receipts cannot be issued in the company’s name, those issued in the employee’s name will be accepted

**Last Updated on 25.08.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)