We’ve summarised the latest Service Tax Policy 7/2025 released by the Malaysian Customs, focusing specifically on construction companies, contractors, and developers.

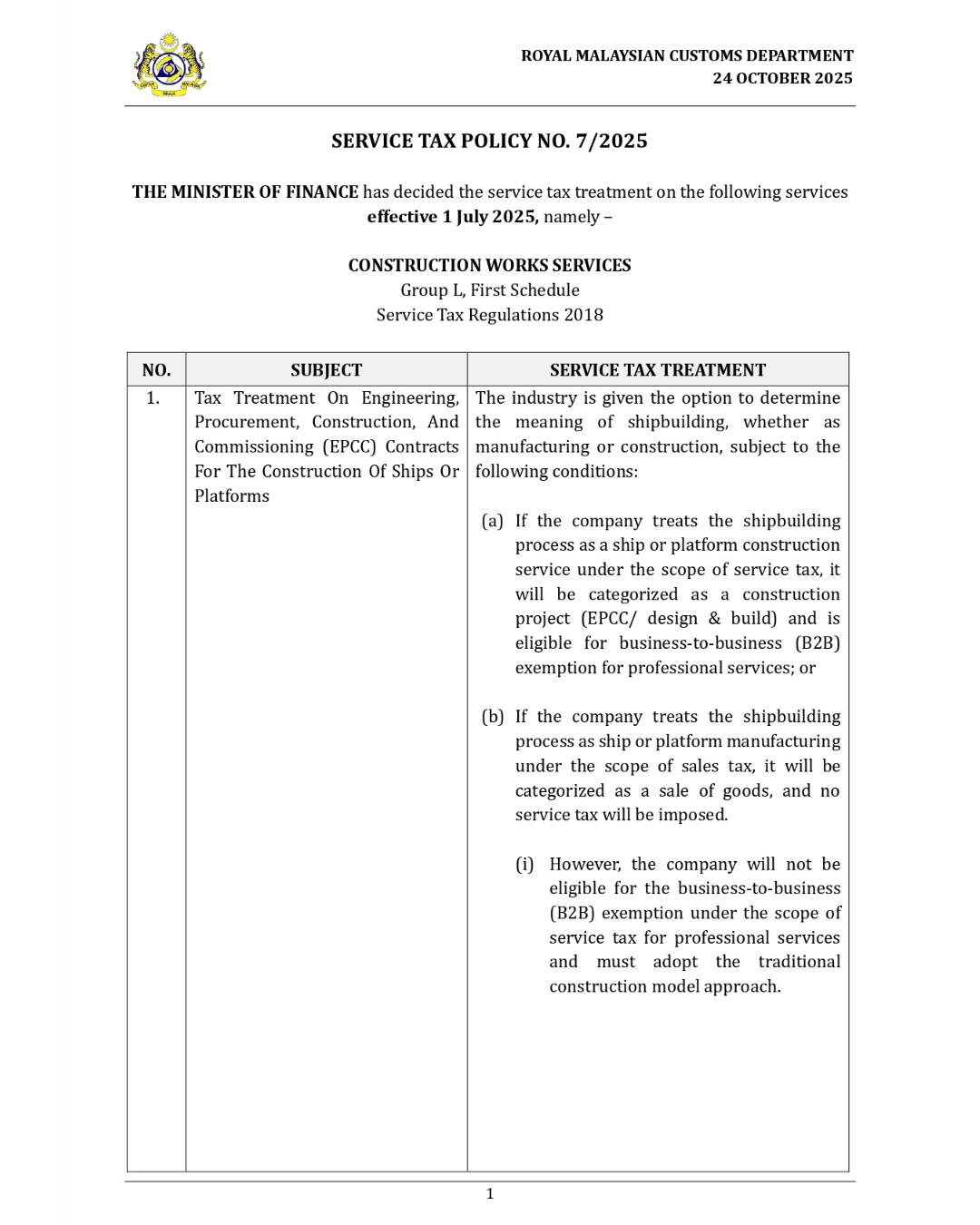

1. EPCC Contracts (Engineering, Procurement, Construction & Commissioning) — SST Treatment for Shipbuilding & Offshore Platforms

Customs now allows the industry to choose whether “shipbuilding” should be treated as Manufacturing (Sales Tax) or Construction (Service Tax).

You may opt for either approach:

(A) Treat as Construction Service

✔ Falls under EPCC / Design & Build

✔ Subject to Service Tax (Construction Services)

✔ Eligible for B2B Exemption (professional services SST exemption) → e.g. engineering consultancy, surveying, architectural services

(B) Treat as Manufacturing (Sales Tax)

✔ Treated as goods supply → No Service Tax

✘ Not eligible for B2B Exemption

✘ Must use traditional construction model (not EPCC)

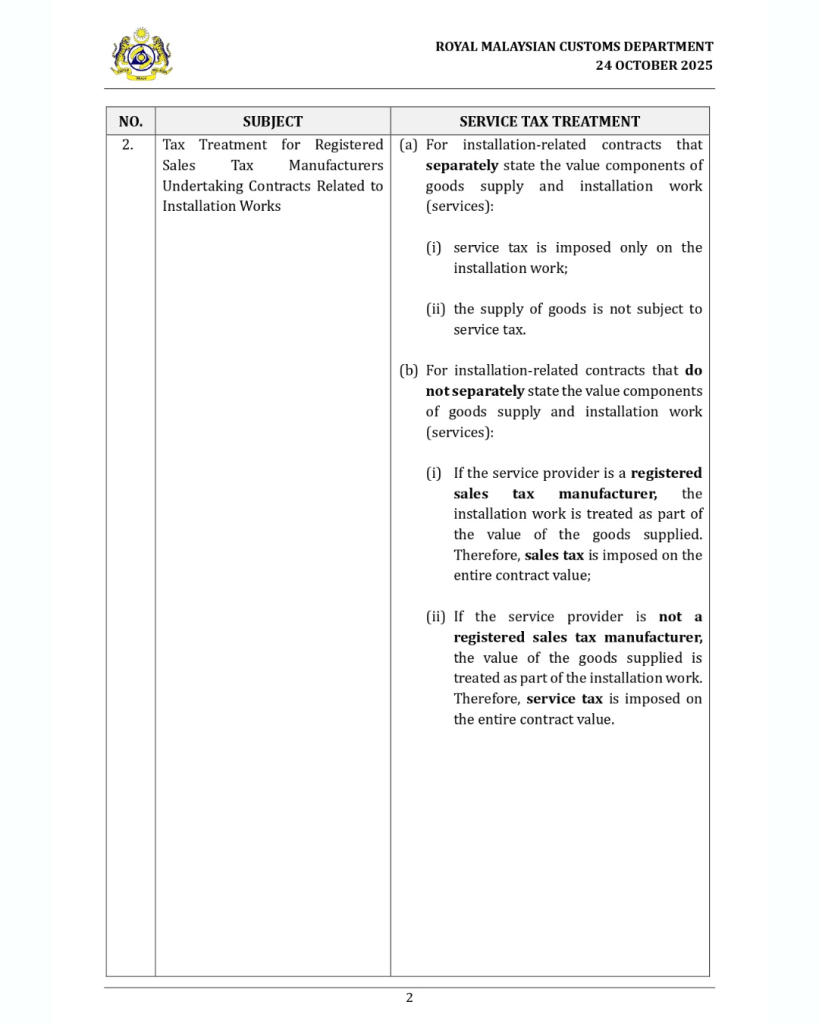

2. SST Treatment for Registered Sales Tax Manufacturers Who Provide Installation Services

This is the most confusing area for M&E contractors, machinery suppliers, and factory installation service providers.

If the contract separately states: Goods value + Installation service value:

✔ SST is only charged on the installation services

✔ Goods supply is not subject to SST

If the contract is lump sum (no breakdown):

(A) Service provider is a Registered Sales Tax Manufacturer:

👉 Installation is treated as part of the goods value

✔ Entire contract is subject to Sales Tax

✘ Not subject to Service Tax

(B) Service provider is not a Registered Manufacturer:

👉 Goods value is treated as part of the service

✔ Entire contract is subject to Service Tax (construction/installation service)

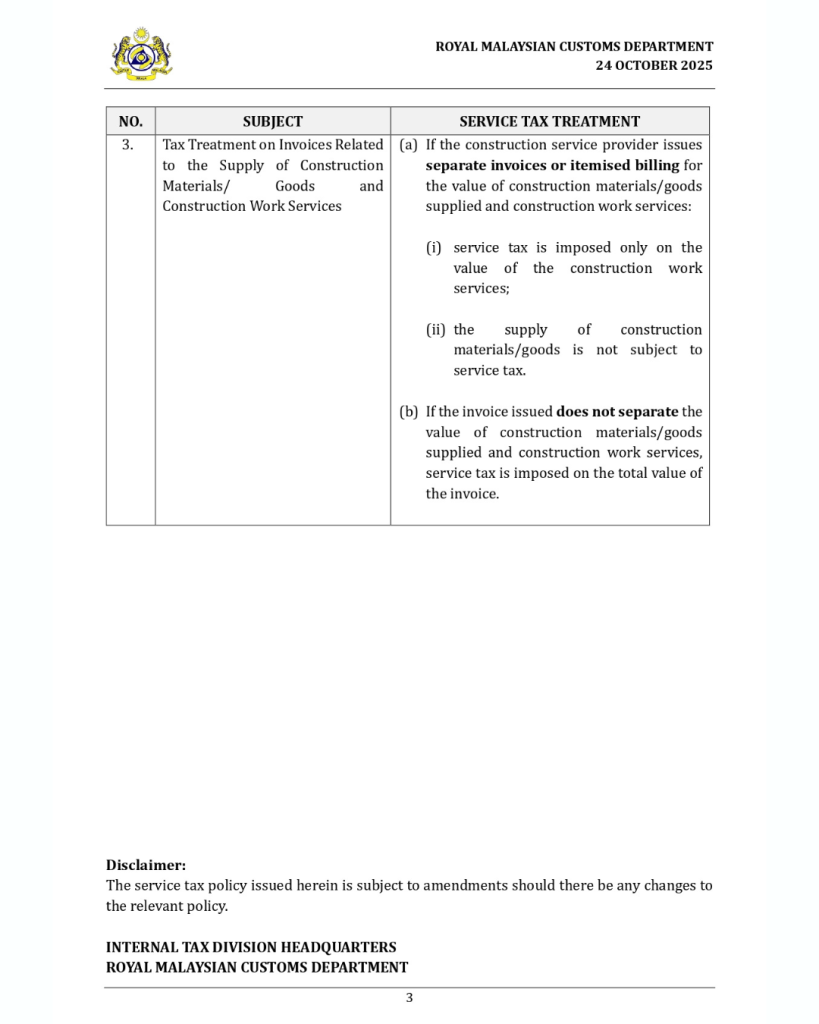

3. Invoice Treatment for Construction Materials & Construction Services

This is one of the most common SST audit issues for contractors.

If the invoice separately states materials + construction services:

✔ SST is charged only on the service

✔ Materials are not subject to SST

If the invoice is a total lump sum (no breakdown):

✔ The entire invoice becomes subject to Service Tax (6%)

→ including the material cost

To avoid unnecessary SST exposure, contractors should:

- Always separate materials and service charges in contracts & invoices

- Understand SST/Sales Tax differences for registered manufacturers vs. non-manufacturers

- For EPCC contracts, choose the tax method that gives the best overall benefit—but consider the impact on B2B exemption

**Last updated on 19.11.2025

**Source from MYSST

(201706002678 & AF 002133)

(201706002678 & AF 002133)