Starting from the 2025 Assessment Year (YA 2025), Malaysia’s National Education Savings Scheme (SSPN) introduces significant changes to tax relief rules. This guide combines policy comparison + practical scenarios (Scenario 1–3) to help parents fully understand the new rules and plan their tax filings effectively.

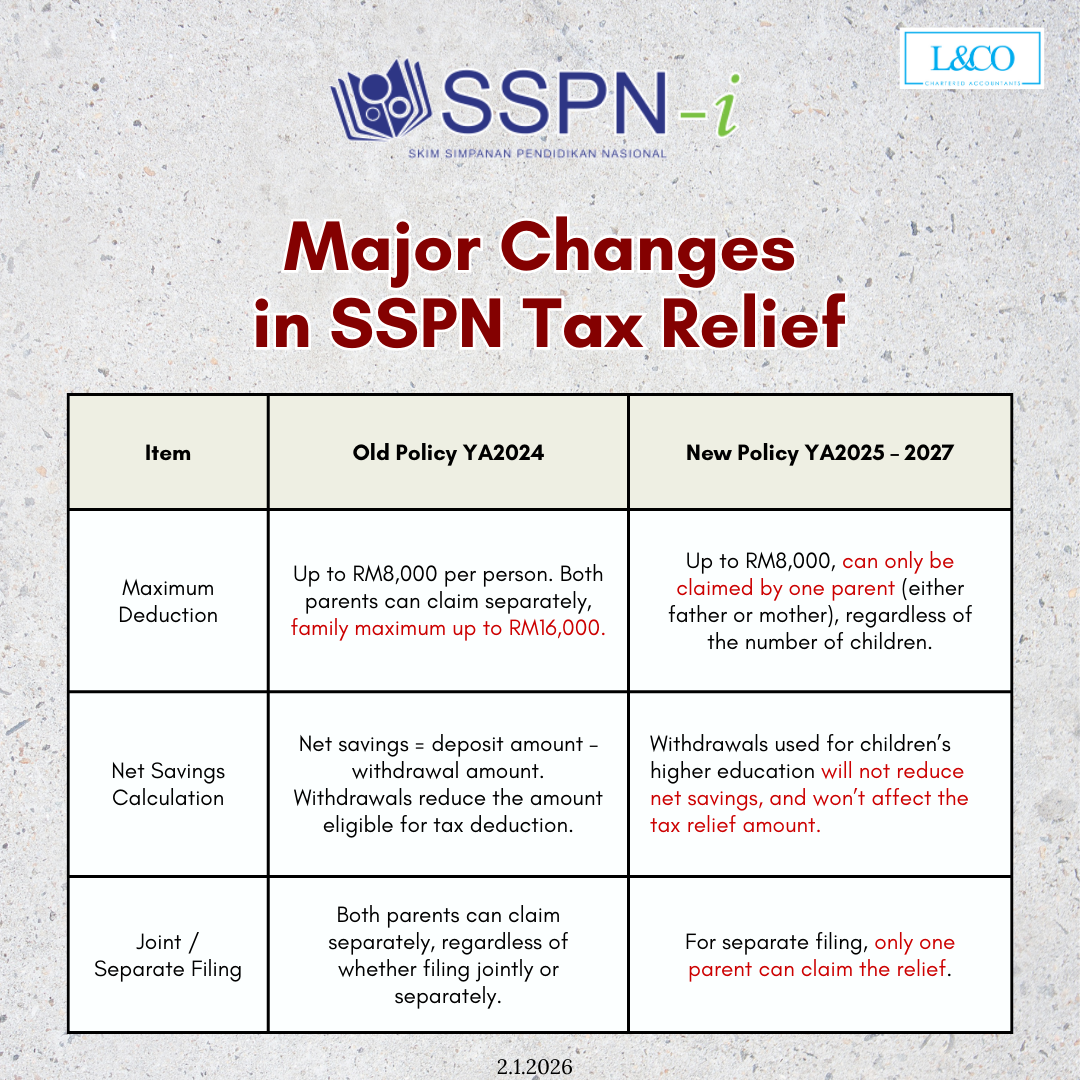

1. SSPN Tax Relief: Before vs. Now

Policy Comparison

Old Policy (Up to YA 2024)

- Each parent could individually claim up to RM8,000 in SSPN tax relief.

- Total family deduction could reach RM16,000.

- Withdrawals for education purposes affected the calculation of the year’s “net contribution.”

New Policy (YA 2025–2027)

- Family-based tax relief cap: RM8,000 per household.

- Only one parent (father or mother) can claim — spouses cannot claim separately.

- Withdrawals for children’s higher education no longer affect the tax relief calculation.

- Tax relief incentive is extended until 2027.

Key point: Deduction is now calculated per family, not per individual.

2. SSPN Tax Relief Scenarios

All examples below are based on the new rules from YA 2025 onward.

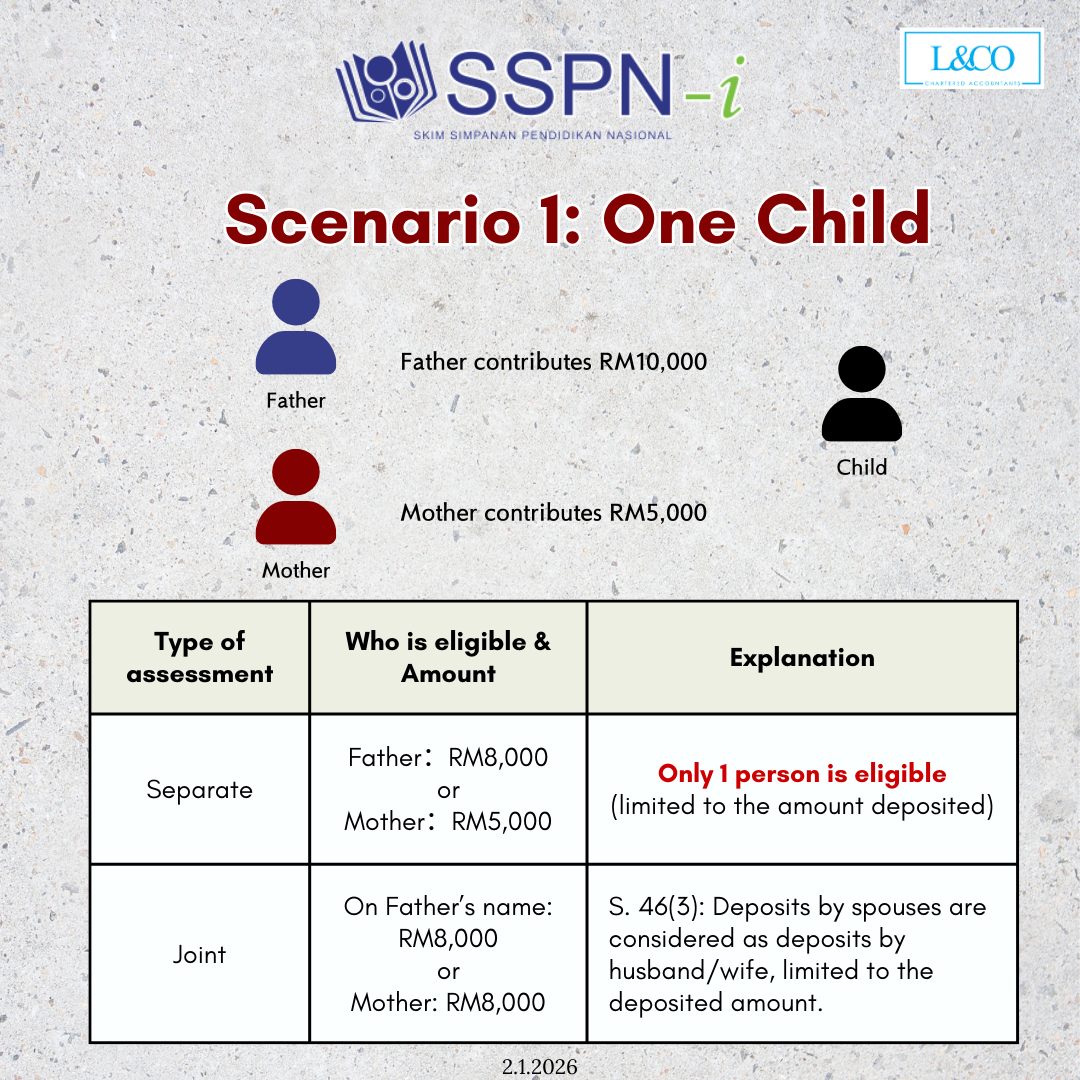

Scenario 1: One Child

Assumption:

- Father contributes RM10,000

- Mother contributes RM5,000

- Contributions are for the same child

Claim Result:

- Regardless of the contributions, only one parent can claim.

- Father can claim RM8,000 (cap)

- Or mother can claim RM5,000 (limited to actual contribution)

Tip: Choose the parent with a higher tax rate to maximize tax savings.

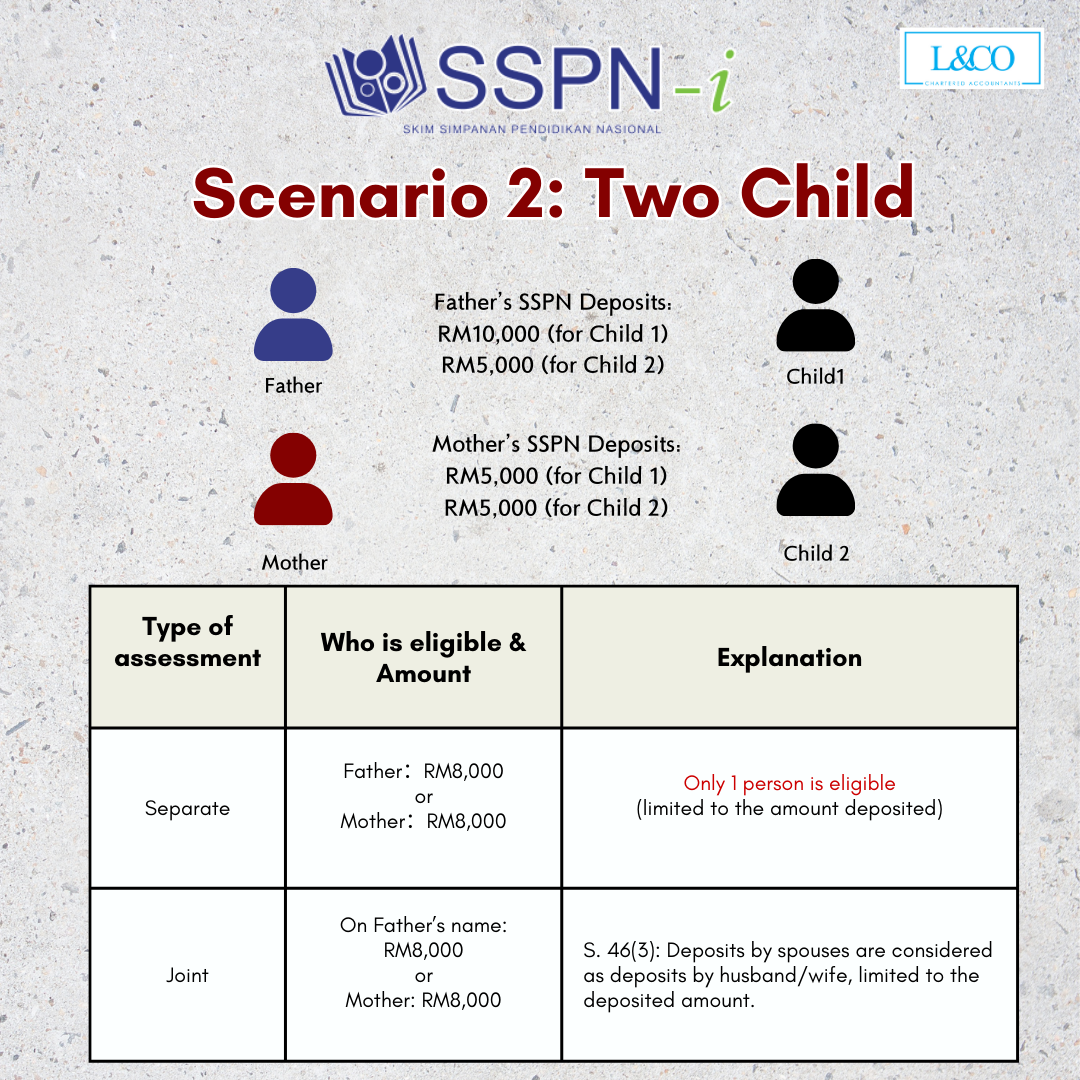

Scenario 2: Two Children

Assumption:

- Father contributes: RM10,000 (Child A) + RM5,000 (Child B)

- Mother contributes: RM5,000 (Child A) + RM5,000 (Child B)

Claim Result:

- Even with two children, the tax relief cap remains RM8,000.

- Parents cannot claim separately for different children.

- Only one parent can claim up to RM8,000.

Note: More children do not increase the deduction.

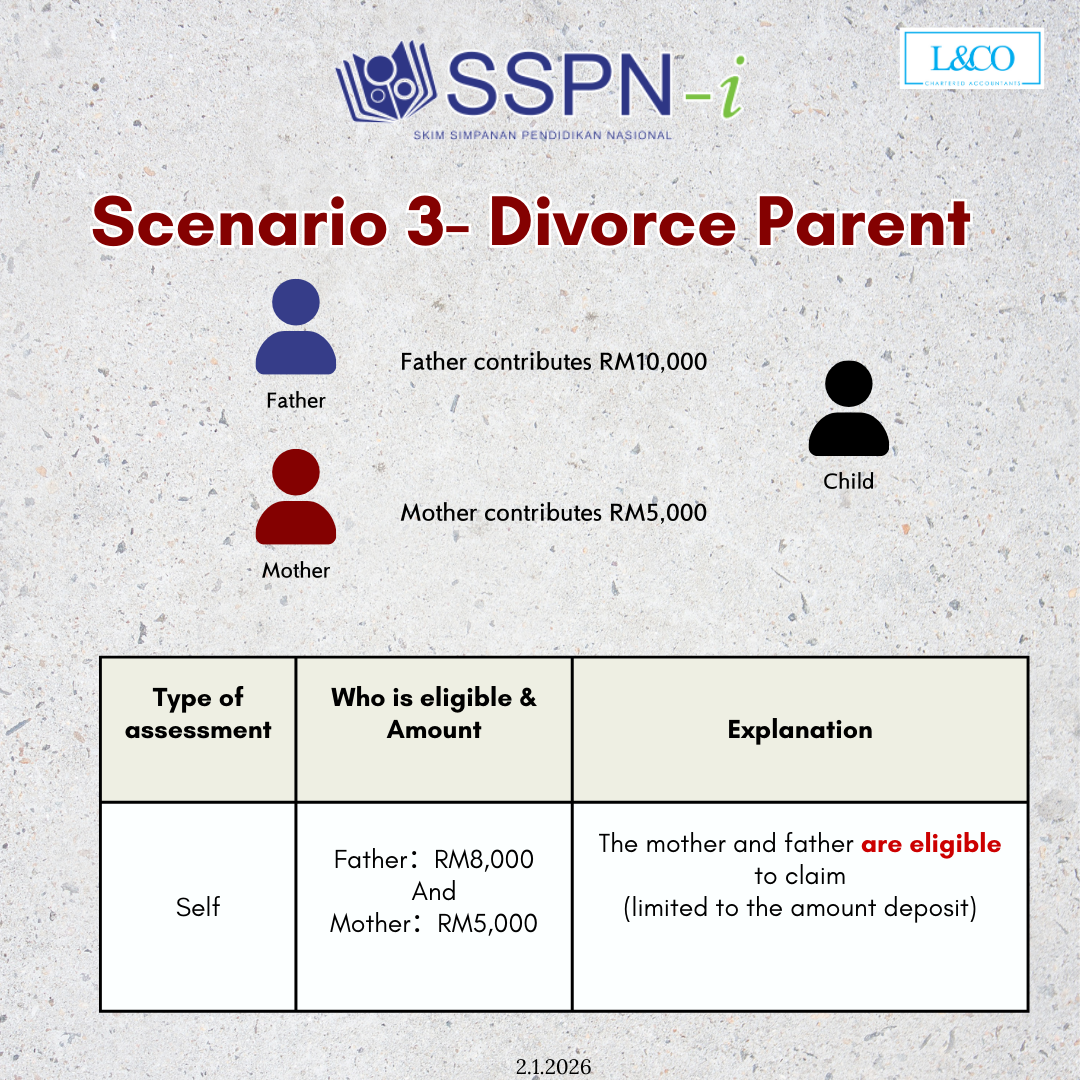

Scenario 3: Divorced Parents

Assumption (Self-Assessment):

- Father contributes RM8,000

- Mother contributes RM5,000

- Parents are divorced and file separately

Claim Result:

- Both parents are eligible to claim.

- Father can claim RM8,000, mother can claim RM5,000, limited to actual contributions.

Note: For divorced parents, the “one parent per family” restriction does not apply.

4. Summary

- Who claims is often more important than how much is deposited

- SSPN tax relief cap: RM8,000 per family / per parent

- Couples cannot split or claim duplicate deduction

- Tax relief incentive extended until 2027

(201706002678 & AF 002133)

(201706002678 & AF 002133)