Second Phase of STR Aids Disbursement

- According to the Prime Minister, the second phase of STR aid’s distribution will be made in early April, in which a recipient under single category will receive RM100 while the recipient under family category will receive RM200.

Extension of SSPN Tax Relief

- The Prime Minister reintroduced the Personal Tax Relief for SSPN and extended it until 2024 in the upper house on March 29.

LHDN Tax Refund Will be Made Within 90 Days.

- For taxpayers who have overpaid tax during PCB or CP500 declaration, they are able to get their tax refund through cheques, tax refund vouchers, e-TT, online transfer or DuitNow within 30 days (for e-filing taxpayers) to 90 days (postage / manual filling taxpayers) after declaring their income tax.

- Also, taxpayers need to ensure that the correct bank account / corresponding account number is indicated while submitting their tax returns forms.

Deferred Implementation of New Taxes Rules

- The government announced the deferred implementation of three new tax regulations, including adjustments to excise tax on Sugar Sweetened Beverages, delivery service tax and low-value goods sales tax (LVG).

- The deferred implementation of these policies not only allows businesses to have more time to get prepared, but also allows the government to have more time to refine relevant laws and regulations and hence ensure more proper implementation.

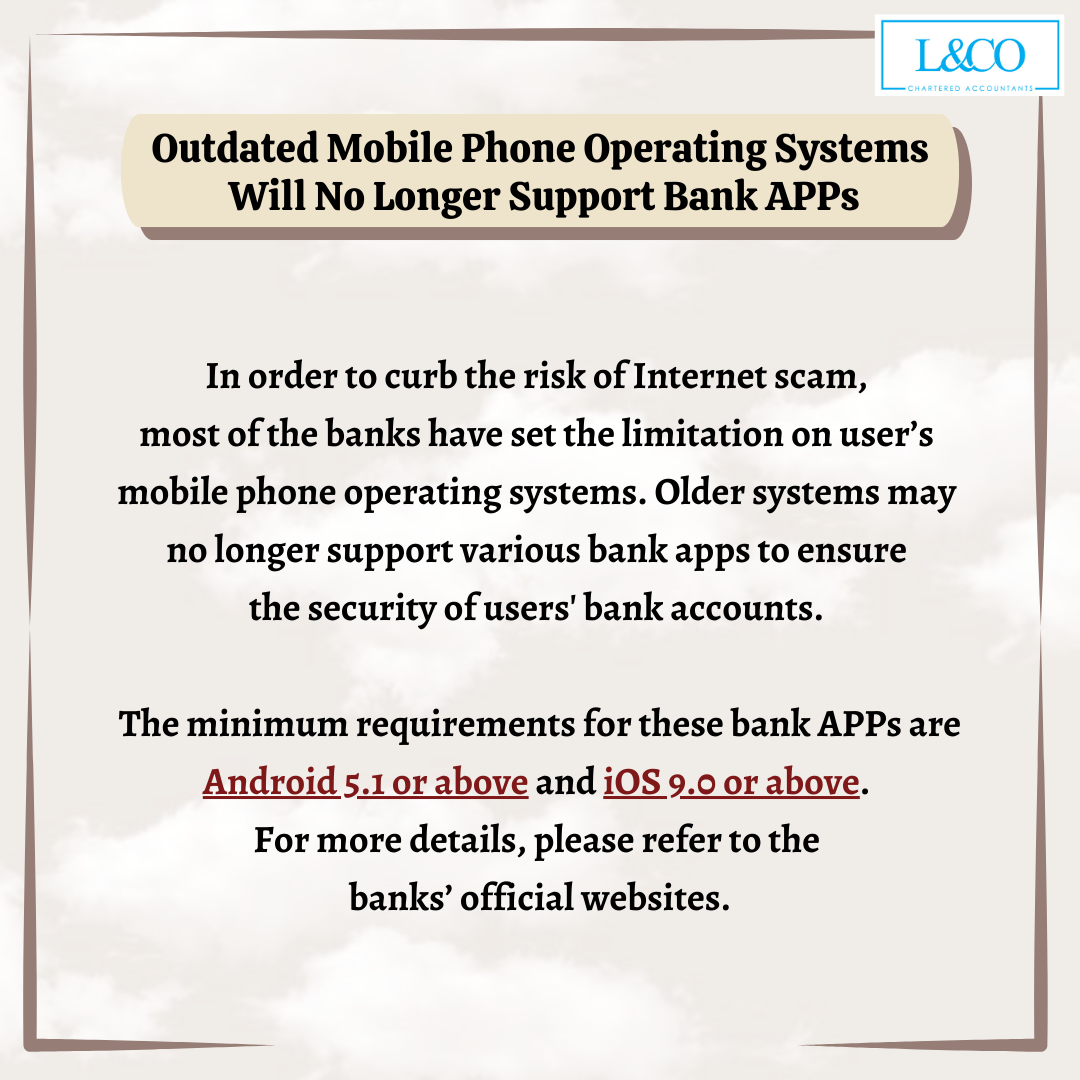

Outdated Mobile Phone Operating Systems Will No Longer Support Bank APPs

- In order to curb the risk of Internet scam, most of the banks have set the limitation on user’s mobile phone operating systems. Older systems may no longer support various bank apps to ensure the security of users’ bank accounts.

- The minimum requirements for these bank APPs are Android 5.1 or above for Android phones, and iOS 9.0 or above for iPhones. For more details, please refer to the banks’ official websites.

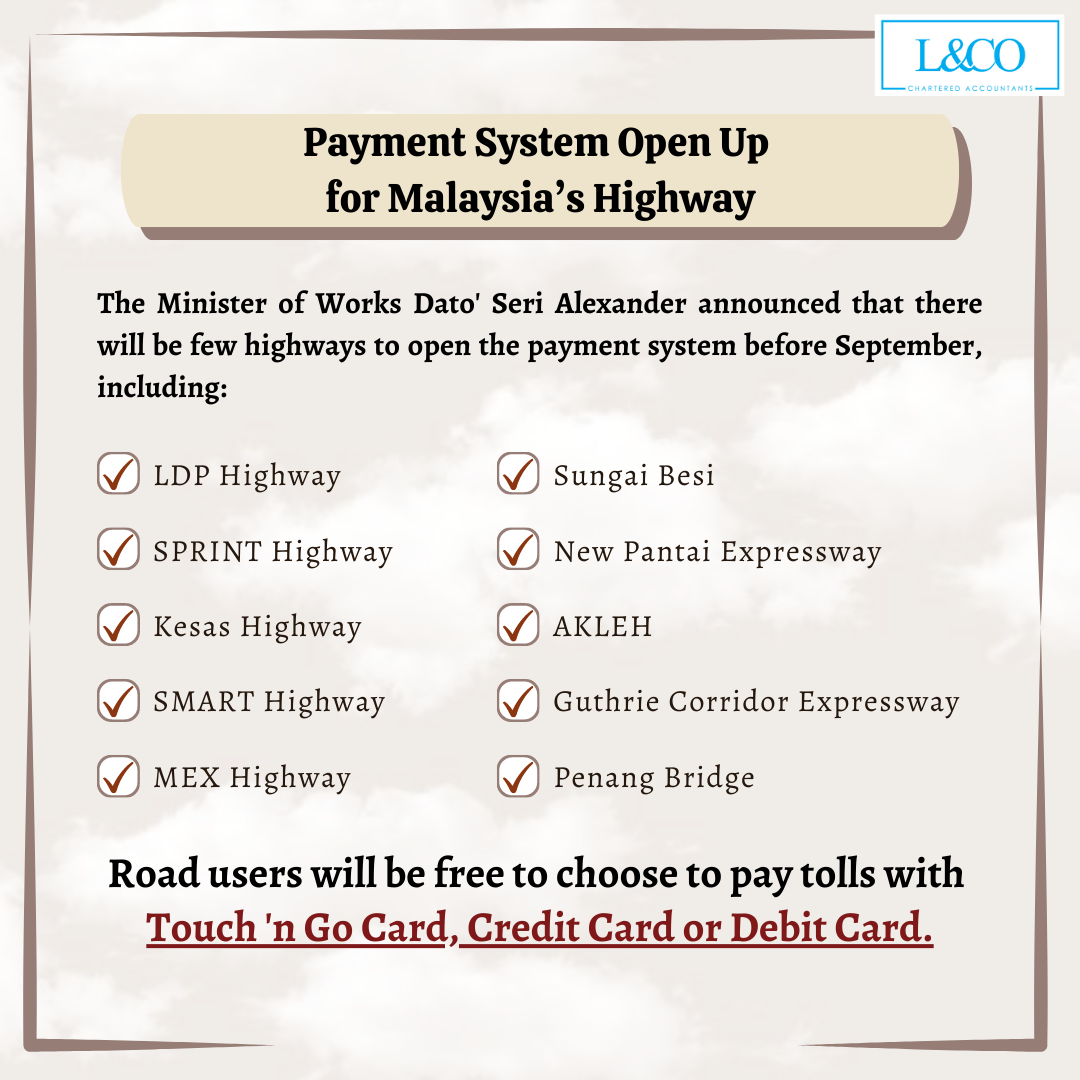

Payment System Open Up for Malaysia’s Highway

- The Minister of Works Dato’ Seri Alexander announced that there will be few highways to open the payment system before September, including LDP, SPRINT, Kesas, SMART, MEX, Sungai Besi, New Pantai Expressway, AKLEH, Guthrie Corridor Expressway and Penang Bridge.

- Road users will be free to choose to pay tolls with Touch ‘n Go Card, Credit Card or Debit Card.

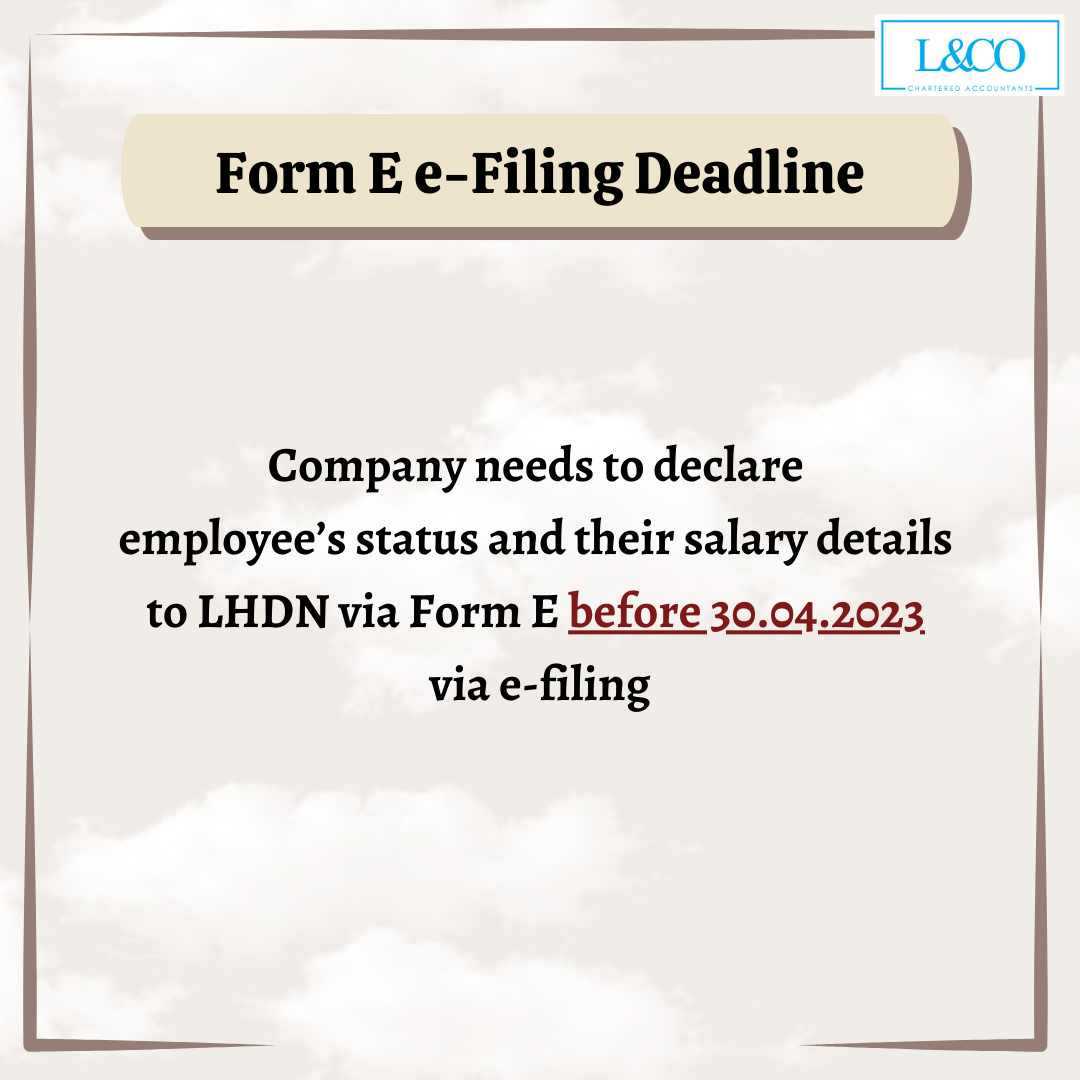

Form E Electronic Filing Deadline

- Company needs to declare employee’s status and their salary details to LHDN via Form E before 30.04.2023 via e-filing

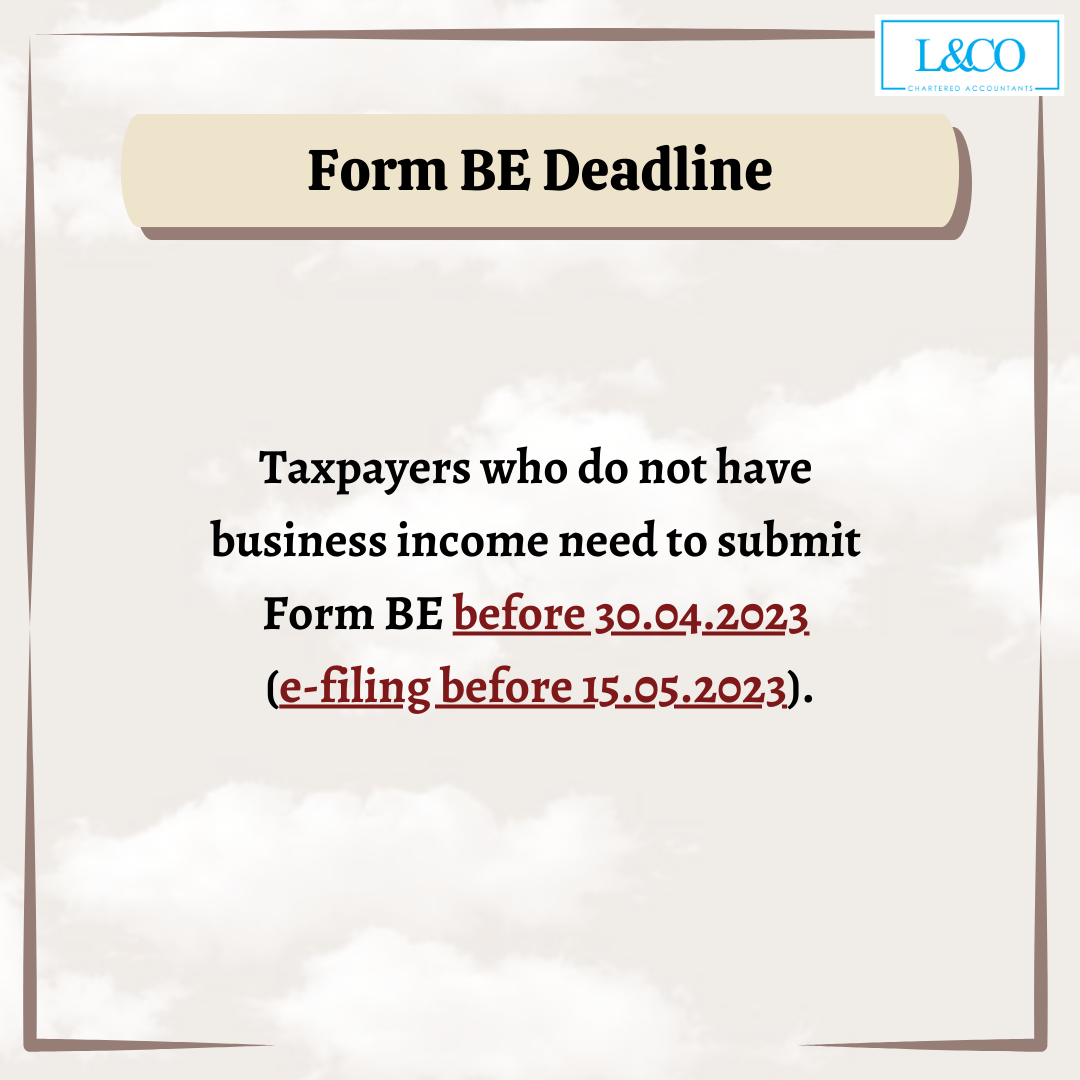

Form BE Deadline

- Taxpayers who do not have business income need to submit Form BE before 30.04.2023 (e-filing before 15.05.2023).

Public Holidays in April

- 07.04.2023 (Friday): Good Friday (For Sabah & Sarawak)

- 08.04.2023 (Saturday): Hari Nuzul Quran (For Kuala Lumpur, Labuan, Putrajaya, Kelantan, Pahang, Perak, Perlis, Penang, Selangor, Terengganu)

- 15.04.2023 (Saturday): Declaration of Melaka as a Historical City (For Malacca)

- 24.04.2023 (Monday): Hari Raya Aidilfitri Holiday Replacement (National, except Johor and Kedah)

- 26.04.2023 (Wednesday): Birthday of the Terengganu Sultan(For Terengganu)

Important Dates in April

- 15.04.2023:PCB (March Salary)

- 15.04.2023:SOCSO & EIS (March Salary)

- 15.04.2023:HRDC (March Salary)

- 15.04.2023:EPF (March Salary)

- 15.04.2023:CP204 Payment

- 30.04.2023:Audited Report (Company financial year ended September 2022)

- 30.04.2023:SST (February – March 2023 Payment)

- 30.04.2023:CP204 Submission (Company financial year ended May 2024)

- 30.04.2023:Form C (Company financial year ended August 2022)

- 30.04.2023:Form E (e-filing)

- 30.04.2023:Form BE

(201706002678 & AF 002133)

(201706002678 & AF 002133)