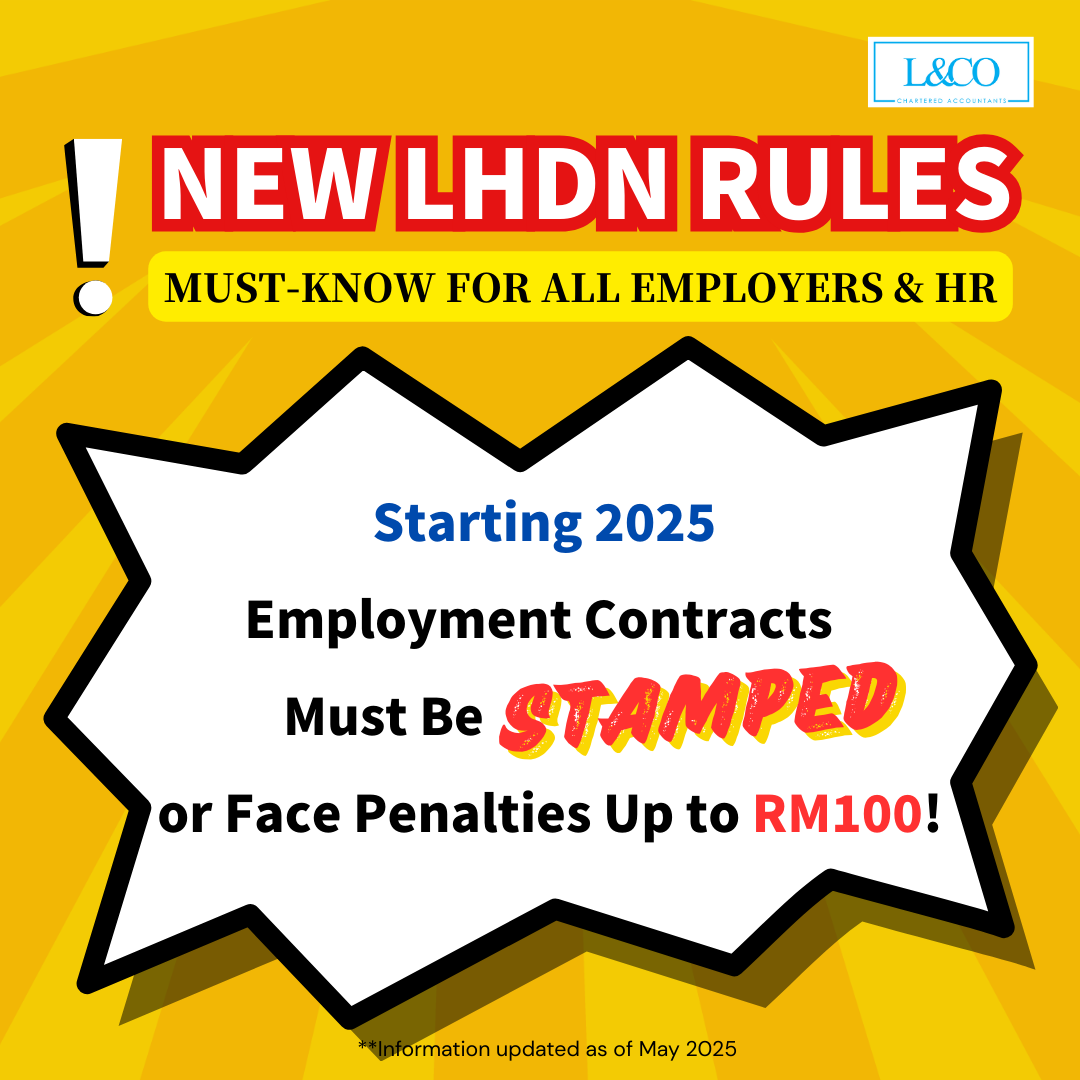

A New Rule Every Malaysian SME Should Know Did you know? Starting 1 January 2025, the Inland Revenue Board of Malaysia (LHDN) has officially implemented [...]

, Good news! Taking your employees on local trips—food, fun, and transport included—can be 100% tax deductible. The government encourages employers to treat their staff [...]

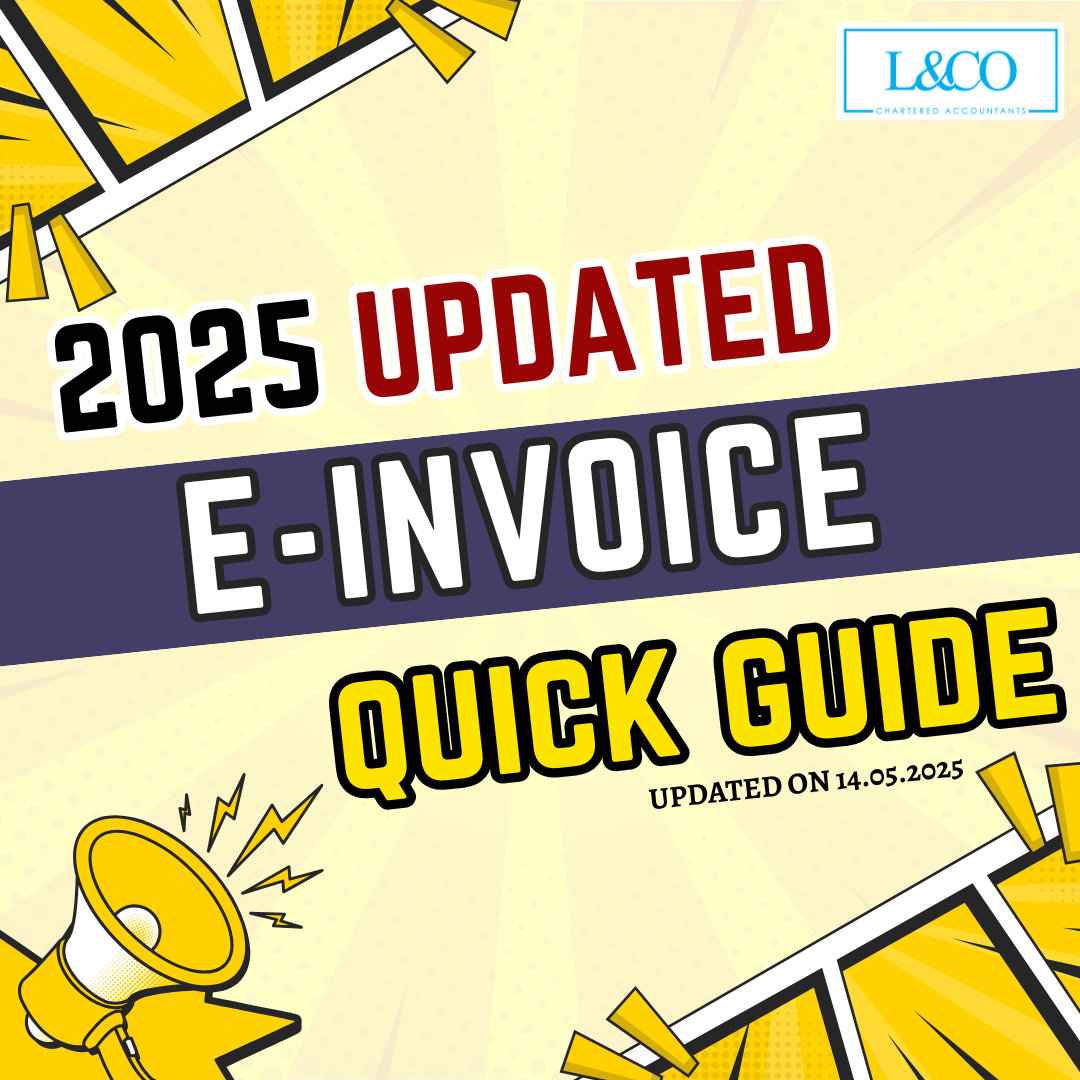

e-Invoice means recording every transaction electronically. With the full implementation of e-Invoice, we will no longer need to keep physical receipts and all transaction records [...]

[MYTAX] HOW TO APPOINT EMPLOYEES AS MYTAX REPRESENTATIVE By doing so, employees will also be able to manage their company tax accounts and will not [...]

The Inland Revenue Board of Malaysia (LHDN) has introduced the MyInvois electronic Point of Sales (e-POS) solution as part of its e-Invoice initiative. At this [...]

𝐁𝐚𝐧𝐤 𝐍𝐞𝐠𝐚𝐫𝐚 𝐰𝐢𝐥𝐥 𝐚𝐧𝐧𝐨𝐮𝐧𝐜𝐞 𝐭𝐡𝐢𝐬 𝐦𝐨𝐧𝐭𝐡 𝐰𝐡𝐞𝐭𝐡𝐞𝐫 𝐭𝐡𝐞𝐲 𝐰𝐢𝐥𝐥 𝐥𝐨𝐰𝐞𝐫 𝐭𝐡𝐞 𝐢𝐧𝐭𝐞𝐫𝐞𝐬𝐭 𝐫𝐚𝐭𝐞! Besides this news, what else is worth paying attention to this month? [...]

As Malaysia moves towards the full implementation of the electronic invoicing (e-Invoice) system, one of the most common questions businesses ask is: “If my supplier [...]

Here's a collection of government grants available in May 2025. Skim Khairat Kematian (SKK) Market Development Grant (MDG) Subsidised Diesel Control System 2.0 (SKDS) programme [...]

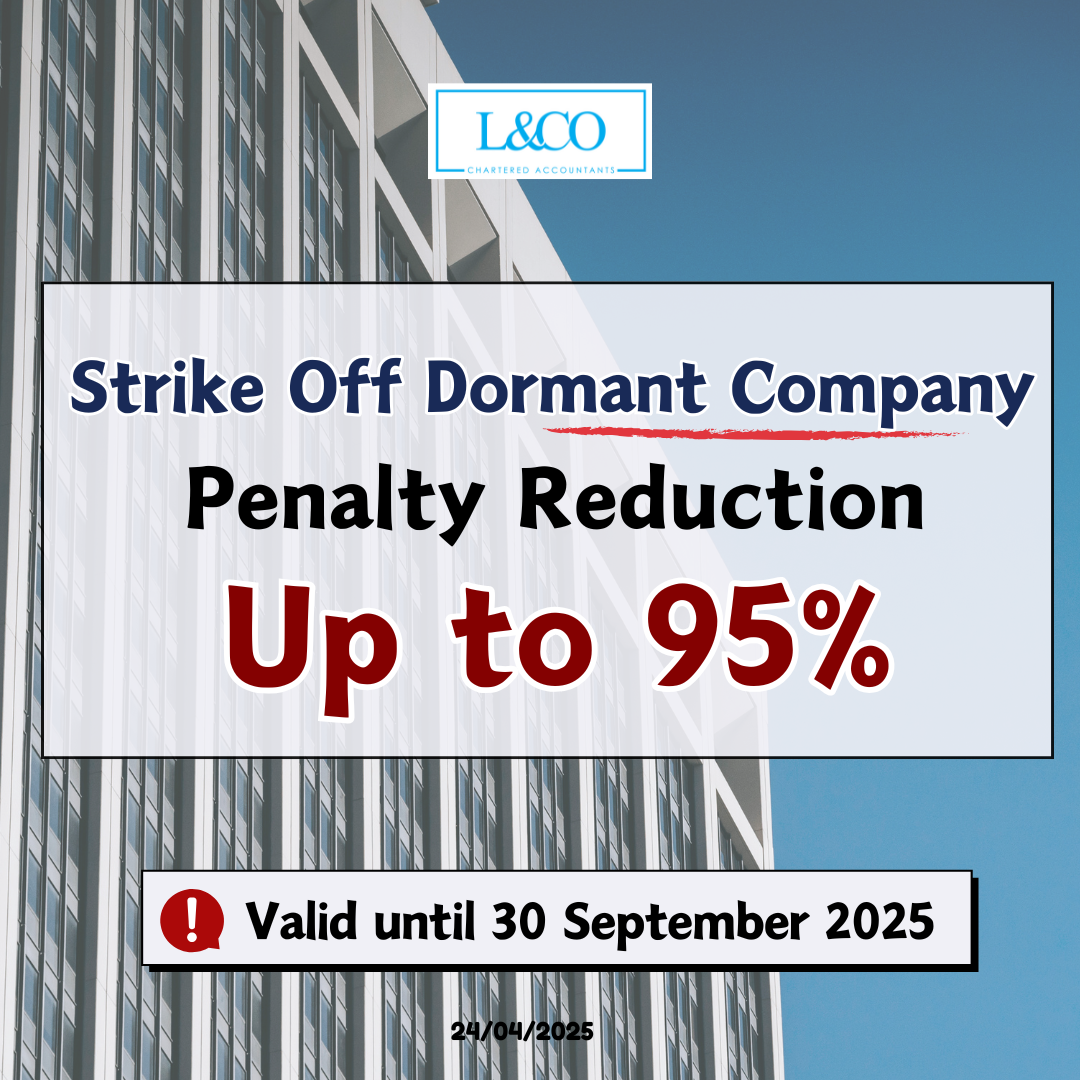

Important Notice: Up to 95% Penalty Waiver by SSM for Dormant Companies! The Companies Commission of Malaysia (SSM) has recently introduced a significant enforcement relief [...]

Many still don’t realize — you might be part of the next mandatory group/company for e-Invoice implementation! What is Batch 3? If your annual [...]

(201706002678 & AF 002133)

(201706002678 & AF 002133)