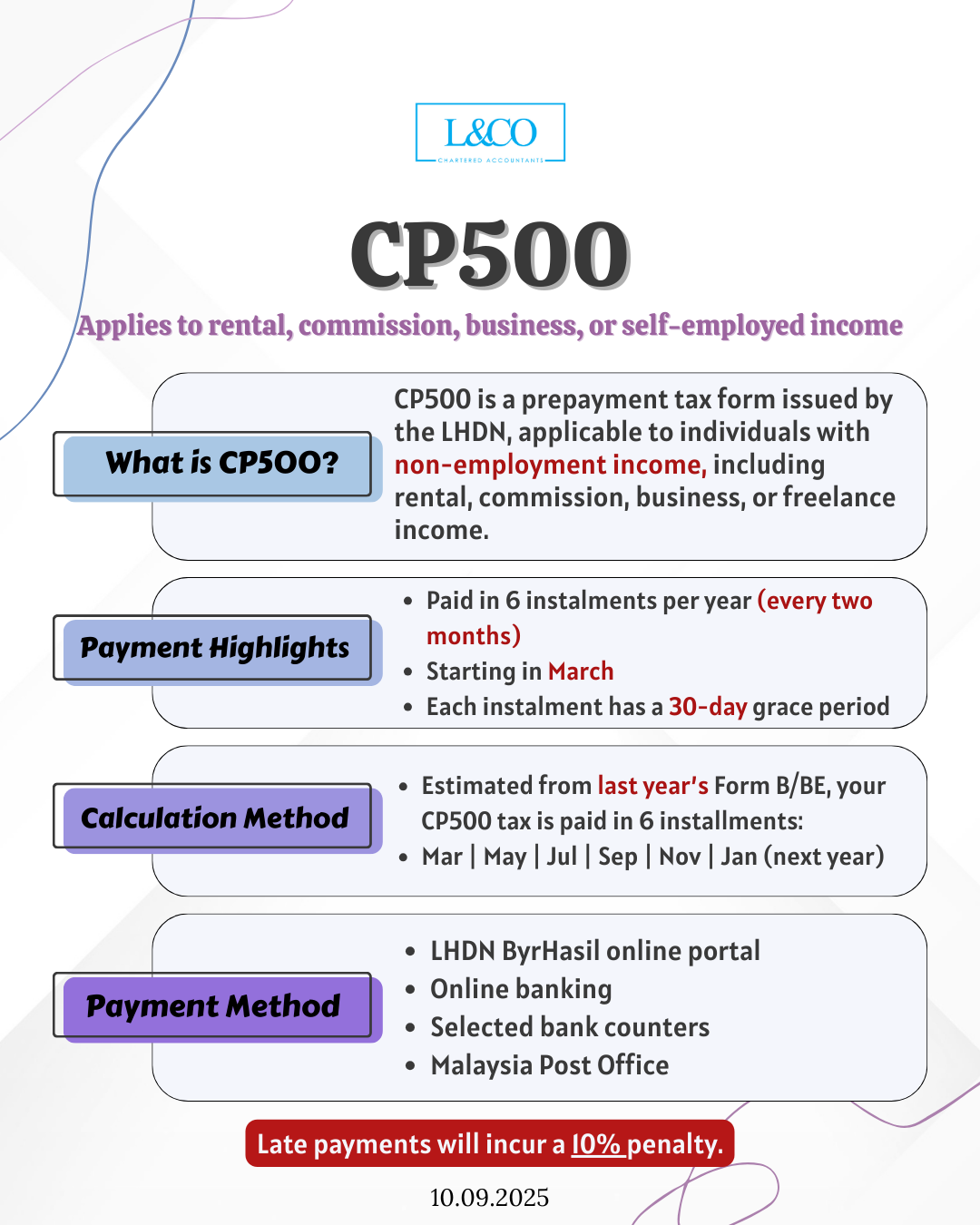

Applicable to individuals earning rental, commission, business, or freelance income, guiding you to easily understand key payment points and methods.

FAQs:

- LHDN ByrHasil online portal

- Online banking

- Selected bank counters

- Malaysia Post Office

Late payments will incur a 10% penalty.

**Last Updated on 10.09.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)