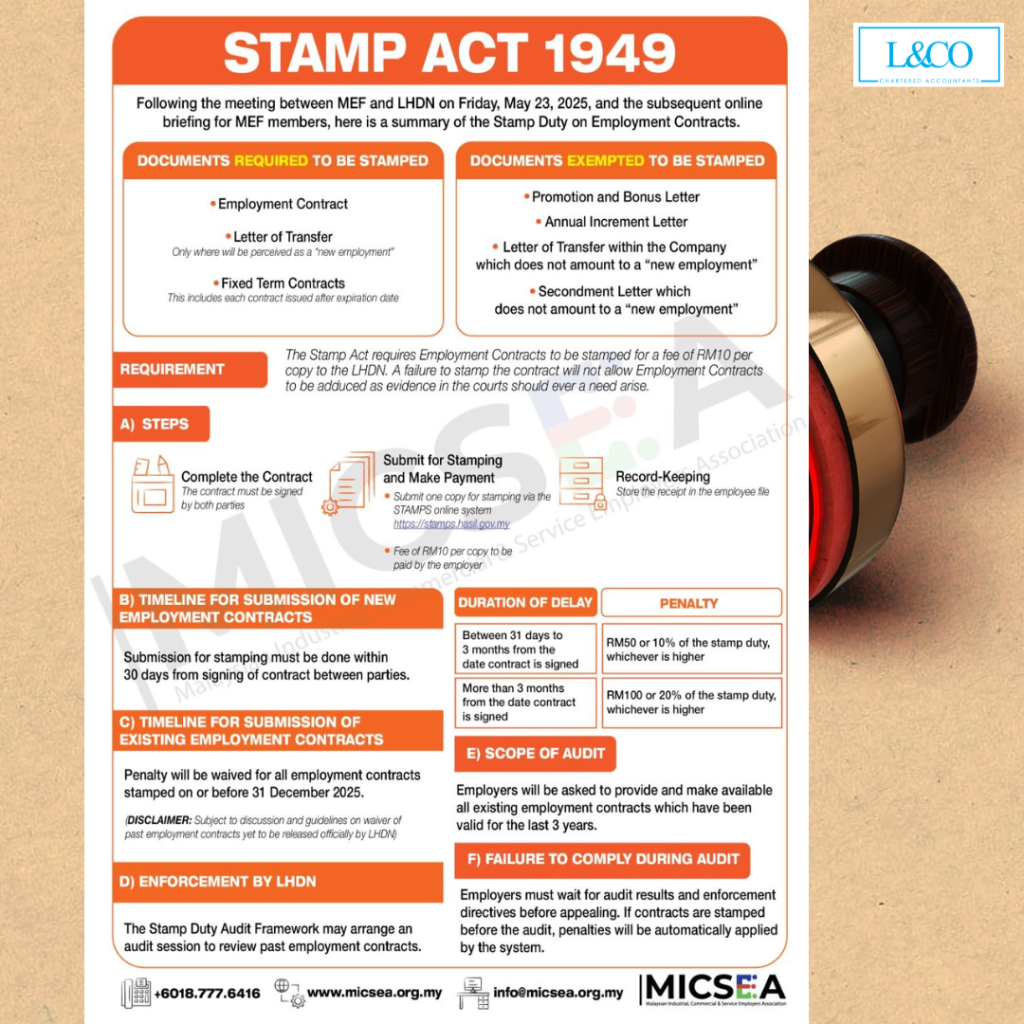

According to an agreement between the Malaysian Employers Federation (MEF) and the Inland Revenue Board of Malaysia (LHDN), employers will be exempted from late submission penalties if they stamp existing employment contracts by December 31, 2025.

✅ 𝐄𝐦𝐩𝐥𝐨𝐲𝐦𝐞𝐧𝐭 𝐝𝐨𝐜𝐮𝐦𝐞𝐧𝐭𝐬 𝐭𝐡𝐚𝐭 𝐫𝐞𝐪𝐮𝐢𝐫𝐞 𝐬𝐭𝐚𝐦𝐩 𝐝𝐮𝐭𝐲:

- Employment contracts

- Letter of Transfer (if considered a new employment)

- Fixed-term contracts (including renewals)

❌ 𝐃𝐨𝐜𝐮𝐦𝐞𝐧𝐭𝐬 𝐭𝐡𝐚𝐭 𝐃𝐎 𝐍𝐎𝐓 𝐫𝐞𝐪𝐮𝐢𝐫𝐞 𝐬𝐭𝐚𝐦𝐩 𝐝𝐮𝐭𝐲:

- Promotion letters

- Deployment/Assignment letters

- Annual Increment letters

- Commendation/Warning letters

- Secondment letters (if not treated as new employment)

𝐈𝐦𝐩𝐨𝐫𝐭𝐚𝐧𝐭 𝐧𝐨𝐭𝐞𝐬 𝐨𝐧 𝐧𝐞𝐰 𝐜𝐨𝐧𝐭𝐫𝐚𝐜𝐭𝐬:

Newly signed employment contracts must be stamped within 30 days of signing, or penalties will apply:

– More than 30 days but within 3 months: RM50 or 10% of stamp duty (whichever is higher).

– More than 3 months: RM100 or 20% of stamp duty.

𝐎𝐭𝐡𝐞𝐫 𝐈𝐦𝐩𝐨𝐫𝐭𝐚𝐧𝐭 𝐍𝐨𝐭𝐞𝐬:

- LHDN may conduct audits and request employment contracts from the past 3 years.

- Employers may appeal after audit results or enforcement actions.

- If contracts are stamped before an audit, the system will automatically waive the penalties.

𝐀𝐭𝐭𝐞𝐧𝐭𝐢𝐨𝐧 𝐄𝐦𝐩𝐥𝐨𝐲𝐞𝐫𝐬:

President of Micsea, advises:

1. Immediate review of contracts from 2022 onwards

2. Attach a letter to apply for penalty waiver for stamp duty stamping

3. The grace period ends on December 31, 2025 — no extensions will be given next year!

𝐇𝐨𝐰 𝐭𝐨 𝐠𝐞𝐭 𝐲𝐨𝐮𝐫 𝐜𝐨𝐧𝐭𝐫𝐚𝐜𝐭𝐬 𝐬𝐭𝐚𝐦𝐩𝐞𝐝:

- Prepare and sign the complete employment contract.

- Pay RM10 stamp duty and keep the receipt.

- HR should keep a stamped copy.

- Submit at LHDN counters or use the online platform.

Time is running out — employers, now is the best time to get compliant and avoid penalties!

**Last Updated on 05.06.2025**

(201706002678 & AF 002133)

(201706002678 & AF 002133)