Service Tax Exemptions for Construction Services

The Royal Malaysian Customs Department has issued Service Tax Policy No. 3/2025, introducing multiple exemptions and transitional arrangements for construction services. Effective immediately, the measures [...]

New Service Tax Policy on Leasing & Rental Services

Malaysia’s updated service tax framework has come into effect. Contract terms, tenant status, and group structure will directly determine tax exposure. Businesses and property owners [...]

Malaysia 2026: New Vehicle Tax Rules for Designated Areas

Effective 2026, any vehicle entering Labuan or Langkawi with a value exceeding RM300,000 will be required to pay Sales Tax Key Highlights From 2026, sales [...]

SST Update: Key Changes Effective from 1 January 2026

Recent announcements on Sales & Service Tax (SST) have raised many questions among businesses. To help clear the confusion, here is a summary of the [...]

Latest SST Update for Leasing & Rental of Tangible Assets

Whether your leasing service is subject to the 6% Service Tax now depends entirely on where the asset is located. Within Malaysia (≤12 nautical miles), [...]

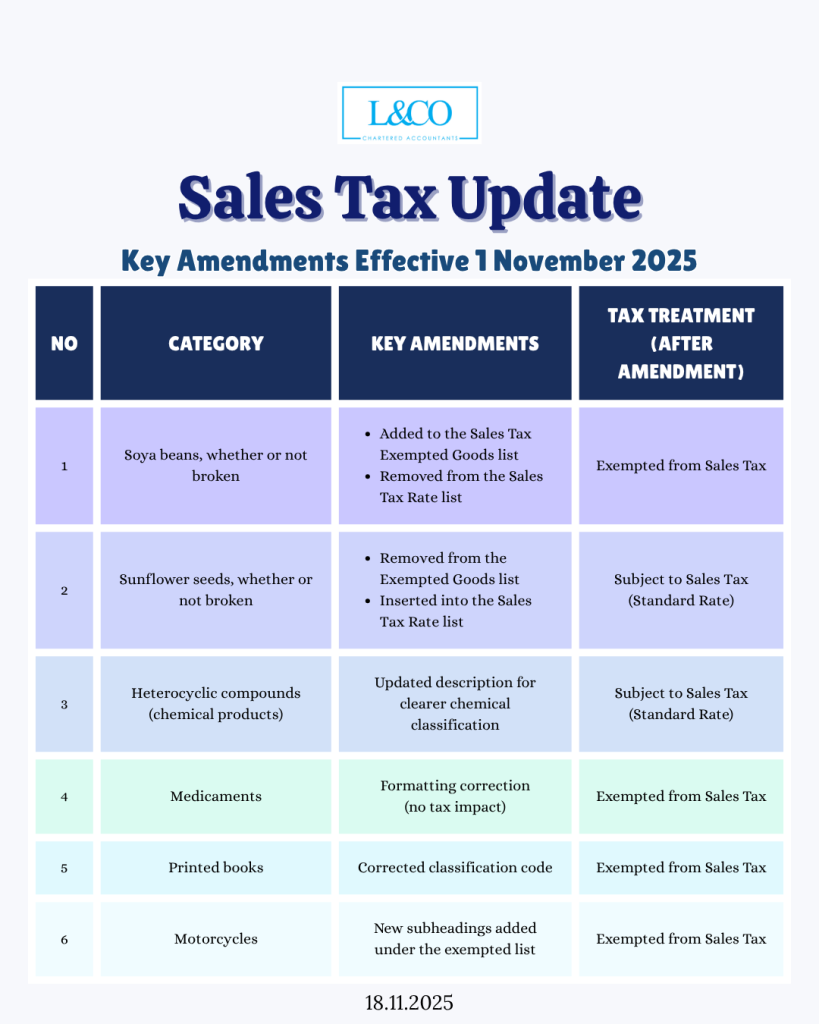

SST Update Policy: Expand SST Exemption Categories

A clear summary of the latest changes to exempted and taxable items. 1. Soya Beans **Whether or not broken Key Amendments: Added to the Sales [...]

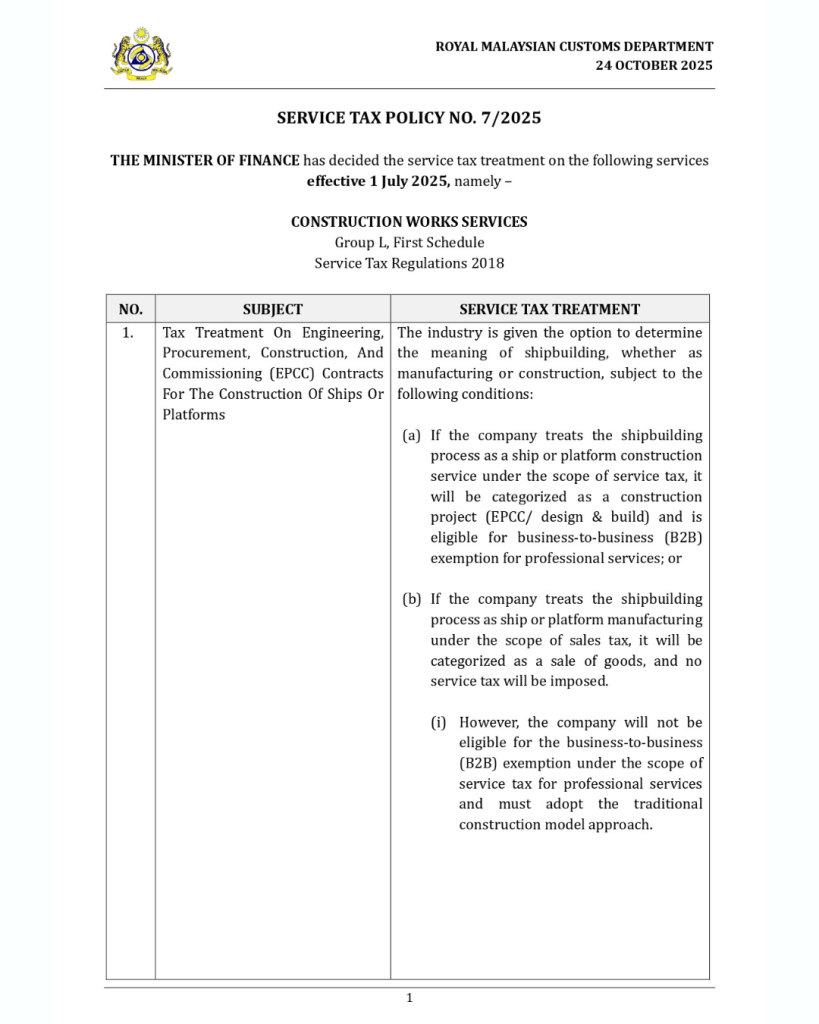

SST Latest Policy 2025: 3 Key Changes for the Construction Industry!

We’ve summarised the latest Service Tax Policy 7/2025 released by the Malaysian Customs, focusing specifically on construction companies, contractors, and developers. 1. EPCC Contracts (Engineering, [...]

Intra-Group Billing & SST Exemption Explained

Does intercompany billing within the same group require a 6% SST? Not necessarily! When 6% SST Can Be Exempted? Under the Service Tax Regulations 2018 [...]

Main Types of Taxes in Malaysia

Malaysia’s tax system is divided into two main categories: -Direct Taxes (administered by LHDN) -Indirect Taxes (administered by RMCD) Direct Taxes Direct taxes are imposed [...]

Service Tax on Imported Taxable Services Overview

Comprehensive Analysis of Scope of Application, Filing Methods, Exemption Conditions, and Special Provisions for Digital Services FAQs: 1. Import Service Tax Explanation Under the First [...]

Attention SMEs! Want to be Exempted from SST? You Must Register for MYPMK!

Effective 1 July 2025, if you are an SME and wish to enjoy Sales and Service Tax (SST) exemption for rental services: You must complete [...]

Latest SST Update: Aircraft & Ship Rentals Now Exempted from Service Tax

Effective 4 July 2025, the following rental/leasing services are no longer subject to Service Tax (SST) in Malaysia Rental of aircraft (excluding drones) Rental of [...]

【Attention Businesses】Key Tax & EPF Deadlines for the Second Half of 2025 – At a Glance

A series of tax and compliance policies will roll out in the second half of 2025! This includes major changes in e-Invoicing, Service Tax, Sales [...]

How to Calculate Your SST Threshold: 3 Key Points Every Business Must Know

Starting from July 2025, Malaysia’s Service Tax (SST) framework has expanded significantly. Many businesses that were previously exempted may now be required to register—depending not [...]

SST 2025: Service Groups, Threshold & Rate

Starting from 1 July 2025, Malaysia’s Service Tax (SST) has expanded to cover more industries and services. Many businesses—especially in services, consulting, digital, and healthcare—must [...]

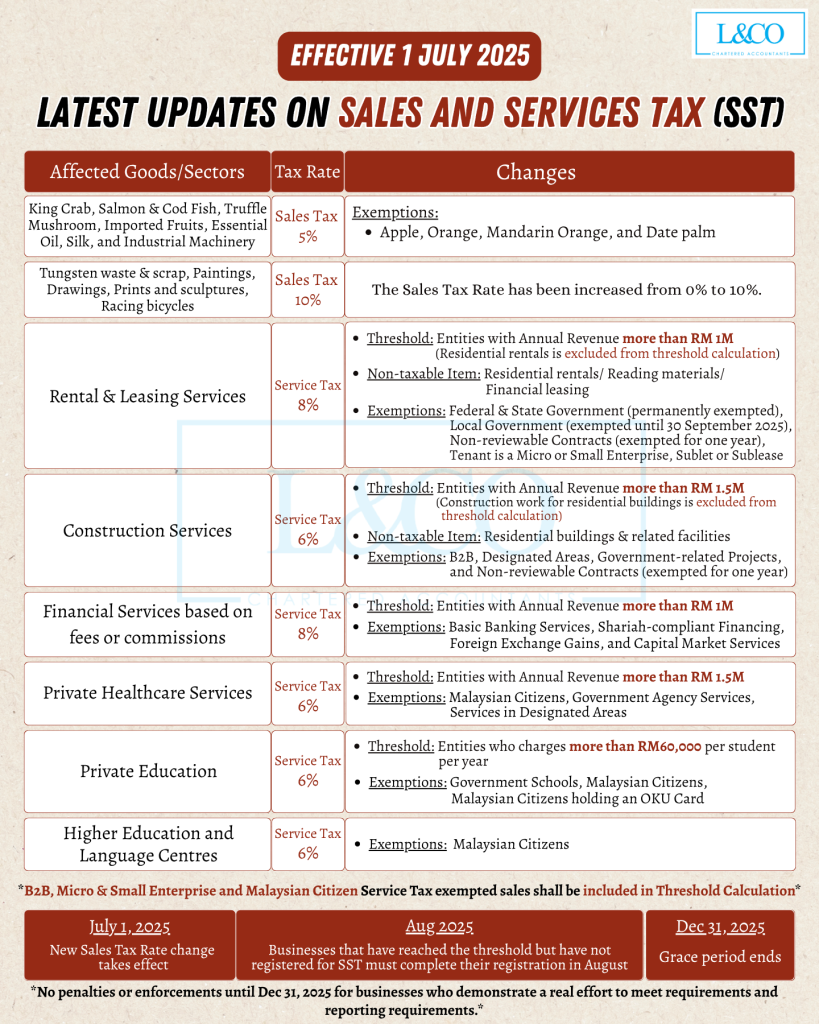

Understand the Latest SST Policy Changes at a Glance!

Effective from 1 July 2025. Wide-ranging impact across financial, leasing, construction, and other service sectors! Key Highlight – Beauty services are now exempted from Service [...]

2025 Private Healthcare SST Guide

Starting July 2025, if you provide private healthcare services to non-Malaysian citizens, you’ll be required to charge 6% Service Tax (SST) ! What services are [...]

【Understand it in 1 minute】Step-by-Step Guide to SST Online Return & Payment Submission

【𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝 𝐈𝐭 𝐢𝐧 𝟏 𝐌𝐢𝐧𝐮𝐭𝐞】𝐒𝐭𝐞𝐩-𝐛𝐲-𝐒𝐭𝐞𝐩 𝐆𝐮𝐢𝐝𝐞 𝐭𝐨 𝐒𝐒𝐓 𝐎𝐧𝐥𝐢𝐧𝐞 𝐑𝐞𝐭𝐮𝐫𝐧 & 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐒𝐮𝐛𝐦𝐢𝐬𝐬𝐢𝐨𝐧 Master your MySST tax submission in just 6 simple steps — from [...]

2025 Construction Services SST Guide

Starting 1 July 2025, certain construction-related services will be subject to Service Tax (SST) in Malaysia ! If you're a contractor, renovation company, or involved [...]

2025 Malaysia SST Guide for Leasing & Rental Services

Starting from 1 July 2025, Malaysia’s Service Tax (SST) framework will be expanded to include certain leasing and rental services under Group K. This change [...]

SST Expansion 2025: Local Fruits Remain Tax-Free & Service Tax Guide

Starting 1 July 2025, Malaysia will implement an expanded Sales and Service Tax (SST) system. In response to public confusion and recent media reports, the [...]

Malaysia’s Major SST Reform in 2025: Service Tax Expansion & Sales Tax Adjustments

Effective from 1 July 2025, the Malaysian government will implement a major reform of the Sales and Service Tax (SST) framework. This change stems from [...]

Revision of Sales and Service Tax (SST) to 8%

Effective from March 2024, Malaysia government officially increased the services tax (SST) rate for several taxable services from 6% to 8%! Which industry are subject [...]

(201706002678 & AF 002133)

(201706002678 & AF 002133)