For first time taxpayer, you need to register a MyTax account for e-filing. However, are you still confused about the registration steps? Don’t worry! We will show you the guidance!

Don’t forget to claim tax relief if you are eligible! Personal Tax Relief 2023: Personal Tax Relief 2023

Application Steps

STEP 1

Browse MyTax official website (https://mytax.hasil.gov.my/), choose your ID type, and key in your ID No.

STEP 2

If you haven’t applied for e pin yet, the system will show “Digital Certification not exist”, click the “e-CP55D” below.

STEP 3

After that, it might appear 2 situations.

- Situation 1, it will show your registered e-Mail.

- Situation 2, you doesn’t have any registered e-Mail.

Click “Yes” for both situation to continue.

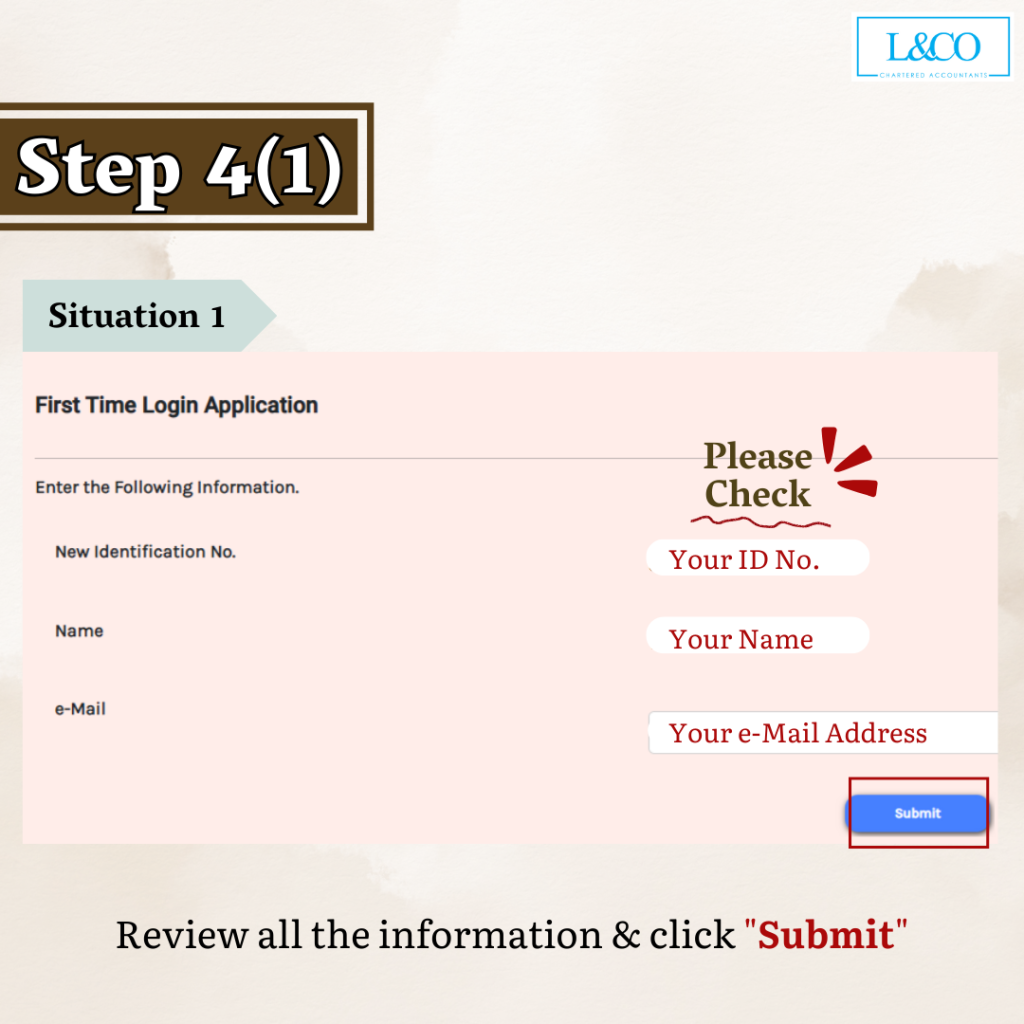

STEP 4 (1)

Situation 1, please confirm your ID No., your name and your registered e-Mail, then click the “Submit” below.

STEP 4 (2)

Situation 2, please confirm your ID No. and your name, then key in your e-Mail address, and upload a color copy of your ID or passport.

- Only jpg., png. and pdf. files are accepted, and the file should not exceed 2MB.

Then click the “Submit” below.

STEP 5

After the submission, LHDN will send the Activation Link to your e-Mail. Click the activation link to activate your MyTax account.

- You might need to wait for a few days to receive activation link and the link is only valid for two days.

STEP 6

Choose ID type and key in ID No., then click the “Submit” below.

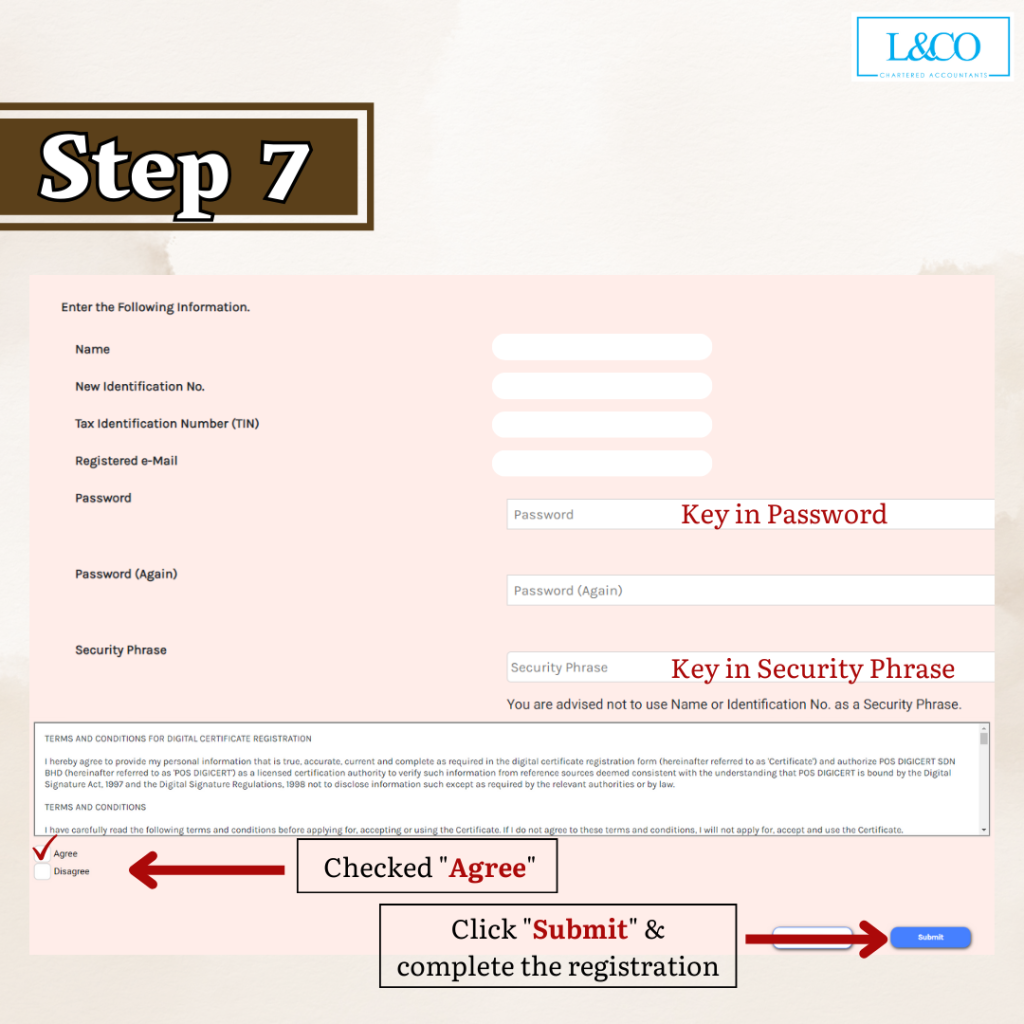

STEP 7

Fill in the password and security phrase, then checked agree at the terms and conditions. After that, click “Submit” and complete the registration.

STEP 8

In MyTax, choose your ID type and key in the ID No., then confirm your security phrase and key in password. Click login and you are ready to file your tax!

Personal Tax Relief 2023: Personal Tax Relief 2023

(201706002678 & AF 002133)

(201706002678 & AF 002133)