Starting 1 July 2025, certain construction-related services will be subject to Service Tax (SST) in Malaysia !

If you’re a contractor, renovation company, or involved in M&E or EPCC works — this affects you!

What are “Construction Services”?

If you’re involved in construction, extension, renovation, electrical or plumbing works, demolition, civil or M&E engineering — and it’s not purely residential, your services may be subject to SST!

- Threshold: RM1,500,000 (total taxable construction services within any 12-month period)

- Rate: 6%

- Effective Date: 1 July 2025

- All contractors – main, sub, renovation, civil, M&E, plumbing, electrical – must register for SST if revenue exceeds the threshold.

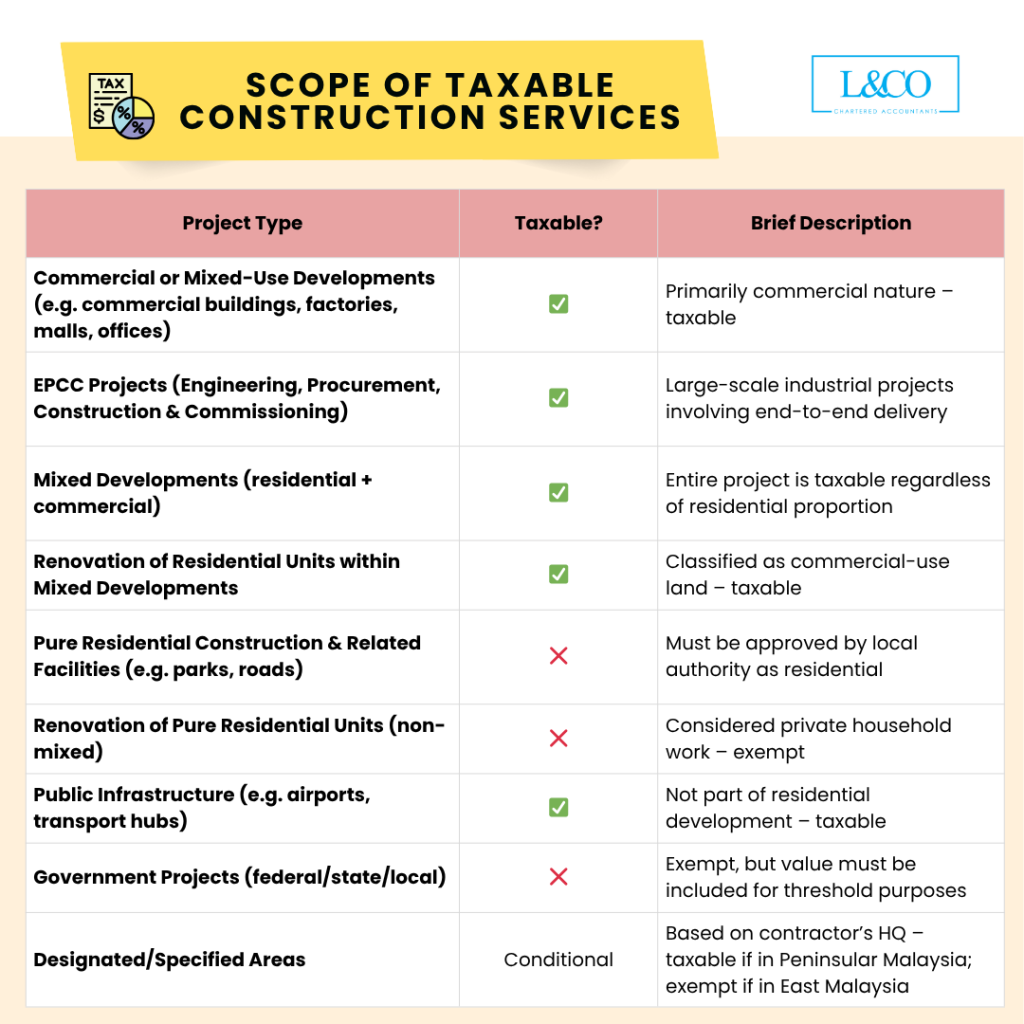

Scope of Taxable Construction Services

May refer to the following graphic:

Important Reminder : Exempt ≠ Excluded from Threshold!

Many assume exempt projects don’t matter for SST registration – this is incorrect.

📌 According to Royal Malaysian Customs SST Guide:

- Even exempt construction services (e.g. projects for the Federal Government, State Government, or Local Authorities) must still be included when calculating the RM1,500,000 registration threshold.

- However, residential buildings and public facilities related to those residential buildings are fully excluded — they do not subject to SST and do not count toward the threshold.

❌ Don’t worry – exempt projects remain exempt even after SST registration. No backdated tax will be imposed on them.

Invoice & Billing Requirements

- Registered contractors must issue SST invoices for taxable projects

- Invoices can be in e-Invoice, paper, or PDF format

- Must include: client details, service description, and 6% tax amount

- For B2B exempt projects, indicate the client’s SST number and exempted value

- Retention sums, progress billings, and stage payments – SST is chargeable upon payment received

- It’s recommended to certify and invoice each claim stage to ensure SST compliance

Frequently Asked Questions (FAQ)

When I provide construction services (excluding pure residential construction and related facilities), and my total revenue exceeds RM1,500,000 over the past 12 months.

It includes the value of services and the cost of materials used in construction.

All materials and works permanently installed or constructed on-site.

If the contract only specifies labour, then only labour fees are subject to SST.

Upon receiving payment from the client. If approved for invoice basis, then based on the invoice date.

SST is chargeable upon receipt of each stage payment. If unpaid for over 12 months, it must still be declared.

Yes. SST is chargeable upon receiving the retention sum.

No. These are considered compensation for loss and are not taxable.

No. It’s treated as a loss compensation and is not subject to SST.

Only the services provided after the effective date are subject to SST.

Only the portion related to work done after 1 July 2025 is subject to SST.

**Last updated on 9.6.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)