To further standardize the corporate e-Invoice system, the Inland Revenue Board of Malaysia (IRBM) has updated the e-Invoice implementation timeline, exemption conditions, and revenue determination criteria based on the latest guideline issued on 8 December 2025.

This guideline applies to all taxpayers conducting business activities in Malaysia, including newly established companies, existing businesses, and sole proprietors. With clear implementation phases and exemption criteria, businesses can better understand when they must start using e-Invoices and under what circumstances they may qualify for full exemption.

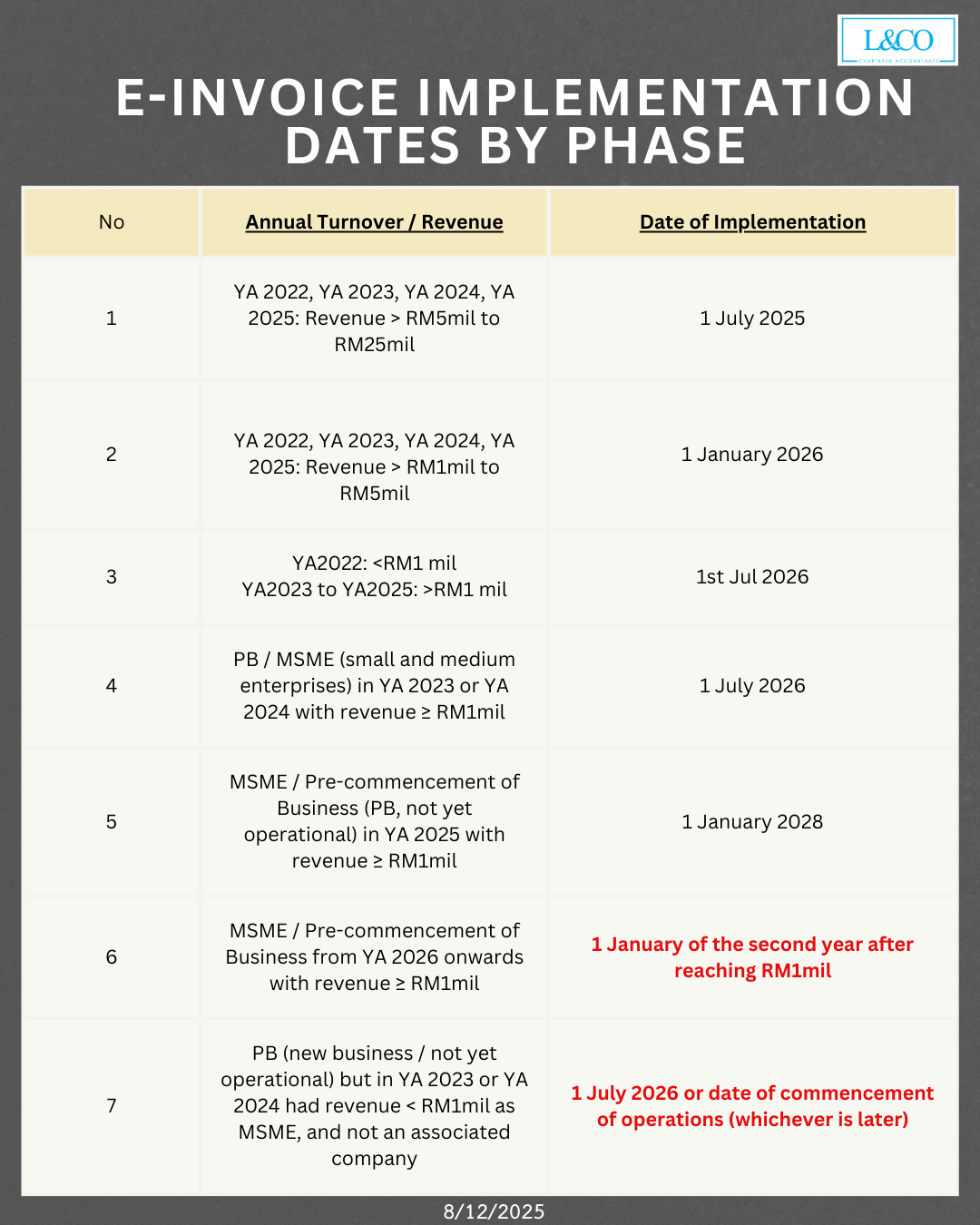

Implementation Timeline and Exemption Guidelines

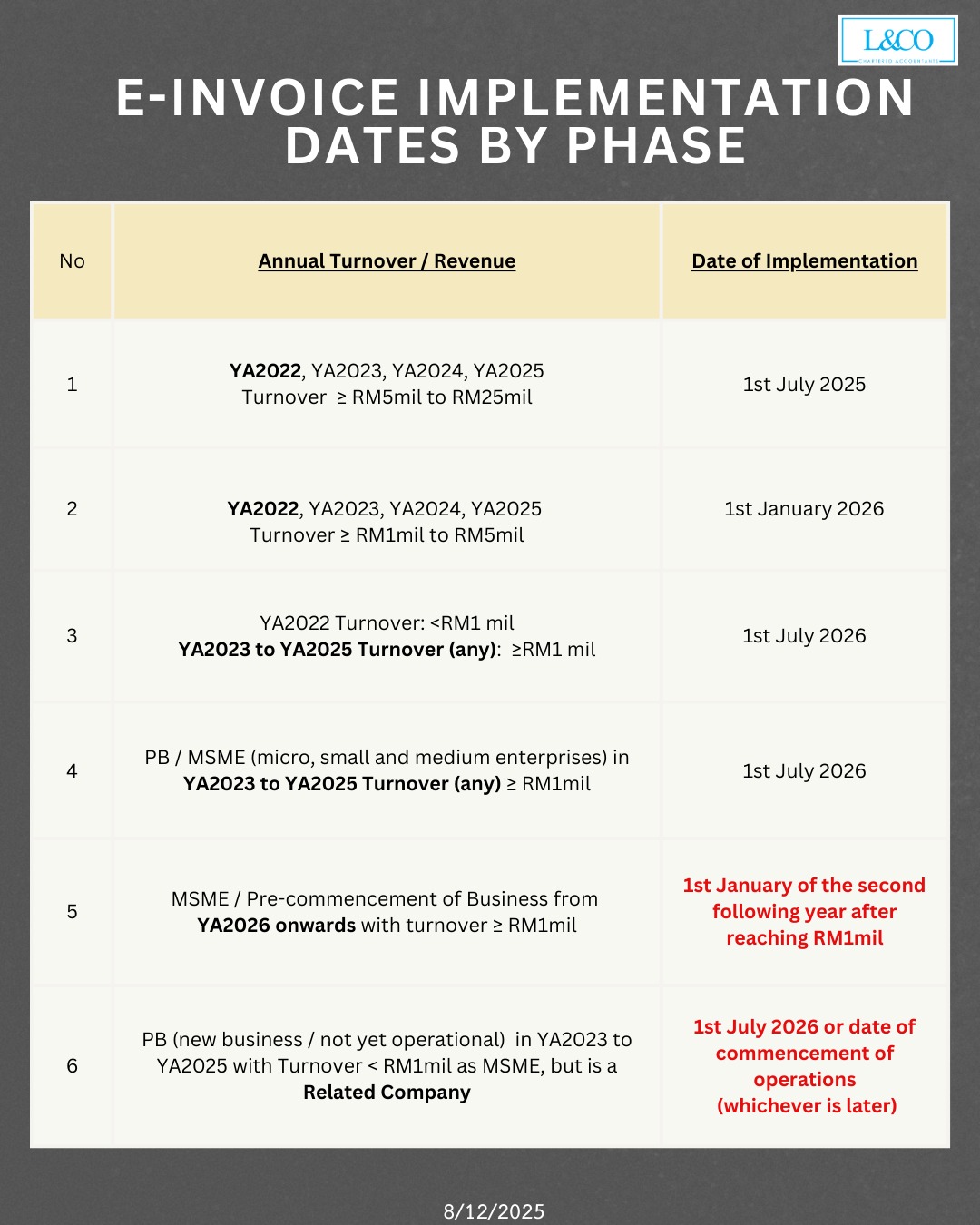

The government has officially increased the E-Invoice annual revenue threshold from RM500,000 to RM1 million. This means:

- January 1, 2026 is the final main batch for businesses to adopt E-Invoice

- July 1, 2026 and onwards will only involve a small group of exceptional cases

Who Can Be Exempted from E-Invoice?

All taxpayers engaged in commercial activities are required to implement E-Invoice according to their respective phase, unless they meet the following conditions for full exemption (including self-billed invoices):

- Annual revenue < RM1,000,000

- No corporate shareholders

- Not a subsidiary

- No associated or joint-venture companies

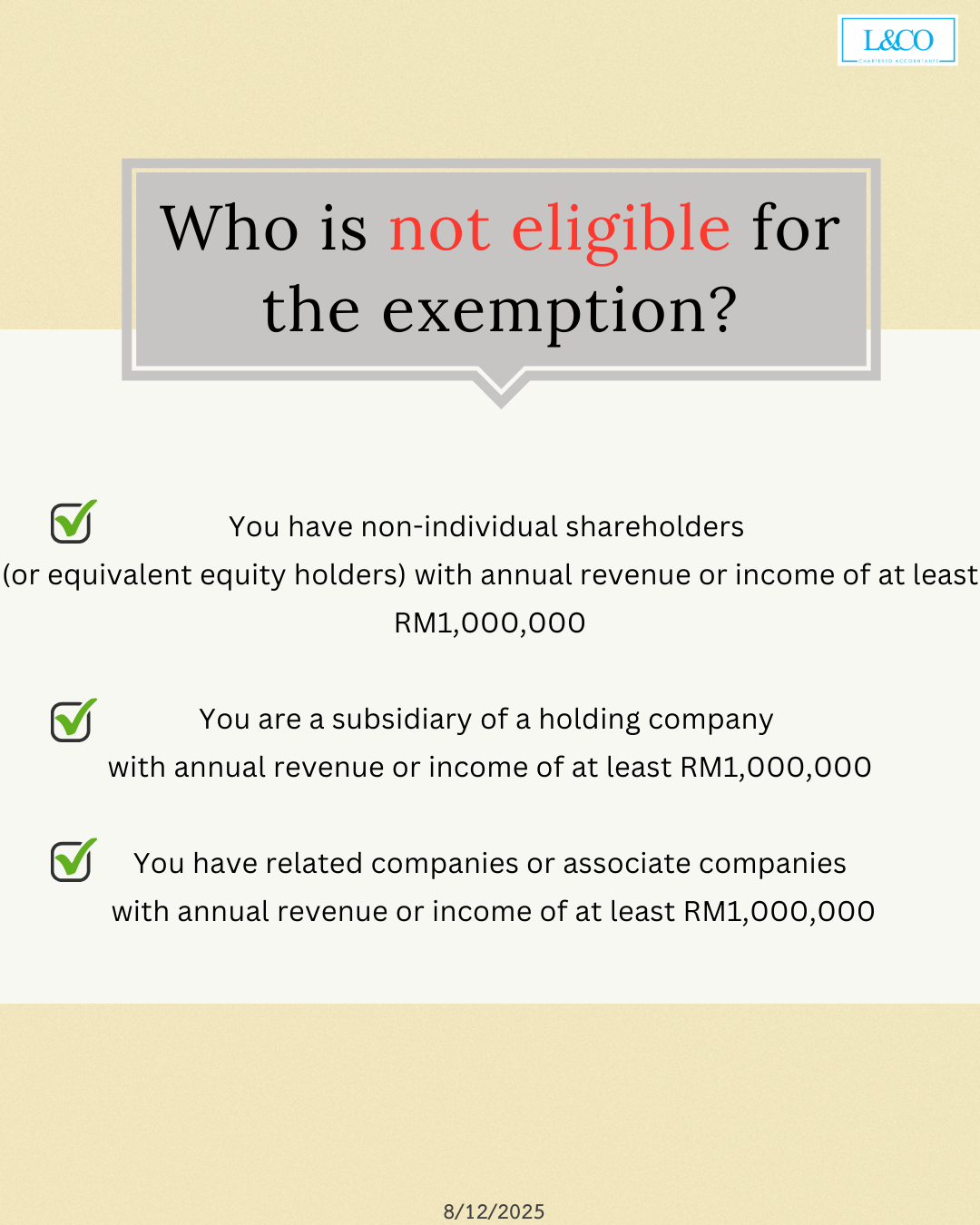

Who Does Not Qualify for Exemption?

- Non-individual shareholders (or equivalent interest holders) with annual revenue ≥ RM1,000,000

- Subsidiaries of holding companies with annual revenue ≥ RM1,000,000

- Associated companies or joint ventures with annual revenue ≥ RM1,000,000

If a business owns multiple enterprises, the total revenue must be consolidated.

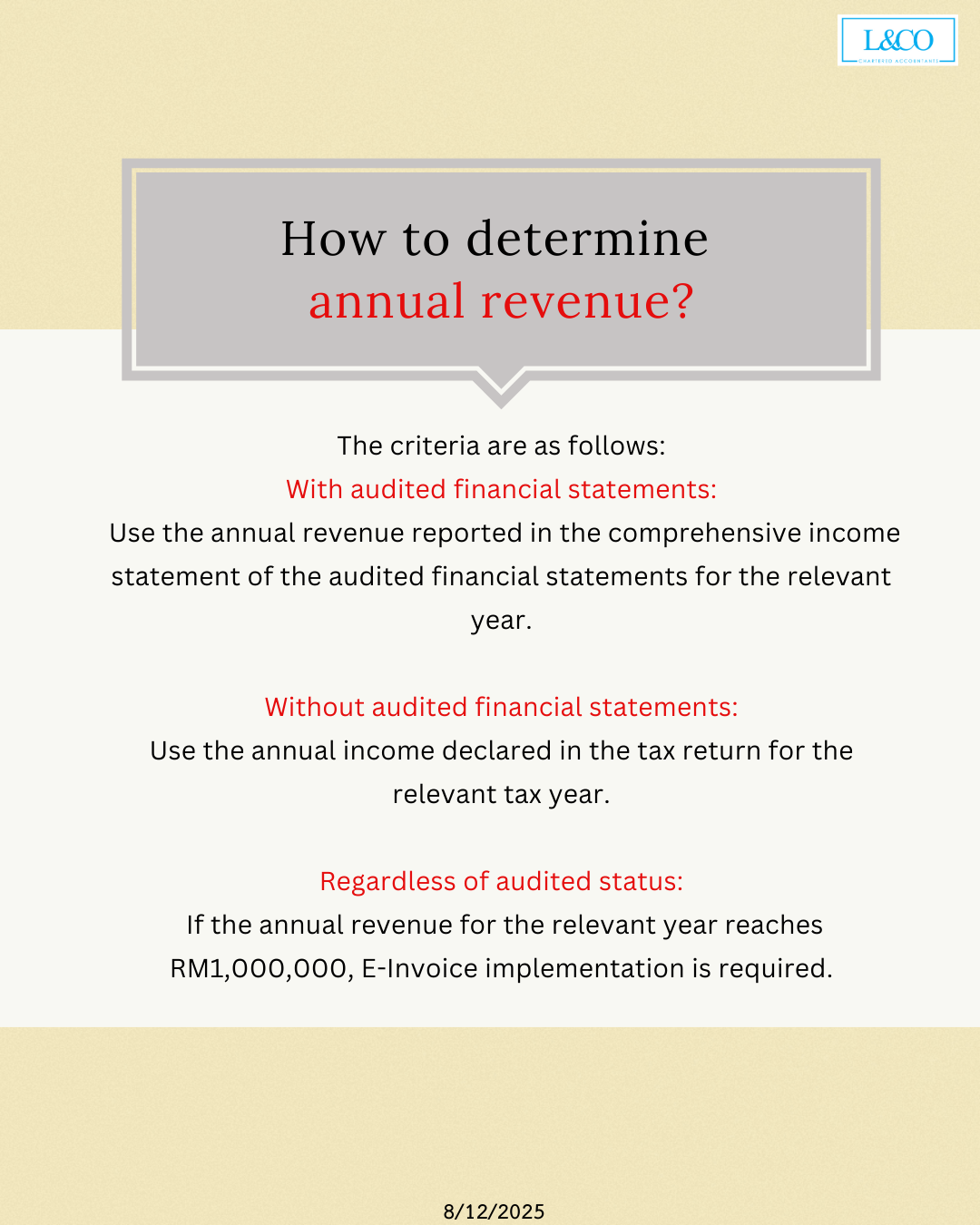

How to Determine Annual Revenue

- With audited financial statements: use the total revenue reported in the audited income statement

- Without audited financial statements: use the annual revenue declared in the tax return

- In all cases: if annual revenue reaches RM1,000,000, E-Invoice must be implemented

For sole proprietors, the requirement to implement E-Invoice is based on the total annual revenue

or income of all sole proprietorships under their name. This combined amount is used

to determine whether the RM1,000,000threshold has been reached.

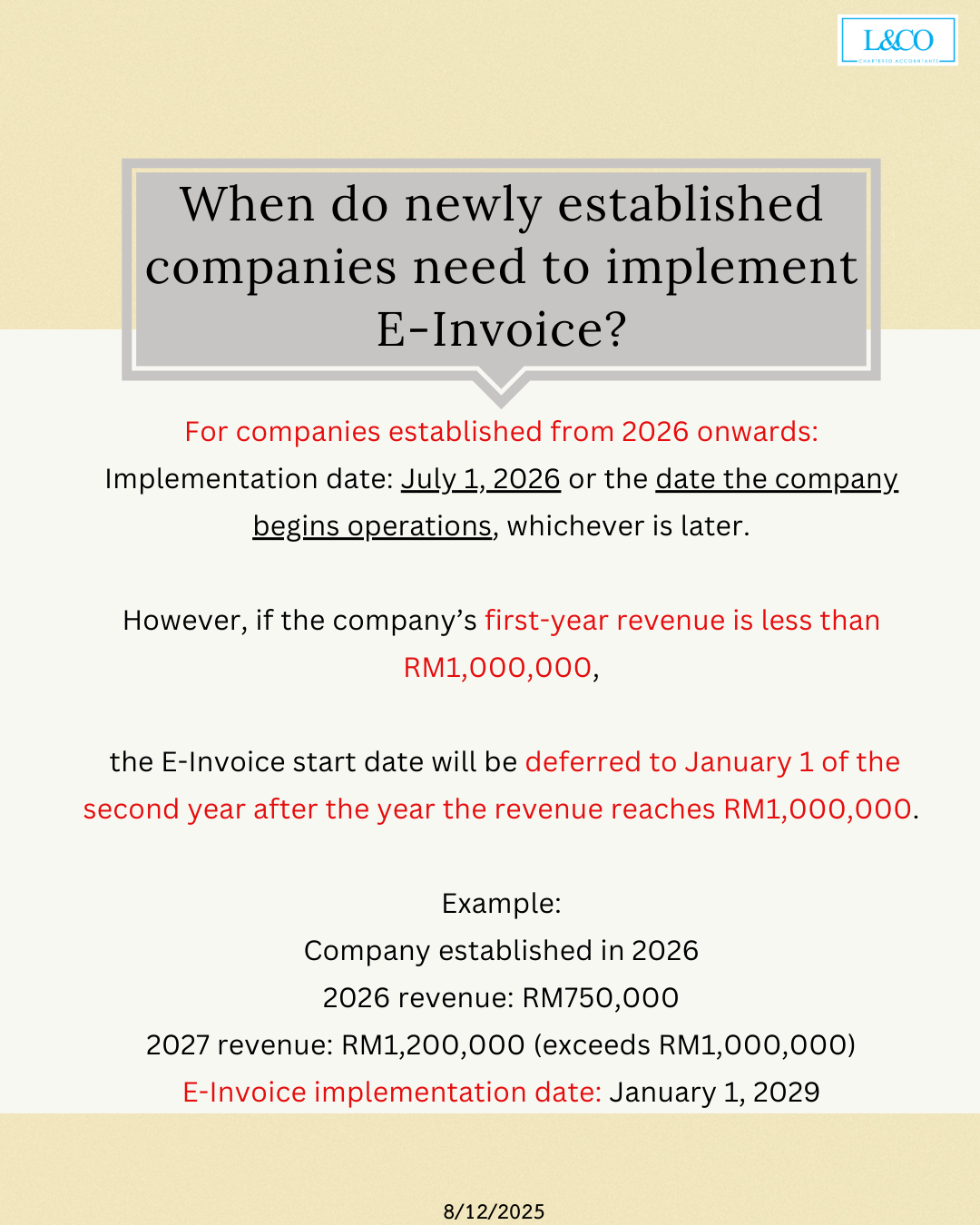

Implementation Timeline for New Companies

- For companies established from 2026 onwards:

Implementation date is July 1, 2026, or the start date of operations (whichever is later)

- If the first-year revenue is below RM1,000,000, the implementation date is delayed to January 1 of the second year after reaching RM1,000,000

Example: Company established in 2026, revenue RM750,000 in 2026, RM1,200,000 in 2027 → E-Invoice implementation date is January 1, 2029

Existing Companies (Established 2023–2025)

- Annual revenue ≥ RM1,000,000: implement E-Invoice from July 1, 2026

- Annual revenue < RM1,000,000 and meeting exemption criteria: fully exempted

- If annual revenue exceeds RM1,000,000 in YA2026 or later, E-Invoice must be implemented from January 1 of the following year

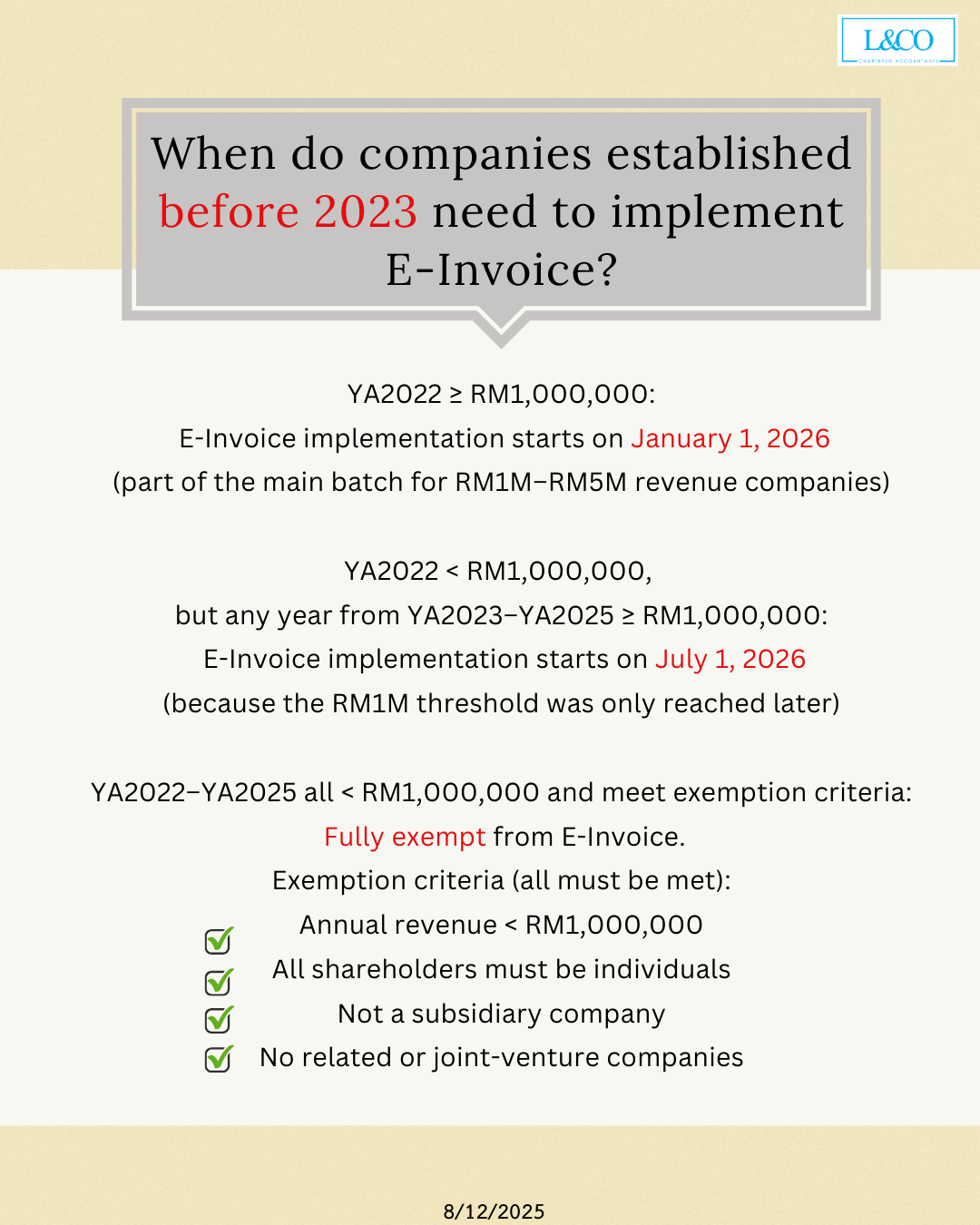

When do companies established before 2023 need to implement E-Invoice?

YA2022 ≥ RM1,000,000 , E-Invoice implementation starts on January 1, 2026

(part of the main batch for RM1M–RM5M revenue companies)

YA2022 < RM1,000,000, but any year from YA2023–YA2025 ≥ RM1,000,000

E-Invoice implementation starts on July 1, 2026

(because the RM1M threshold was only reached later)

YA2022–YA2025 all < RM1,000,000 and meet exemption criteria:

Fully exempt from E-Invoice.

(201706002678 & AF 002133)

(201706002678 & AF 002133)