Effective 1 April 2022, Taxpayers can use the e-TT system for the payment of Withholding Tax (WHT). The e-TT system will generate a Virtual Account Number (VA) as a payment identification identity. With the VA number, taxpayers can make payments within and outside Malaysia through Telegraphic Transfer (TT), Electronic Funds Transfer (EFT), and Interbank GIRO Transfer methods.

Payment Steps

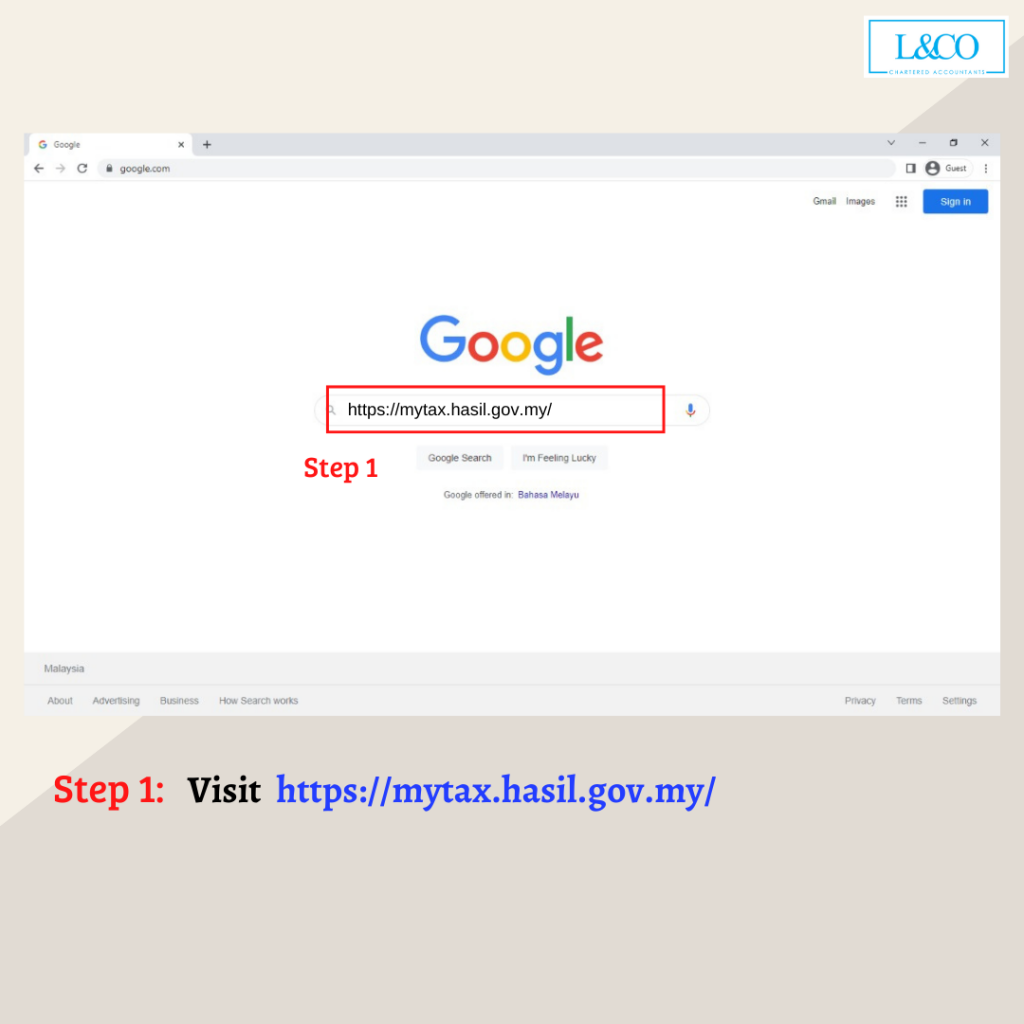

1. Visit MyTax Website

- MyTax website: https://mytax.hasil.gov.my/

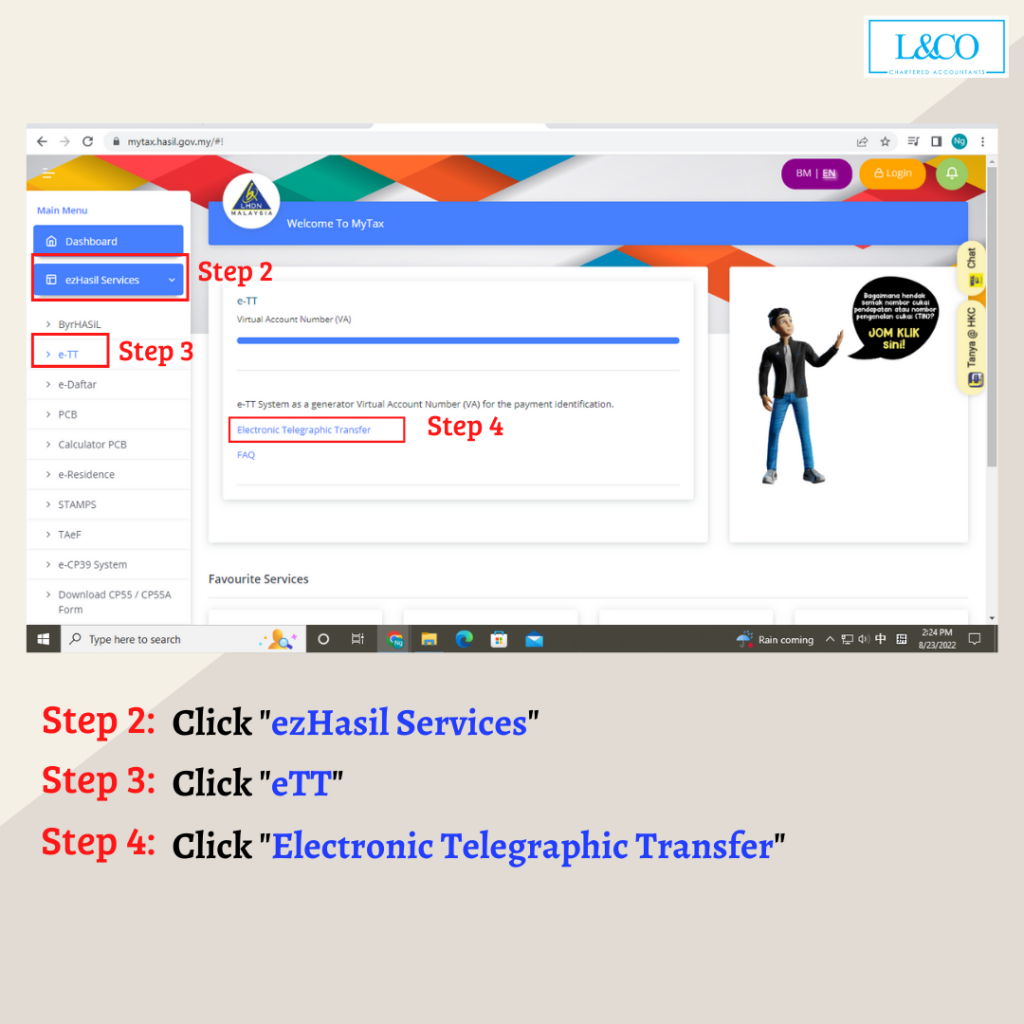

- After visit the website, click “ezHasil Services”, “e-TT”, and “Electronic Telegraphic Transfer”

2. Click “Next”

3. Fill in the Identification Information

- Fill in the personal details and security code

- Then, click “Next”

4. Enter Email

- Enter email

- Then, click “Next”

5. Enter OTP Code

- Enter OTP code

- Then, click “Verify”

6. Fill in Payment Details

- Click “Payment Details”

- Then, choose “Withholding Tax (WHT)” at “Payment Type”

- Fill up individual’s income tax number and address

- Then, click “S 109 – Royalty, interest” at “Section”

- Fill in all information

- Then, click “Next”

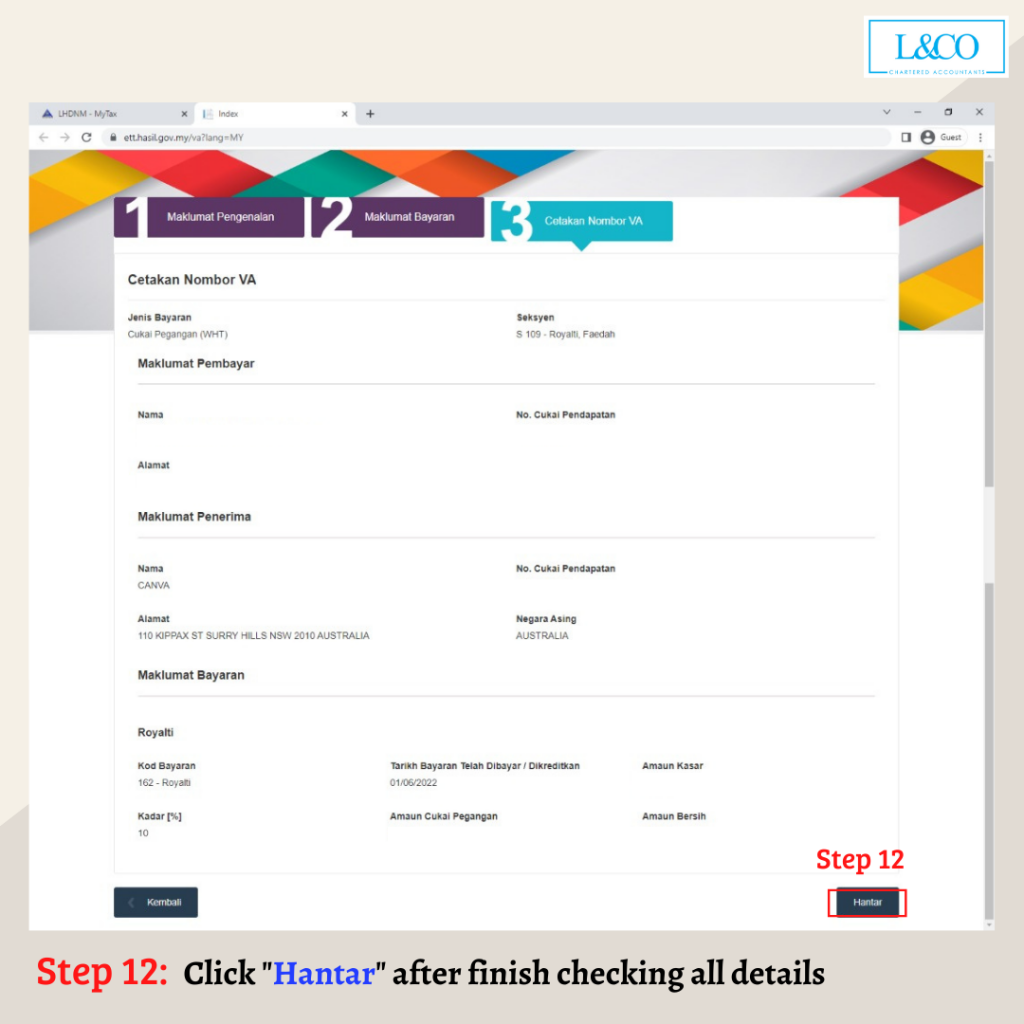

7. Check Details

- Check all details

- Then, click “Hantar”

8. Print out VA Number

- Click “Cetak No. VA” to print out VA number

9. Payment Method

- VA number will be the Account No. during payment (Take note: the one VA number can be use for once)

- Type of payment: Online banking, Bank counter, or ATM

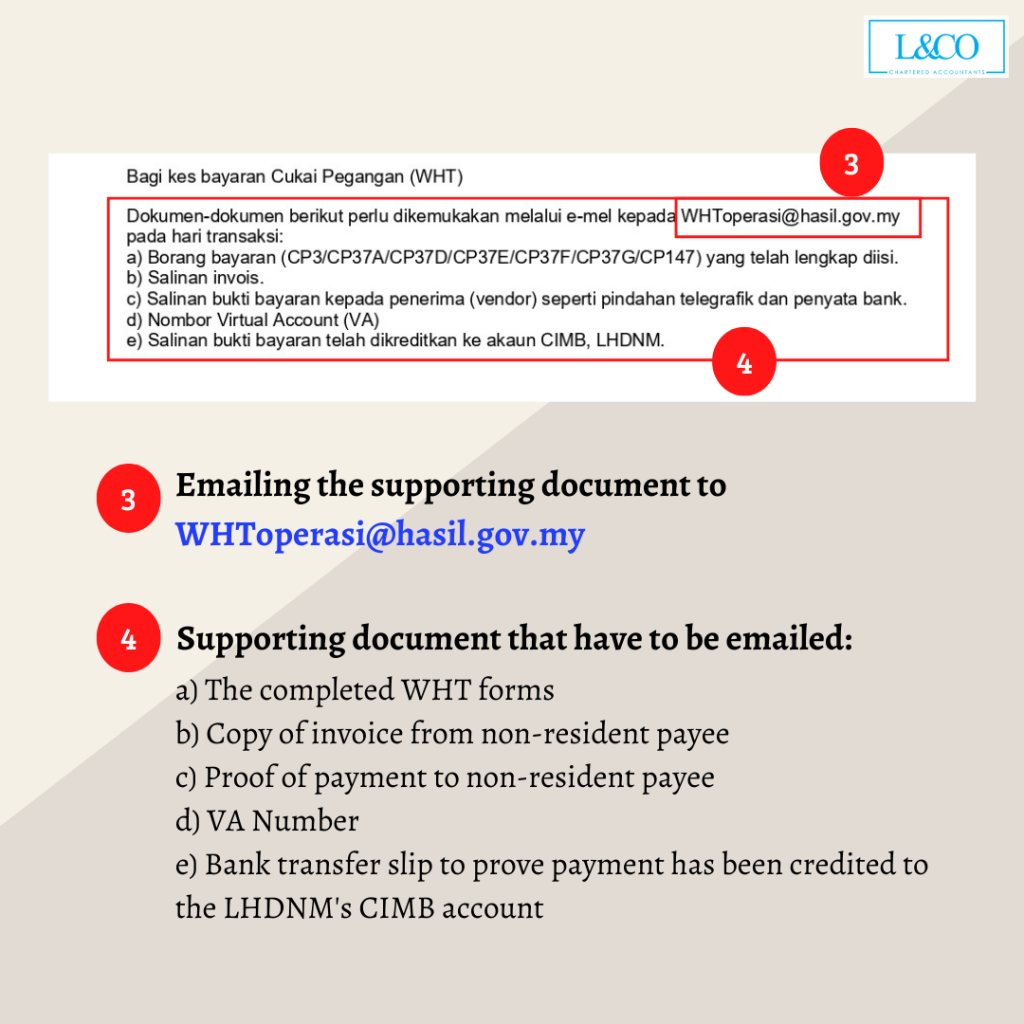

- Then, email the supporting documents to WHToperasi@hasil.gov.my

10. Supporting Documents

The supporting documents that have to be email:

- The completed WHT form

- Copy of invoice from non-residents payee

- Proof of payment to non-residents payee

- VA number

- Bank transfer slip to prove payment has been credited to LHDNM’s CIMB account

(201706002678 & AF 002133)

(201706002678 & AF 002133)