KWSP will launch the ‘Flexible’ third EPF account in April! Besides this news, what else is worth paying attention to this month? Let’s take a look together!

KWSP Will Launch The ‘Flexible’ Third EPF Account In April!

- KWSP will introduce the ‘Flexible’ third EPF account in April. Members are required to contribute a certain percentage of their monthly salary. Withdrawals are only allowed for emergencies. Currently, there are two account in EPF, namely the Account 1 and Account 2, with a percentage rate of 70% and 30%.

The Second Phase of STR Will Be Distributed In April!

- The second phase of STR financial assistance will be disbursed in April. If you have provided your bank account information, the cash aid will direct transferred to your bank account. If not, you can collect cash aid via BSN counters. This government aid program is aimed to assist low-income families and individual.

You Can Now Transfer Directly From Touch ‘n Go eWallet to Alipay!

- The GOremit feature of Touch ‘n Go eWallet now supports direct transfers to Alipay in China! To use the direct transfers feature, simply open the app, click on the GOremit icon, select ‘China’ as the recipient’s country, and enter the amount. Each transaction incurs an RM25 processing fee, and the system will display real-time exchange rates and the final amount.

You Can Withdraw From The KWSP Account Once It Reaches RM1 million!

- According to information on the KWSP official website, you can withdraw from the KWSP account once it reaches RM1 million in savings, without having to wait until age 55! However, the RM1 million must remain in the KWSP account, and members can only withdraw the excess savings. Eligible users can apply through KWSP i-Akaun or service counters!

SSPN Dividends Will Be Announced Soon!

- SSPN will announce the dividends distribution in April, and may introduce an additional 1% bonus! Users only need to deposit at least RM500 within a specified period to enjoy the extra 1% bonus. The bonus will be calculated based on the amount deposited, with a maximum reward of RM8,000, but withdrawals are not allowed during the specified period!

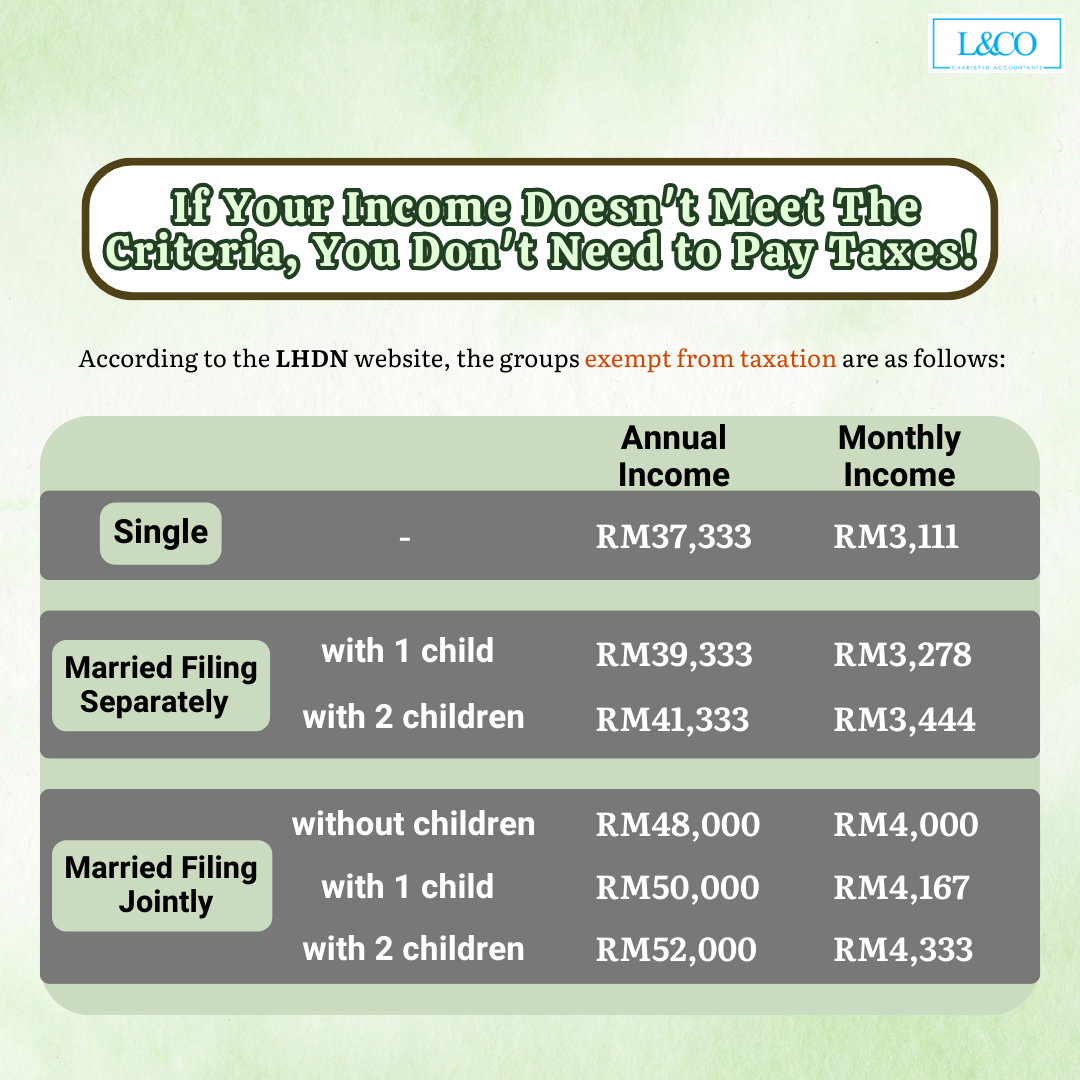

If Your Income Doesn’t Meet The Criteria, You Don’t Need to Pay Taxes!

According to the LHDN website, the groups exempt from taxation are as follows:

- Single

Annual Income: RM37,333

Monthly Income: RM3,111

- Married Filing Separately

With 1 child

Annual Income: RM39,333

Monthly Income: RM3,278

With 2 children

Annual Income: RM41,333

Monthly Income: RM3,444

- Married Filing Jointly

Without children

Annual Income: RM48,000

Monthly Income: RM4,000With 1 child

Annual Income: RM50,000

Monthly Income: RM4,167With 2 children

Annual Income: RM52,000

Monthly Income: RM4,333

Public Holiday in April

- 10.04.2024 (Wednesday): Hari Raya Aidilfitri (National)

- 11.04.2024 (Thursday): Hari Raya Aidilfitri Holiday (National)

- 26.04.2024 (Friday): Sultan of Terengganu’s Birthday (Terengganu only)

Important Dates in April

- 15.04.2024: PCB (March salary)

- 15.04.2024: SOCSO & EIS (March salary)

- 15.04.2024: HRDC (March salary)

- 15.04.2024: EPF (March salary)

- 15.04.2024: CP204 payment

- 30.04.2024: Audited Report (Company F.Y.E Sep 2023)

- 30.04.2024: CP204 Submission (Company F.Y.E May 2025)

- 30.04.2024: Form C (Company F.Y.E Aug 2023)

- 30.04.2024: SST (February – March 2024 payments)

- 30.04.2024: Form E (e-filing)

- 30.04.2024: Form BE

(201706002678 & AF 002133)

(201706002678 & AF 002133)