Insolvency Act Amendment

- According to Budget 2023, insolvents with small debts are given a second chance to discharge from bankruptcy if they fulfilled the following situation:

- Bankruptcy declaration had surpassed 5 years from the date of the acceptance order and the bankruptcy order

- The amount of outstanding debt does not exceed RM50,000

- There is no court order, court proceeding and/or investigation being carried out on the insolvent under the Insolvency Act 1967

- Further details, kindly seek assistance from the department or their website (https://www.mdi.gov.my)

PTPTN Payment Discount

- According to Budget 2023, 20% discount will be provided on PTPTN loan repayments for 3 months starting March.

- Besides, PTPTN loan borrowers whose monthly income is or lower than RM1,800 can apply for a six-month deferment starting from March.

EPF i-Saraan 2023

- The government has agreed to extend the EPF voluntary contribution programme, i-Saraan, and increase the maximum limit of the matching contribution incentive for 2023 from RM 250 to RM 300 per year.

Pakej Perpaduan

- Several Malaysian telecommunication providers will start providing the Pakej Perpaduan. This package provides mobile Internet plan with affordable price, aiming to provide support to underserved communities (Youths under 30, senior citizens aged 60 and above, veterans of uniformed bodies, OKU and B40 groups)

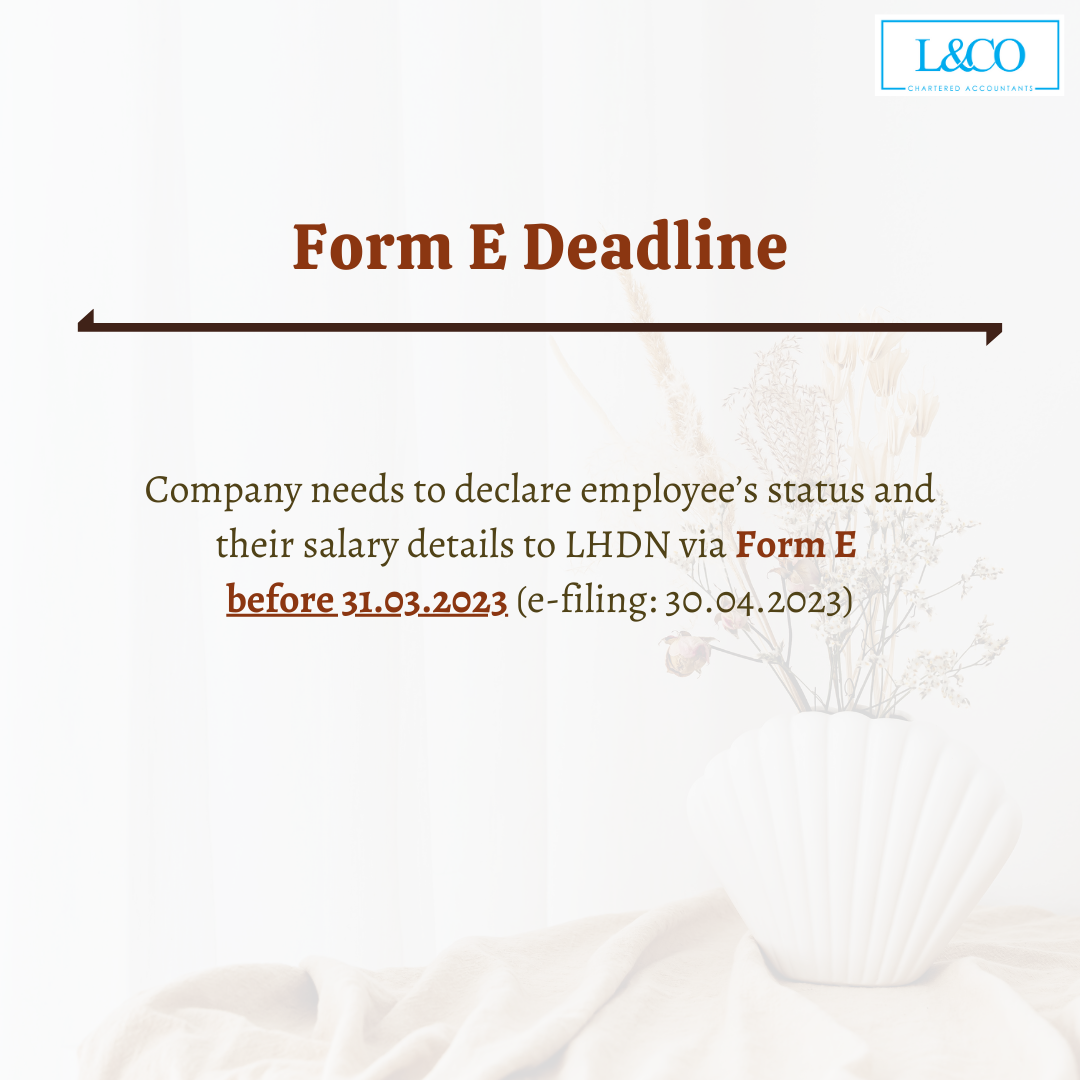

Form E Deadline

- Company needs to declare employee’s status and their salary details to LHDN via Form E before 31.03.2023 (e-filing: 30.04.2023)

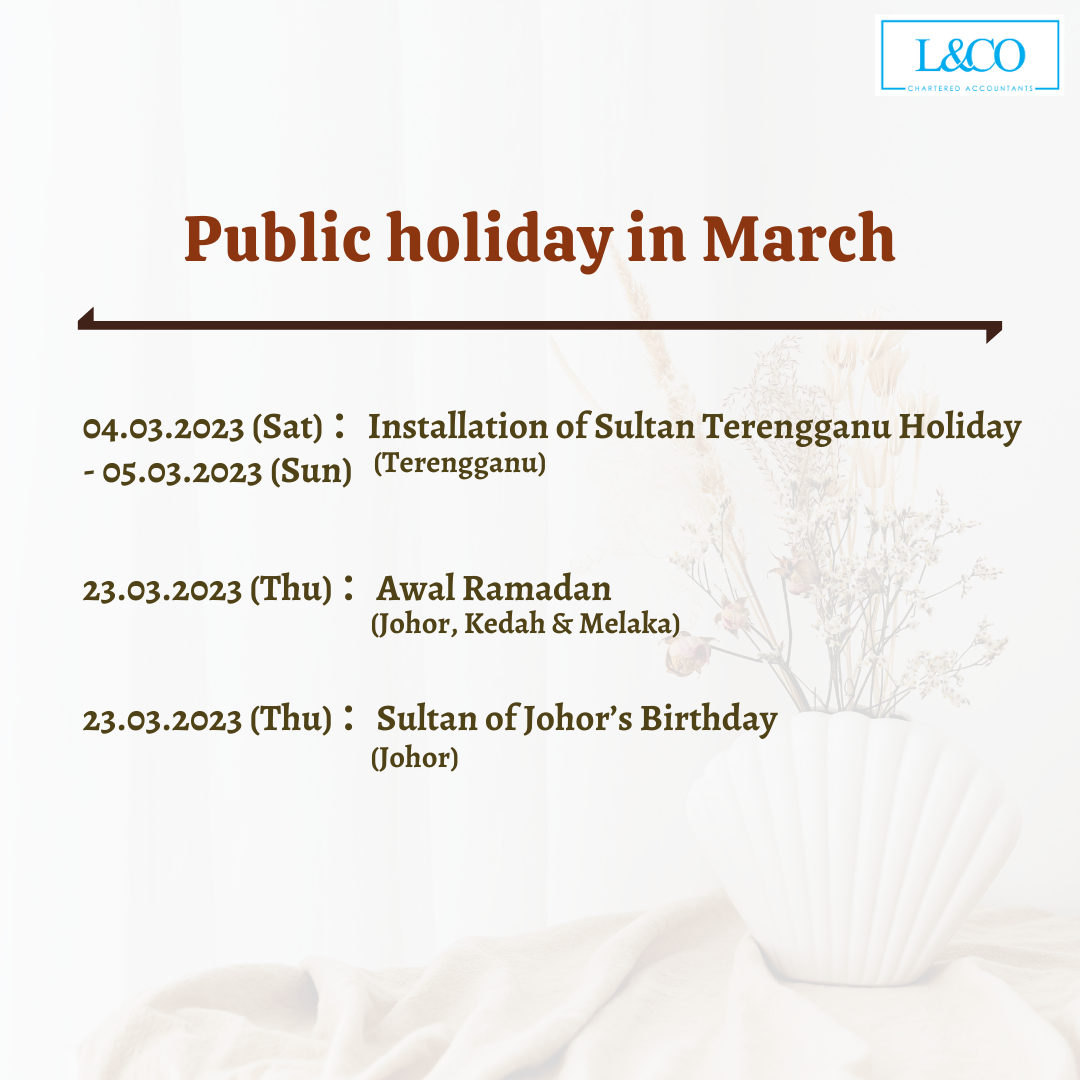

Public Holidays in March

- 04.03.2023 – 05.03.2023 (Sat – Sun) :Installation of Sultan Terengganu Holiday (Terengganu)

- 23.03.2023 (Thu) :Awal Ramadan (Johor, Kedah & Melaka)

- 23.03.2023 (Thu):Sultan of Johor’s Birthday (Johor)

Important dates in March

- 15.03.2023:PCB (February Salary)

- 15.03.2023:SOCSO & EIS (February Salary)

- 15.03.2023:HRDF (February Salary)

- 15.03.2023:EPF (February Salary)

- 15.03.2023:CP204 Payment

- 30.03.2023:CP500 (First payment)

- 30.03.2023:Audited Report (Company financial year ended August 2022)

- 31.03.2023:SST (January – February 2023 Payment)

- 31.03.2023:CP204 Submission (Company financial year ended April 2024)

- 31.03.2023:Form C (Company financial year ended July 2022)

(201706002678 & AF 002133)

(201706002678 & AF 002133)