Starting 1 July 2025, Malaysia will implement an expanded Sales and Service Tax (SST) system. In response to public confusion and recent media reports, the Ministry of Finance (MOF) has issued an official clarification regarding sales tax on local fruits and service tax obligations for businesses.

This article summarizes the key updates and what businesses need to prepare moving forward.

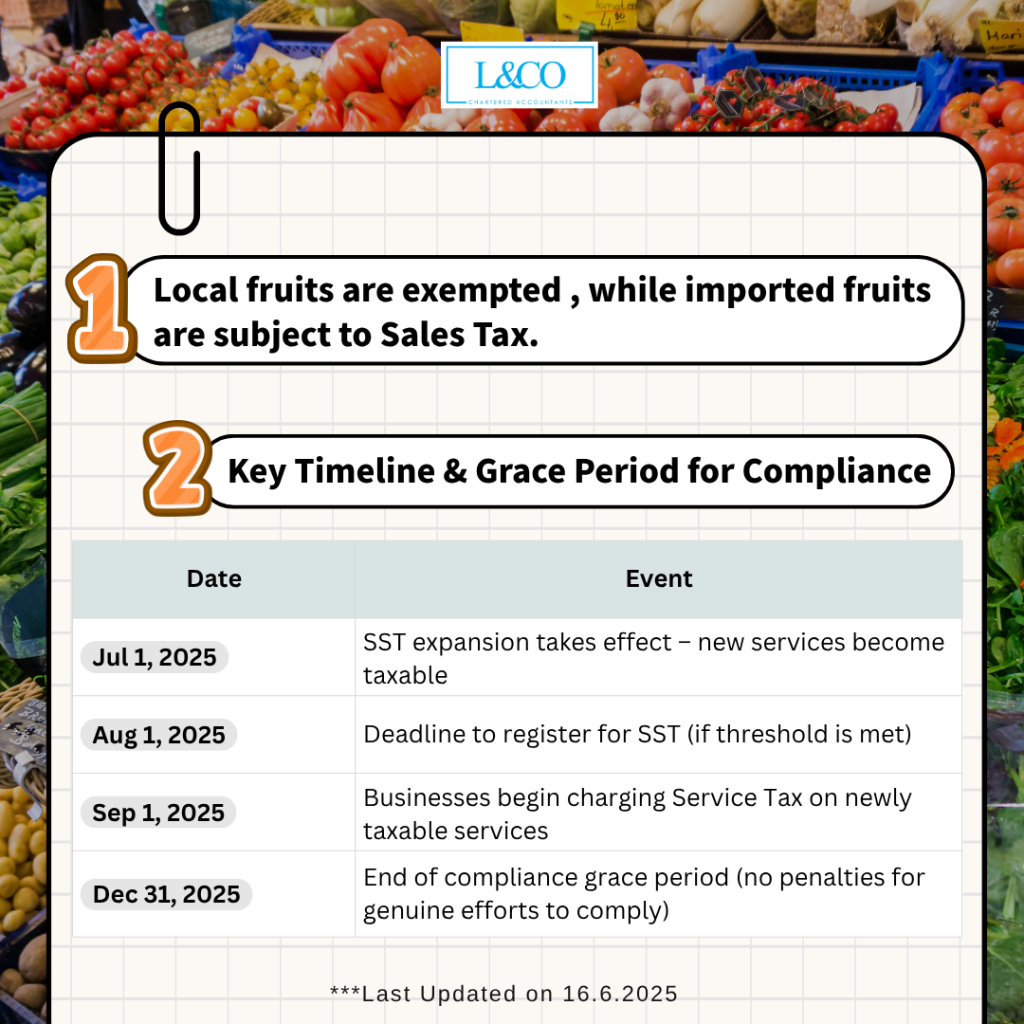

1. Local Fruits Are Not Subject to Sales Tax

There have been reports suggesting that local tropical fruits will be subject to Sales Tax under the new PU(A) 170/2025 Gazette Order.

Clarification from MOF:

- Fruits grown and harvested in Malaysia are classified as agricultural produce, not manufactured goods — and are therefore exempted from Sales Tax.

- Imported fruits, such as bananas, pineapples, and rambutans from other countries, are subject to 5% Sales Tax under the new SST item list.

Conclusion:

Locally grown fruits = No Sales Tax

Imported fruits = 5% Sales Tax applies

2. Expansion of Service Tax

Does My Business Need to Register for SST?

Check if the total revenue from the relevant services has exceeded RM500,000 over the past 12 months.

If yes:

You are required to:

-Register for SST by August 2025

-Start charging Service Tax from 1 September 2025

If not yet, continue monitoring your revenue to ensure compliance once the threshold is crossed.

3. Key Timeline & Grace Period for Compliance

To help businesses prepare, the government has provided a clear implementation timeline and a grace period to support smooth transition.

Compliance Grace Period: Until 31 December 2025

The MOF acknowledges that businesses may need time to adjust.

Therefore, a compliance grace period has been granted until the end of 2025.

During this period:

-No penalties will be imposed on businesses that make reasonable efforts to comply with the new rules.

4. What Businesses Should Do Now

- Review your business activities – Are you offering any services newly subject to SST?

- Evaluate your revenue – Has it exceeded the threshold in the past 12 months?

- Prepare your SST registration and accounting system before September

- Seek professional advice to ensure timely and accurate compliance

**Last Updated on 16.6.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)