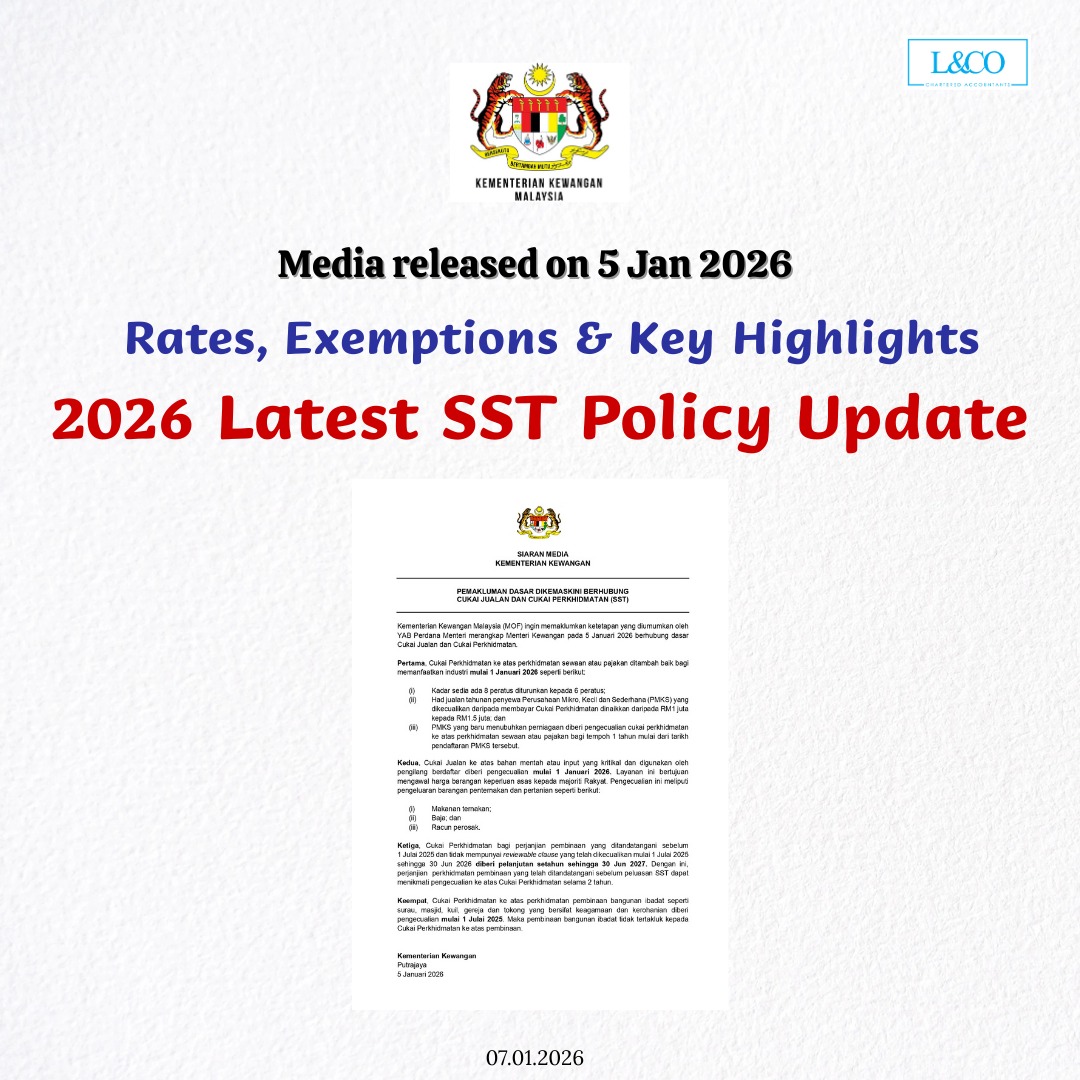

Recent announcements on Sales & Service Tax (SST) have raised many questions among businesses.

To help clear the confusion, here is a summary of the latest SST updates released by the Ministry of Finance:

Here’s what you need to know:

1. Service Tax Reduction for Rental Services

- Effective: 1 January 2026

- Service tax rate reduced from 8% to 6%

- SME exemption threshold increased from RM1 million to RM1.5 million

- Newly registered SMEs are eligible for a 1-year exemption on rental service tax

👉 This is good news for SMEs renting offices, shops, or warehouses.

2. Sales Tax Exemption on Key Agricultural and Livestock Inputs

- Effective:1 January 2026

- Manufacturers are exempt from sales tax on key inputs including::Animal Feed, Fertilizers, Pesticides

- Purpose:To control prices of basic agricultural products and food and prevent inflation from affecting consumers.

3. Extended Construction Service Tax Exemption

- Applies to construction agreements signed before 1 July 2025 without reviewable clauses

- Exemption period extended to 30 June 2027 (previously 30 June 2026)

- Total exemption period: 2 years

4. Service Tax Exemption for Places of Worship (Effective 1 July 2025)

- Includes mosques, suraus, churches, temples, etc.

- Fully exempt from service tax for buildings used for religious or spiritual purposes

Conclusion

These SST reforms aim to ease the burden on SMEs, stabilize prices of essential goods, and support religious and community projects. The actual impact depends on your business type and eligibility.

**Last updated as 07.01.2026

(201706002678 & AF 002133)

(201706002678 & AF 002133)