Late submission of tax return forms and late payment of tax are common mistakes in tax filing. However, all these “common mistakes” might cost you a penalty up to RM20,000! Even if you didn’t submit a notice to LHDN regarding your mailing address amendment, you will face a penalty as well!

Let’s take a look on the list of LHDN penalties! Don’t forget to share it with your friends and family!

| 1. Payment of Income Tax After Deadline | ||

|---|---|---|

| Type of Offences | Provisions Under ITA 1967 | Penalties |

| Payment of Income Tax after deadline. | Section 103(3) | 10% increment from the tax payable. |

| 2. Payment of Estimated Income Tax Instalments After Deadline (For Business Income) | ||

|---|---|---|

| Type of Offences | Provisions Under ITA 1967 | Penalties |

|

Payment of Estimated Income Tax instalments after deadline (For Business Income). |

Section 107B(3) | 10% increment from the tax payable. |

|

Actual tax 30% higher than the revised estimate of tax. |

Section 107B(4) |

10% of the difference in actual tax balances and estimated tax made. |

| 3. Other Offences, Fines and Penalties | ||

|---|---|---|

| Type of Offences | Provisions Under ITA 1967 | Penalties |

|

Failure (without reasonable excuse) to furnish an Income Tax Return Form / give notice of chargeability to tax. |

Section 112(1) |

A fine up to RM20,000 / Imprisonment not exceeding 6 months / Both. |

|

Make an incorrect tax return by omitting / understating any income. |

Section 113(1)(a) |

A fine up to RM10,000 & 200% of tax undercharged. |

|

Give any incorrect information in matters affecting the tax liability of a taxpayer or any other person. |

Section 113(1)(b) |

A fine up to RM10,000 & 200% of tax undercharged. |

|

Willfully and with intent to evade or assist any other person to evade tax. |

Section 114(1) |

A fine up to RM20,000 / Imprisonment not exceeding 3 years / Both & 300% of tax undercharged. |

|

Assist or advise (without reasonable care) others to under declare their income. |

Section 114(1)(a) |

A fine up to RM20,000 / Imprisonment not exceeding 3 years / Both.

|

|

Obstruct any authorized officer of IRBM in carrying out his duties. |

Section 116 |

A fine up to RM10,000 / Imprisonment not exceeding 1 year / Both. |

|

Fails (without reasonable excuse) to comply with an order to keep proper records and documentation. |

Section 119(a) | A fine up to RM10,000 / Imprisonment not exceeding 1 year / Both. |

|

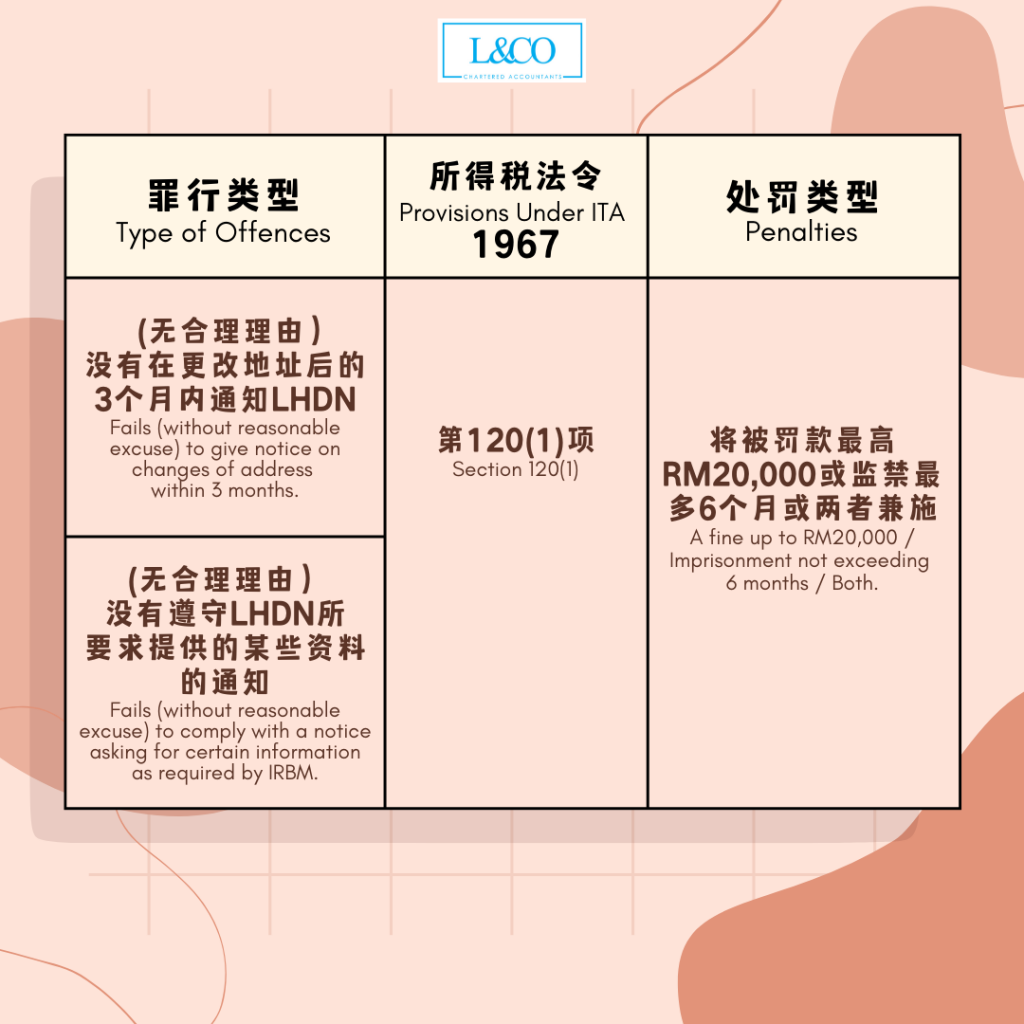

Fails (without reasonable excuse) to give notice on changes of address within 3 months. |

Section 120(1) |

A fine up to RM20,000 / Imprisonment not exceeding 6 months / Both. |

|

Fails (without reasonable excuse) to comply with a notice asking for certain information as required by IRBM. |

Section 120(1) |

A fine up to RM20,000 / Imprisonment not exceeding 6 months / Both. |

(201706002678 & AF 002133)

(201706002678 & AF 002133)