*This Wage Subsidy Programme has ENDED*

What is Wage Subsidy Programme 2.0 (WSP2.0)?

The wage subsidy (WSP1.0) is a financial assistance paid to employers of every enterprise, for each worker earning RM4,000 and below and for a period of six months only.

On 23rd September 2020, WSP is extended for another 3 months by Prime Minister and known as WSP2.0. Under WSP2.0, employers are able to receive RM 600 for another three months.

The purpose of the wage subsidy programme is to help employers affected economically by Covid-19 to continue operations and avoid the loss of jobs and income streams for all enterprises.

Implementation of Wage Subsidy Programme 2.0

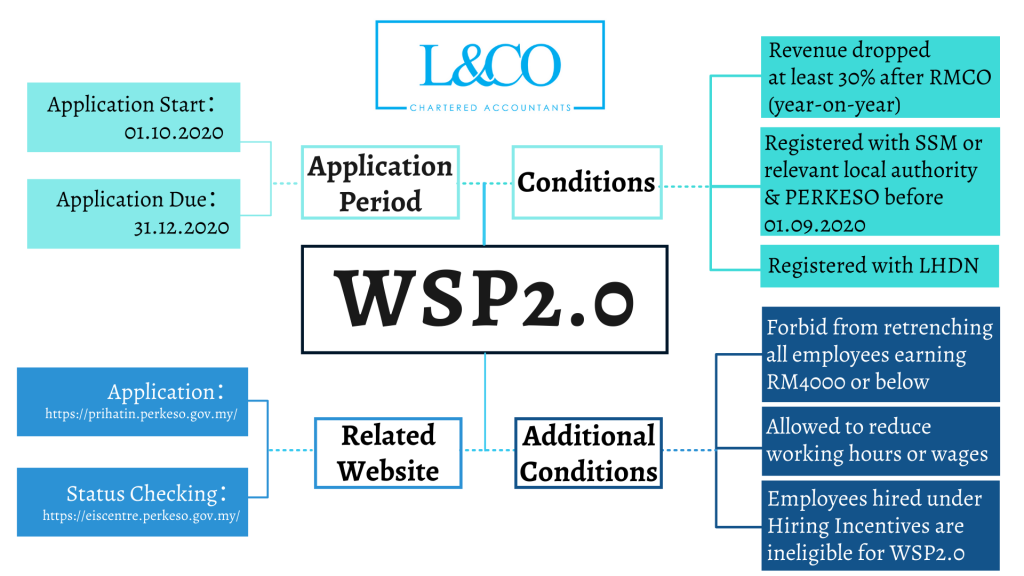

The Wage Subsidy Programme 2.0 is effective from 1 October 2020. Employers are required to meet the following conditions:

a) Business sales or revenue dropped at least 30% year-on-year (from 2019 to 2020) after the implementation of the RMCO.

b) Only for employees earning RM4,000 and below (Contributing SOCSO/EIS)

c) Registered with SSM or relevant local authority before 1 September 2020

d) Registered with or contributing to SOCSO and EIS before 1 September 2020

e) No retrenchment (instructed by employer) allowed

f) Reduce working hours or wages are allowed if the employees agreed

g) Employees hired under Hiring Incentives are ineligible for WSP2.0

EE = employees

Mths= months

| Size of Company | Not more than 75 employees (EE) | 76 – 200 EE | 201 EE and above |

| Number of Eligible Employees | Max 75 EE | Max 200 EE | Max 200 EE |

| Duration of subsidy | |||

| WSP Recipients | 3 Mths | ||

| New Applicants | 6 Mths | ||

| Eligibility conditions | |||

| Percentage of Revenue Dropped | Business sales or revenue have decreased by at least 30% year-on-year (from 2019 to 2020) after the implementation of the RMCO. | ||

| Employer Registration | 1. Employers and employees registered with and contributed to SOCSO before 01.09.2020

2. Employers registered with SSM or relevant local authority before 01.09.2020 3. Employers registered with LHDN |

||

| Employee’s Salary per Month | Employees earning RM4,000 and below | ||

| Other Conditions | Employers are forbidden from retrenching all employees earning RM4000 or below. Yet, they are allowed to reduce working hours or wages if the employees agreed. | ||

| Effective date | 01 October 2020 | ||

| How to apply | Apply through prihatin.perkeso.gov.my from 01 October 2020 | ||

| Deadline | 31 December 2020 | ||

(Table 1)

FAQ for Wages Subsidy Program 2.0 (WSP2.0)

On 23rd September 2020, WSP is extended for another 3 months by Prime Minister and known as WSP2.0. Under WSP2.0, employers are able to receive RM 600 for another three months.

The purpose of the wage subsidy programme is to help employers affected economically by Covid-19 to continue operations and avoid the loss of jobs and income streams for all enterprises.

- WSP2.0 start effective from 1st October 2020.

- WSP2.0 cover for 3 months for WSP recipients or 6 months for New recipients.

- Last day of application of WSP is 31st December 2020

Yes, employers currently receiving WSP subsidy must apply for WSP2.0.

- Employers or employees who have not registered with or contributing to PERKESO before 1 September 2020;

- Employers who registered with SSM or relevant local authority and operates on or after 1 September 2020;

- Employee’s earning more than RM4,000

- Employee has been lay off

- Civil servants or employees of statutory bodies and local authorities

- Self-employed (with no employer) including freelancers

- Foreign workers and expatriates

New:

- Employers who haven’t registered with LHDN;

- Employees who hired under Hiring Incentives;

- Name list of employees (based on the size of company)

- Employer’s bank account information (copy of first page of the bank statement)

- The Business Registration Number (BRN) details used when opening the bank account (please refer to bank to avoid confusion)

- A copy of SSM / ROS / ROB / relevant local authority registration certificate

- PSU2.0 Declaration Form

- It is the company registration number provided by bank when opening the company bank account

- Employees should request the BRN directly from their banks to ensure accuracy

- The BRN Form can be downloaded from prihatin.perkeso.gov.my

- The company’s BRN and bank account information are necessary to enable payment via Electronic Fund Transfer (EFT)

- Failure to provide the correct BRN will delay the payment process

The PSU2.0 Declaration Form serves as a written confirmation that the employer declares all information provided to be factual and accurate. All employers regardless of size or sector must submit a declaration form.

The Government introduced the PRIHATIN economic stimulus package, which includes the WSP2.0, to assist employers negatively impacted by Covid-19 with continuing their business operations and retaining their employees. B40 employees earning RM4,000 or less a month are prioritised as low-income workers are more likely to be severely impacted if they are retrenched as a result of the Covid-19 pandemic.

Wages are defined as per the 1969 Employees’ Social Security Act (Act 4). All remuneration in cash e.g. basic salary / overtime / commission / payments in form of annual leave, sick leave, maternity leave, public holidays / service charges count as wages. Wages are also subjected to RM 4,000 ceiling.

- Employers do not need to reapply in each subsequent month. However, they are required to update the information provided on prihatin.perkeso.gov.my if there are any changes like business closure, reduction in the number of eligible employees, etc.

- If there is any change to the number of eligible employees (increase or decrease), the employer must provide an update by the 15th of the month.

- Applications that misstate the number of local employees (does not tally with the information on ASSIST) will be querried. Employers should make sure all information is accurate before submitting their applications to avoid delays.

- SOCSO reserves the right to reject any application if the information provided is inaccurate.

- Employers who falsify information may face legal action.

Employers must register with SOCSO as well as SSM / relevant local authorities / any other professional associations before 1st September 2020 and employ at least one local worker to qualify for the WSP2.0.

The employer can apply for the WSP2.0. However, the employee must start working and be registered under the employer (on SOCSO’s ASSIST portal) prior to 1st September 2020.

Yes, employers who fulfill all conditions listed in Table 1 by 31st December 2020 can apply for WSP2.0. Successful applicants will receive subsidies for an extra 3 months.

Yes, employers who fulfill all conditions listed in Table 1 by 31st December 2020 can apply for WSP2.0 on prihatin.perkeso.gov.my.

Yes. The employer can submit a PSUB application for the registered employees after 1st April 2020. The employer will receive the wage subsidy at the rate of RM 600 monthly per employee for only three months under WSP2.0 by fulfilling the eligibility requirements in Table 1.

Employers may provide concrete monthly sales figures when applying on prihatin.perkeso.gov.my. The figures should show that sales or revenue in a certain month decreased by at least 30% compared to the same month in the previous year after the RMCO.

?Sales in August 2019: RM120,000

Sales in August 2020: RM 78,000 (Total income dropped: 35%)

?Sales in September 2019: RM100,000

Sales in September 2020: RM 69,500 (Total income dropped: 30.5%)

No, employers do not need to reapply. They only need to update the list of eligible employees by the 15th of the month on prihatin.perkeso.gov.my. Failure to report any changes may result in legal action.

- Employees may check whether their employer have successfully applied for the WSP on https://eiscentre.perkeso.gov.my/.

- They may also submit a complaint at e-aduanpsu.

- Any other labour disputes may be referred to the Department of Labour (JTK) at 03-8890 3404 / 03-88862409 / jtksm@mohr.gov.my

SOCSO has the right to suspend all future payments and reclaim any money that has been paid to the employer. The employer may also face legal action.

No, employers must include all employees in their declaration including their foreign workers.

For WSP2.0 application purposes, employees will be defined using the definition stipulated under in Act 4 of the 1969 Employees’ Social Security Act.

- Employers will receive a reference number after they completed their application on prihatin.perkeso.gov.my. They may check their application status by entering their reference number.

- A list of approved employers (including the number of employees approved) may also be found on website https://eiscentre.perkeso.gov.my/.

Yes, employers must pay contributions as mandated by Act 4 and Act 800.

No, employers may not utilise any of their WSP or WSP2.0 aid to pay their share of SOCSO and EIS contributions.

- WSP2.0 payments are issued based on a company’s SSM / ROS / ROB / trading license / registration with professional regulatory body. Payments are NOT made based on the number of individual branches with different employer codes.

- Applications from different branches of a company (using different employer codes) that only has one SSM / ROS / ROB / trading license / professional regulatory body registration will be combined and considered as one application.

- When different branches of the same company (with only one SSM / ROS / ROB / trading license / registration with professional regulatory body) apply using different employer codes, the company size used to determine payment rates will be calculated based on the combined workforce of all the branches.

- The number of employees eligible to receive WSP or WSP2.0 aid will be determined based on the company’s SSM / ROS / ROB / trading license / registration with professional regulatory body.

(201706002678 & AF 002133)

(201706002678 & AF 002133)