The Royal Malaysian Customs Department has issued Service Tax Policy No. 3/2025, introducing multiple exemptions and transitional arrangements for construction services. Effective immediately, the measures [...]

Malaysia’s updated service tax framework has come into effect. Contract terms, tenant status, and group structure will directly determine tax exposure. Businesses and property owners [...]

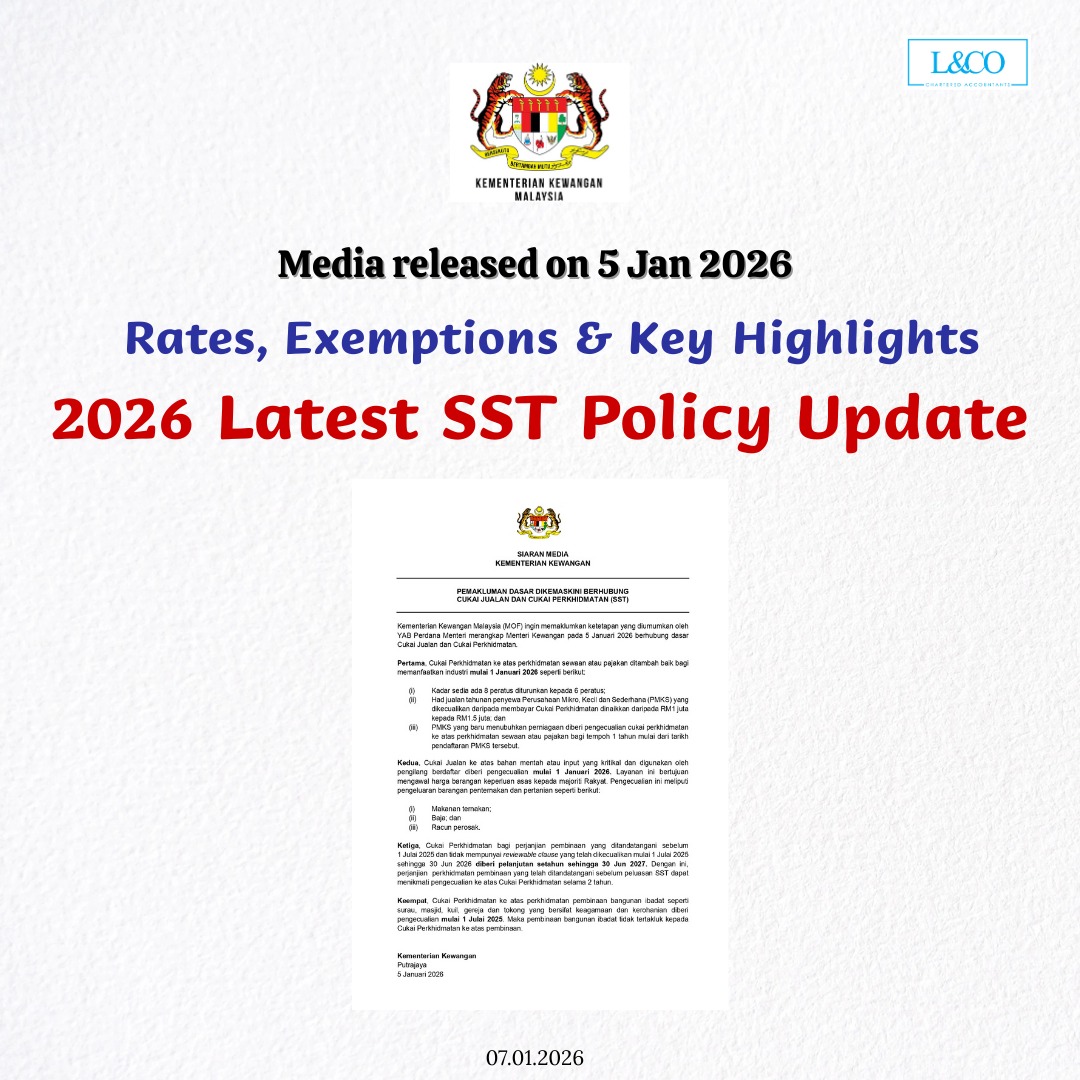

Effective 2026, any vehicle entering Labuan or Langkawi with a value exceeding RM300,000 will be required to pay Sales Tax Key Highlights From 2026, sales [...]

Recent announcements on Sales & Service Tax (SST) have raised many questions among businesses. To help clear the confusion, here is a summary of the [...]

Whether your leasing service is subject to the 6% Service Tax now depends entirely on where the asset is located. Within Malaysia (≤12 nautical miles), [...]

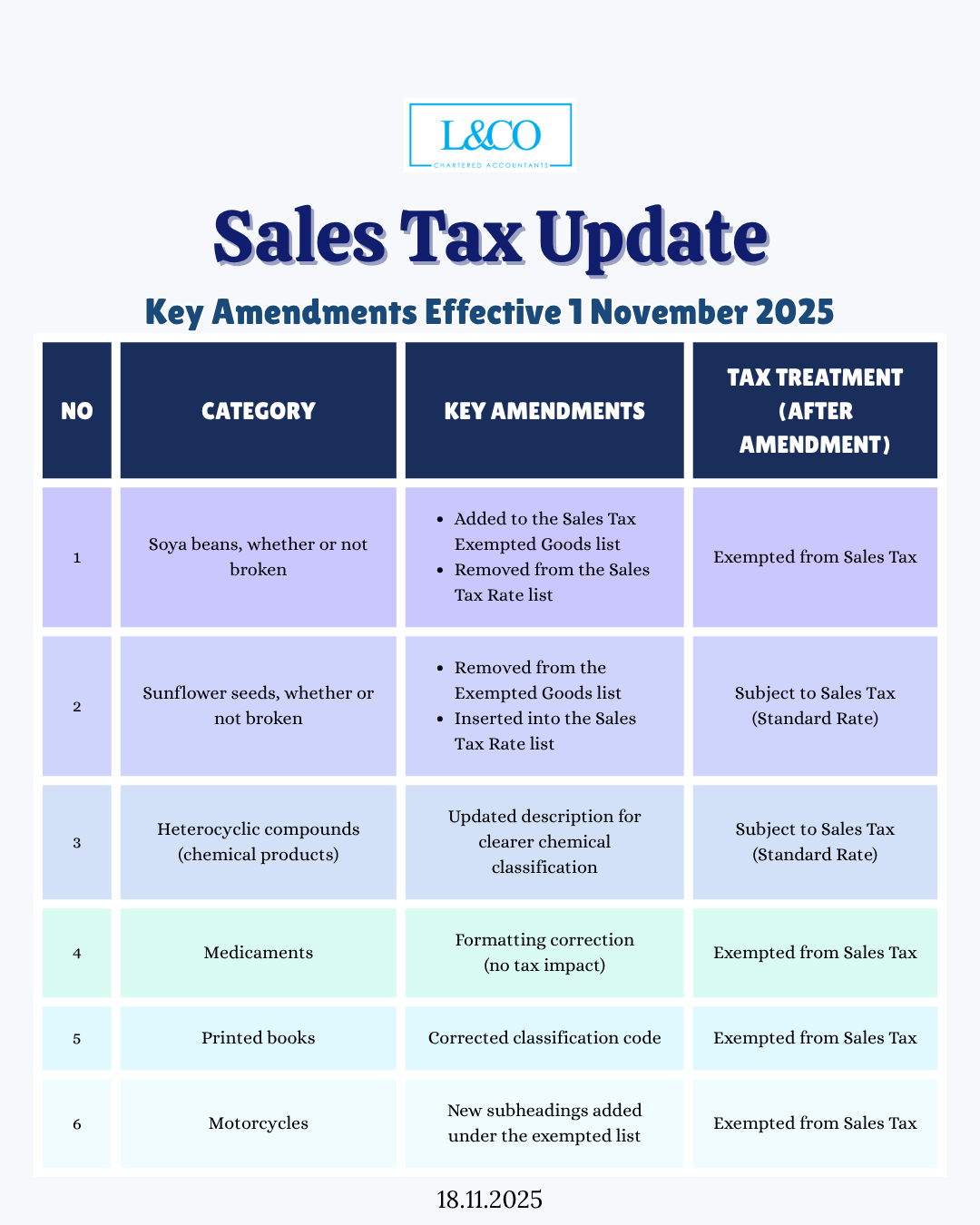

A clear summary of the latest changes to exempted and taxable items. 1. Soya Beans **Whether or not broken Key Amendments: Added to the Sales [...]

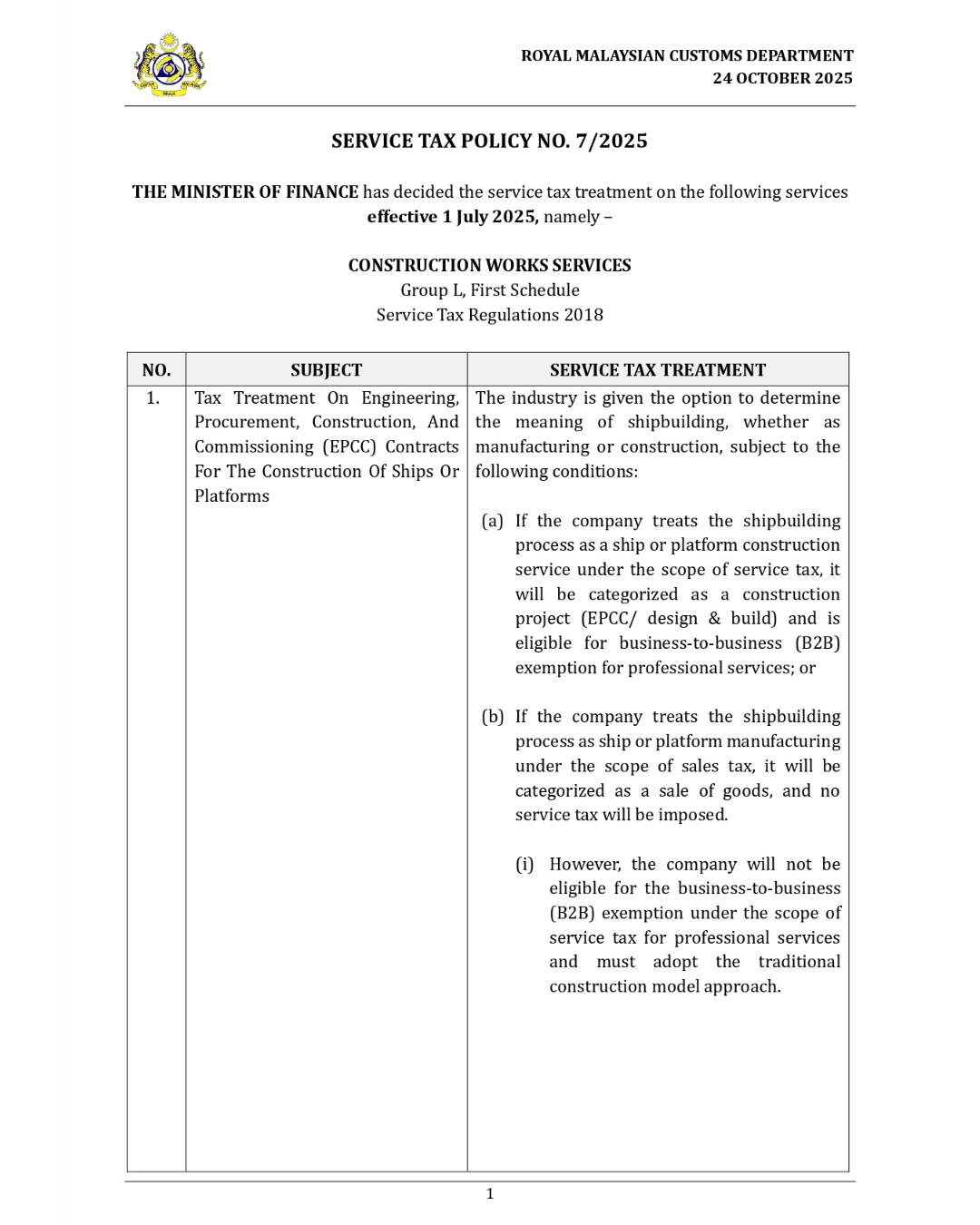

We’ve summarised the latest Service Tax Policy 7/2025 released by the Malaysian Customs, focusing specifically on construction companies, contractors, and developers. 1. EPCC Contracts (Engineering, [...]

Does intercompany billing within the same group require a 6% SST? Not necessarily! When 6% SST Can Be Exempted? Under the Service Tax Regulations 2018 [...]

Malaysia’s tax system is divided into two main categories: -Direct Taxes (administered by LHDN) -Indirect Taxes (administered by RMCD) Direct Taxes Direct taxes are imposed [...]

Comprehensive Analysis of Scope of Application, Filing Methods, Exemption Conditions, and Special Provisions for Digital Services FAQs: 1. Import Service Tax Explanation Under the First [...]

(201706002678 & AF 002133)

(201706002678 & AF 002133)