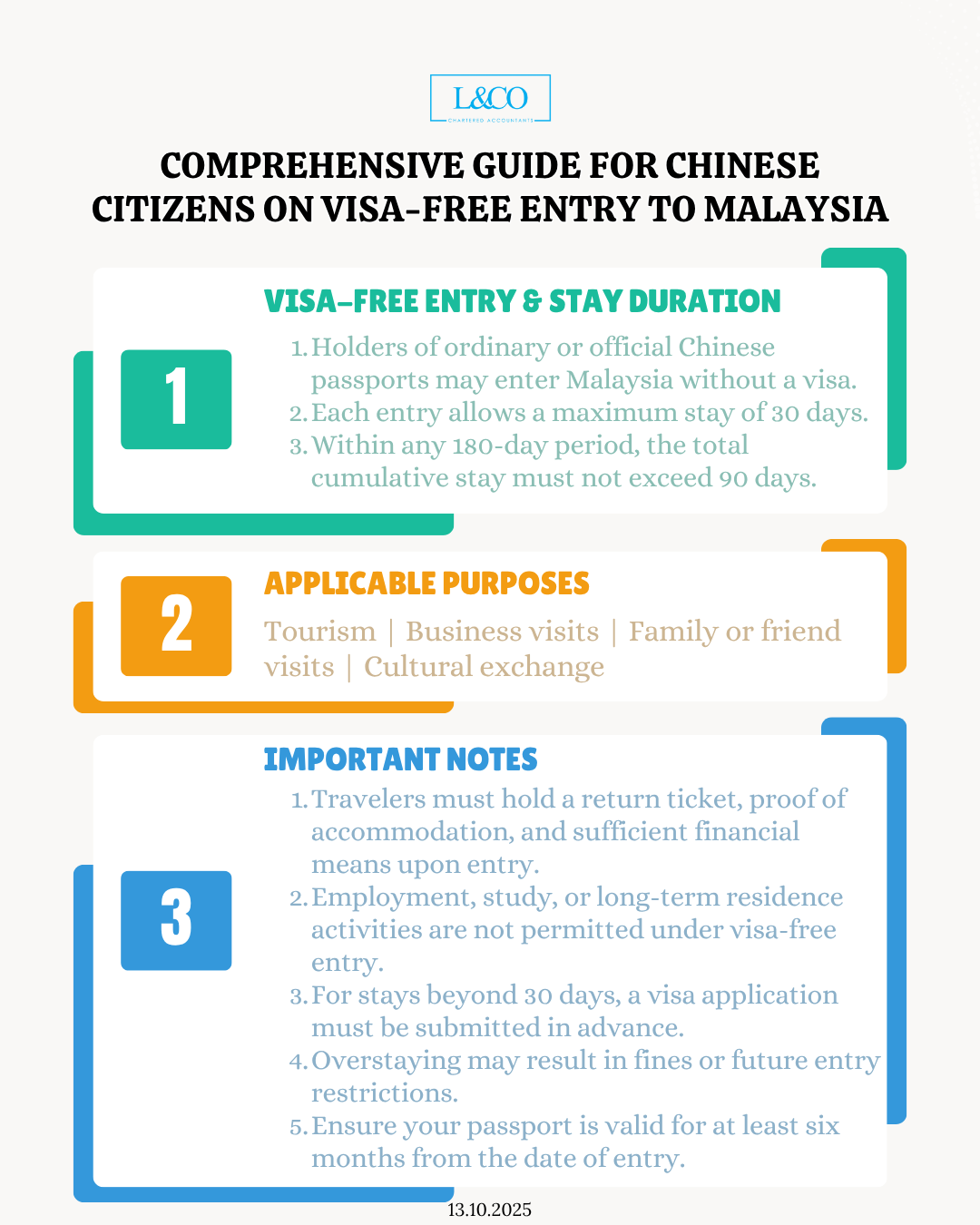

How Long Can Chinese Citizens Stay in Malaysia? Here’s the Latest Official Guide! Starting July 17, 2025, China and Malaysia have officially launched a mutual [...]

Malaysia’s tax system is divided into two main categories: -Direct Taxes (administered by LHDN) -Indirect Taxes (administered by RMCD) Direct Taxes Direct taxes are imposed [...]

The 2026 Malaysian Budget has been officially unveiled. Despite global economic uncertainty and geopolitical tensions, the government continues to adhere to the “Prosperous Economy” framework, [...]

Important Reminder for Malaysian Taxpayers: Taxpayers who have received a CP500 Notice — take note! If your estimated income has changed, you may submit the [...]

When incorporating a company in Malaysia, one of the most important questions entrepreneurs face is: how should shares be allocated. A well-planned equity structure not [...]

Company Losses ≠ Tax Exemption! Even when a business is operating at a loss, the following situations may still be taxable 1. Bad Debt Written [...]

As Malaysia transitions towards nationwide e-Invoice implementation in 2024/25, the Inland Revenue Board of Malaysia (IRBM) has outlined specific categories of income and expenses that [...]

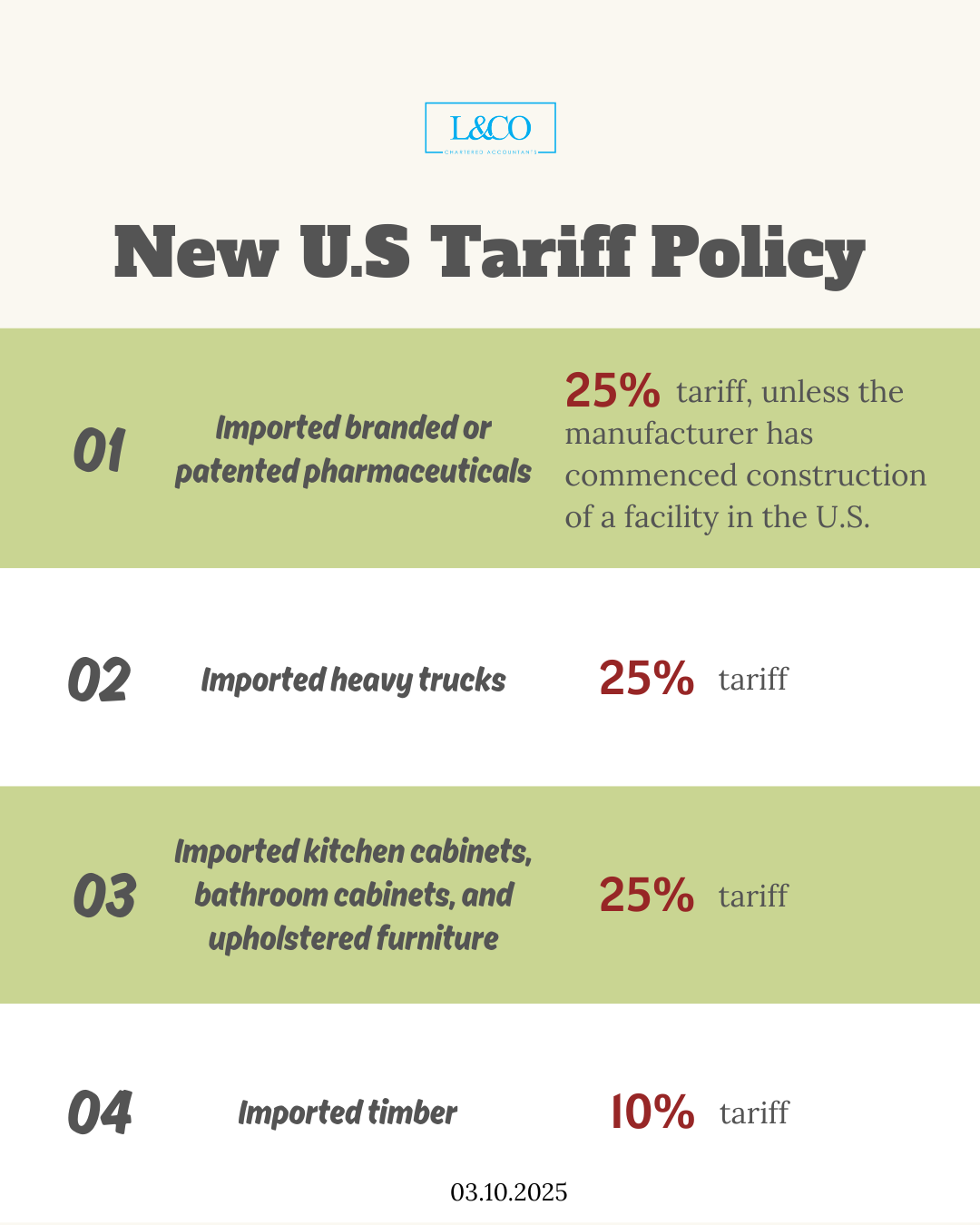

To boost the domestic industry, the United States has announced new tariff hikes on various imported goods: Branded or patented pharmaceuticals: 100% tariff, with exemptions [...]

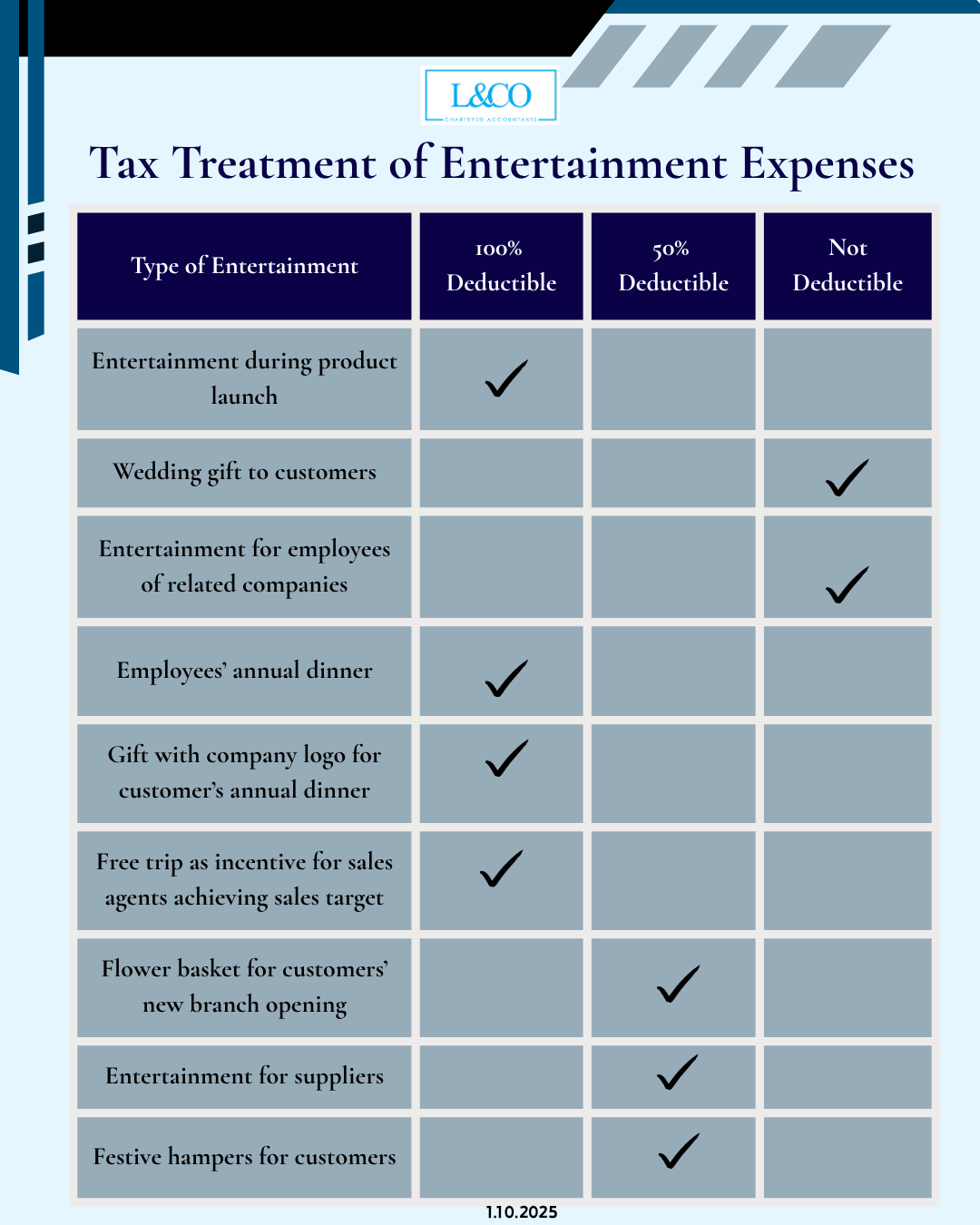

According to Income Tax Act 1967, Section 39(1)(l) and LHDN Public Ruling No. 3/2008 & 4/2015: Not all entertainment expenses are deductible. -In general, entertainment [...]

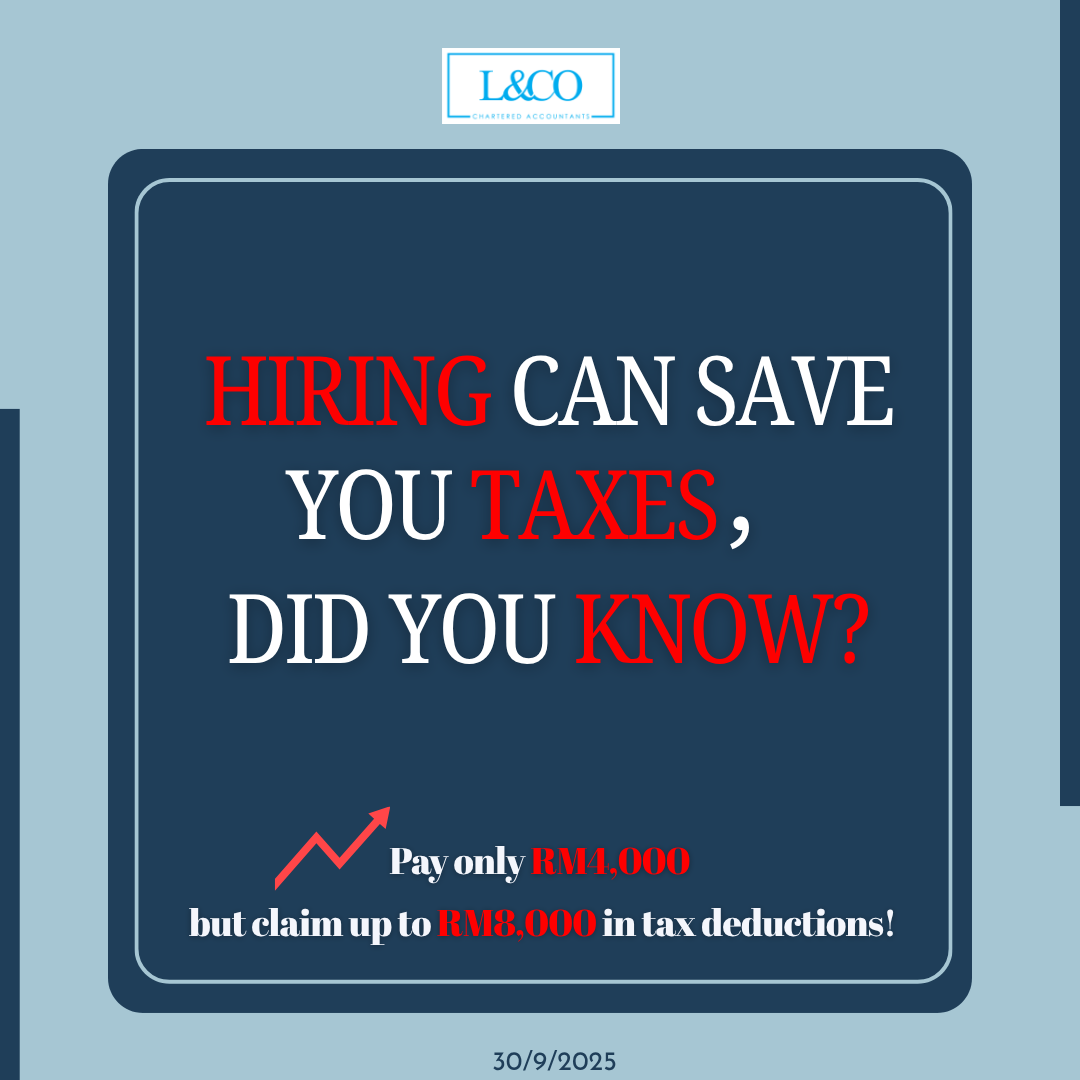

In Malaysia, hiring certain employees qualifies for a Double Deduction: -Senior employees: aged 60+, full-time, monthly salary ≤ RM4,000 -Interns: TalentCorp MySIP certified, allowance ≥ [...]

(201706002678 & AF 002133)

(201706002678 & AF 002133)