Effective from March 2024, Malaysia government officially increased the services tax (SST) rate for several taxable services from 6% to 8%!

Which industry are subject to the expansion of the service tax? How to charge SST during Transition Period? Let’s take a look!

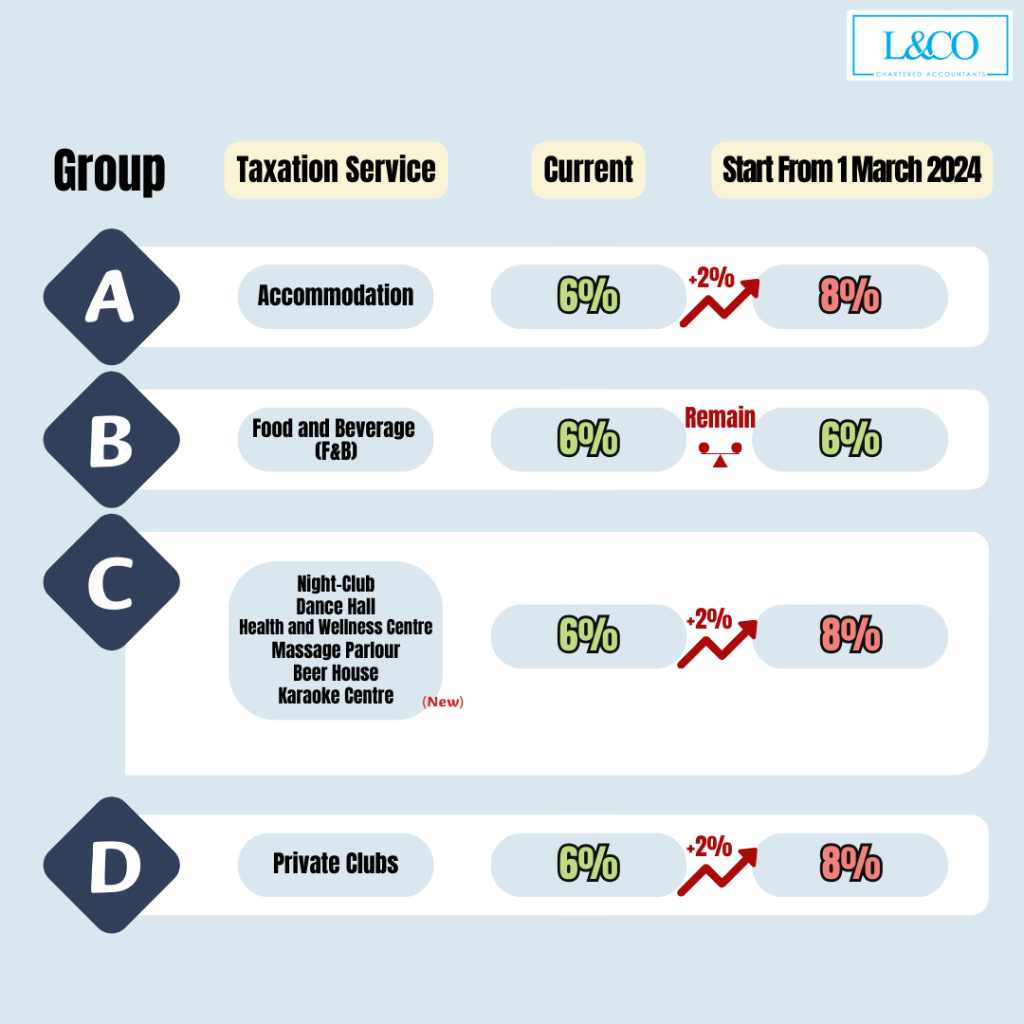

The Expansion of Service Tax Scope

· Group A: Accommodation

– From 6% increase to 8%

· Group B: Food and Beverage (F&B)

– Remain 6%

· Group C: Night Club, Dance Hall, Health and Wellness Centre, Massage Parlor, Beer House, Karaoke Centre

– From 6% increase to 8%

· Group D: Private Clubs

– From 6% increase to 8%

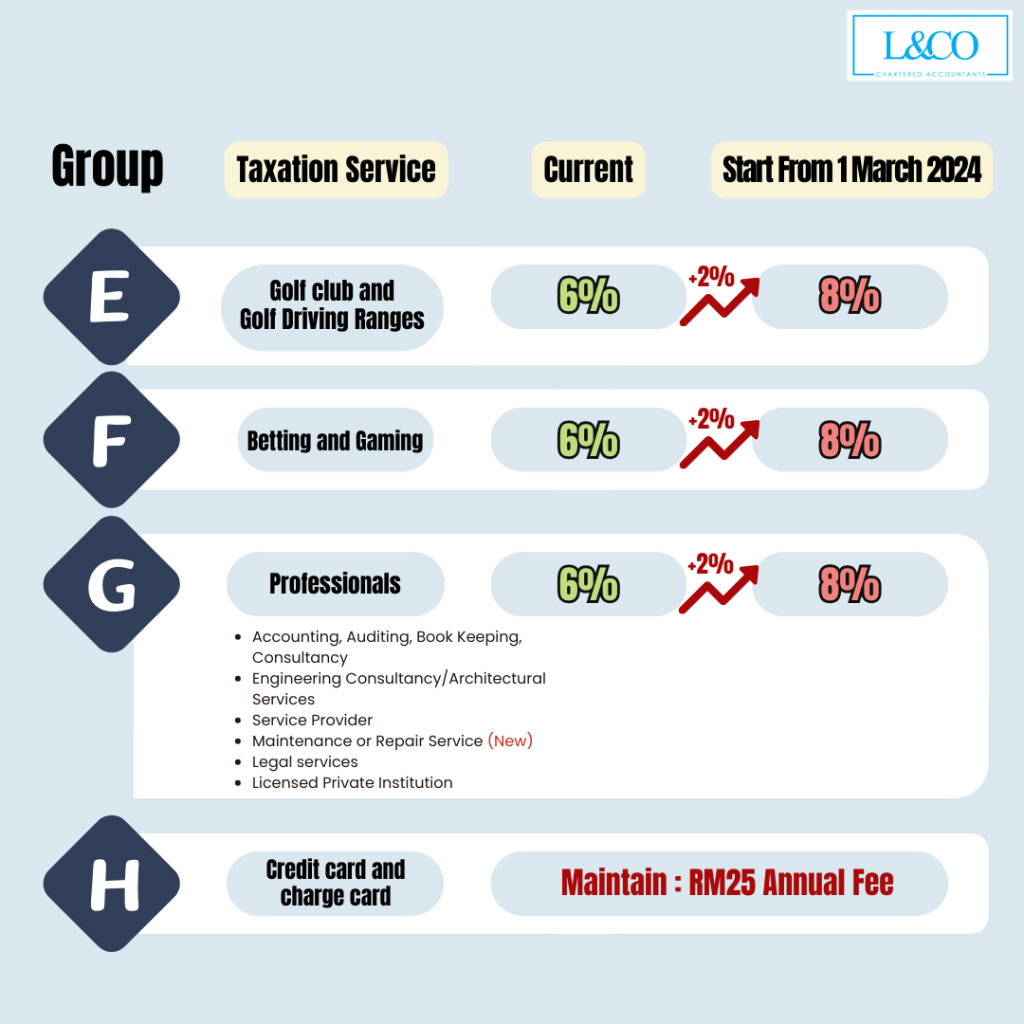

. Group E: Golf Club and Golf Driving Ranges

– From 6% increase to 8%

· Group F: Betting and Gaming

– From 6% increase to 8%

· Group G: Professionals

– From 6% increase to 8%

· Group H: Credit Card and Charge Card

– Maintain RM25 Annual Fee

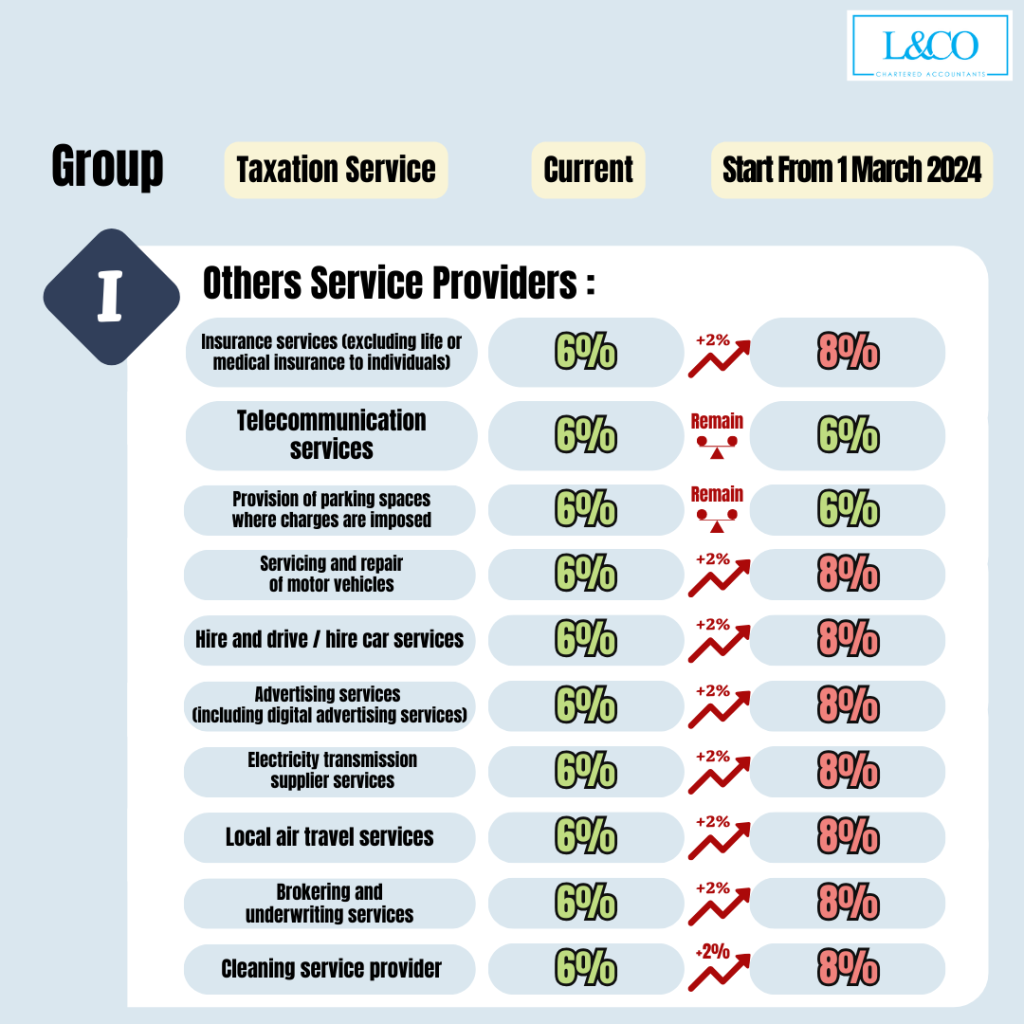

·Group I: Others Service Providers

Insurance Services (excluding Life or Medical Insurance to individuals)

– From 6% increase to 8%

Telecommunication Services

– Remain 6%

Provision of Parking Spaces where Charges are Imposed

– Remain 6%

Servicing and Repair of Motor Vehicles

– From 6% increase to 8%

Hire and Drive / Hire Car Services

– From 6% increase to 8%

Advertising Services (including Digital Advertising Services)

– From 6% increase to 8%

Electricity Transmission Supplier Services

– From 6% increase to 8%

Local Air Travel Services

– From 6% increase to 8%

Brokering and Underwriting Services

– From 6% increase to 8%

Cleaning Service Provider

– From 6% increase to 8%

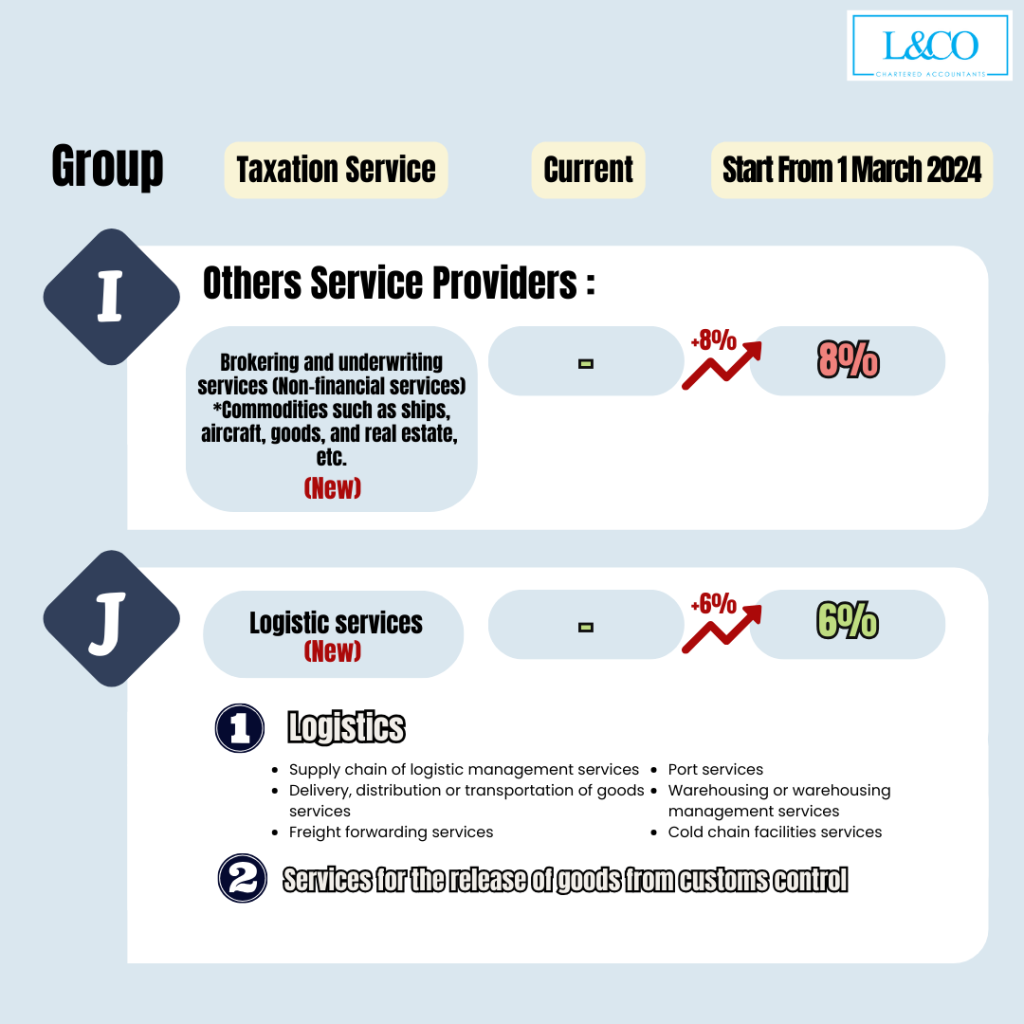

· Group I: Others Service Providers

Brokering and underwriting services (Non-financial services) *Commodities such as ships, aircraft, goods, and real estate,

etc.

– From 0% to 8%

· Group J: Logistic Services

– From 0% to 6%

The Sales and Services Tax (SST) annual threshold is: Rm 500,000

*Note: The information comes from the Royal Malaysian Customs Department (RMCD) seminar and the Ministry of Finance Gazette. There may be changes, and final details are subject to official announcements.

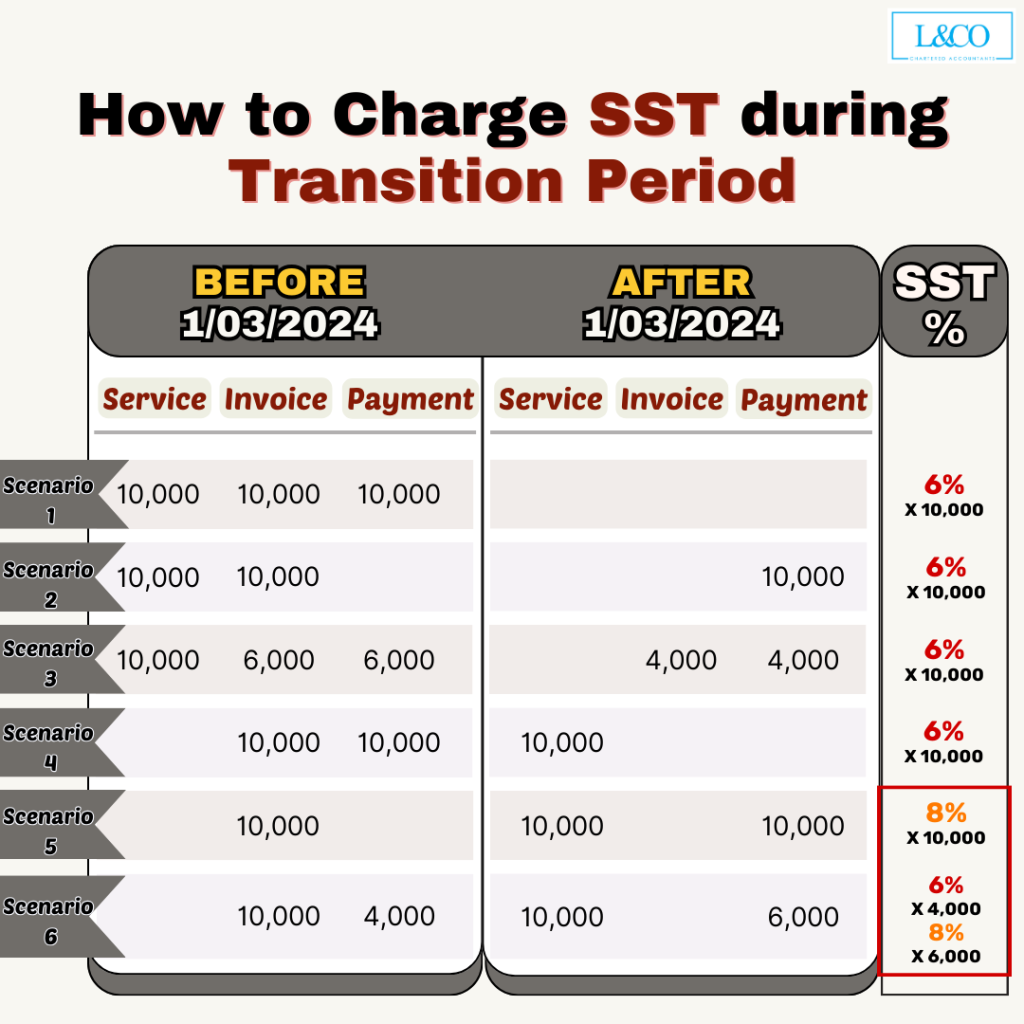

A Complete Scenarios on How to Calculate the Service Tax during Transition Period

Many businesses may wonder how to charge SST if the service was provided before but payment hasn’t been received yet. It’s simple, here’s how:

✅ Invoice issued, ✅ Service completed, and ✅ Payment received: SST = 6%

✅ Invoice issued, ✅ Service completed but ❌ Payment not received: SST = 6%

✅ Invoice issued, ❌ Service not completed but ✅ Payment received: SST = 6%

✅ Invoice issued, ❌ Service not completed and ❌ Payment not received: SST = 8%

✅ Invoice issued, ❌ Service not completed but ✅ Partial payment received:

◼ Payment received before 01.03.2024: SST = 6%, Payment received after 01.03.2024: SST = 8%

@lncoaccountants SST提高到8%是最近很热门的话题! 政府决定从2024年3月开始调整大多数行业的服务税(Service Tax)税率,从6%上涨至8!而需要缴纳服务税的行业范围将会扩大哦! #ServiceTax #Malaysia #Taxation #SST

(201706002678 & AF 002133)

(201706002678 & AF 002133)