We all know that employees are mandatory to contribute 11% of the salary amount to EPF every month. Do you know what you can do with this savings?

Employees Provident Fund (EPF) is a government statutory body that helps to manage the compulsory savings plan and retirement planning for private sector workers in Malaysia. Under EPF, members can enjoy a 2.50% minimum guaranteed dividend rate! Which means, even if the economy is down, your EPF savings have a guaranteed 2.5% dividend, and the dividend rate will rise according to the market! (In 2017, members get a 6.9% interest rate!)

Other than mandatory contributions, EPF members can make voluntary self contributions via online banking to contribute more to their retirement fund!

(The ways to make self contribution is in our Facebook page.)

(The ways to make self contribution is in our Facebook page.)

If you thought the only usage of EPF savings is for retiring, then you were wrong. You can actually use the savings in many ways, including purchasing an asset!

Before looking into this, you need to understand some basic knowledge of EPF.

EPF has 2 saving accounts, Account 1 & Account 2, all your contributions will be separated into these 2 accounts automatically.

【Account 1】:

- 70% of total monthly contribution (employers + employees)

- Savings can only withdraw after aged of 55 for retirement purpose

【Account 2】:

- 30% of total monthly contribution (employers + employees)

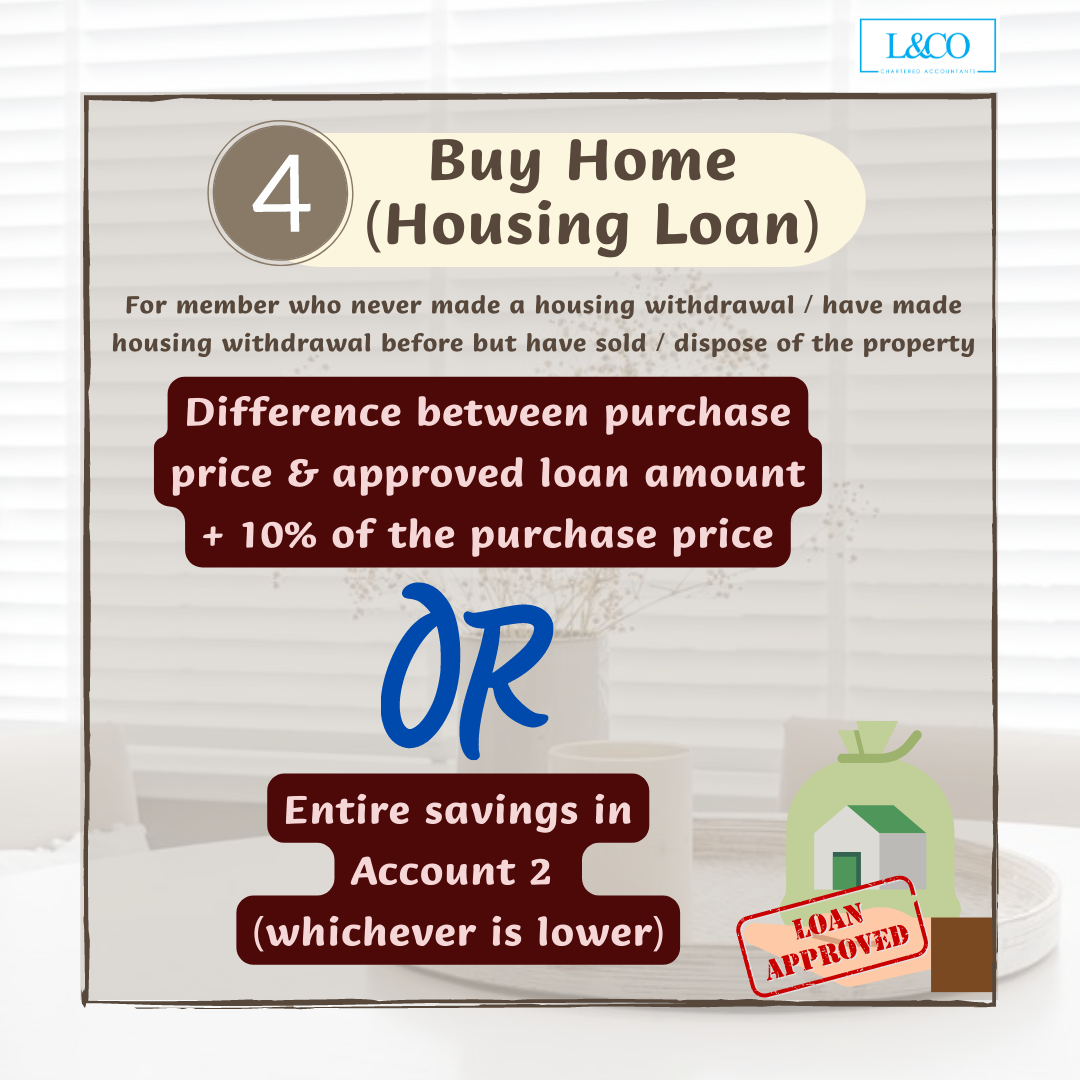

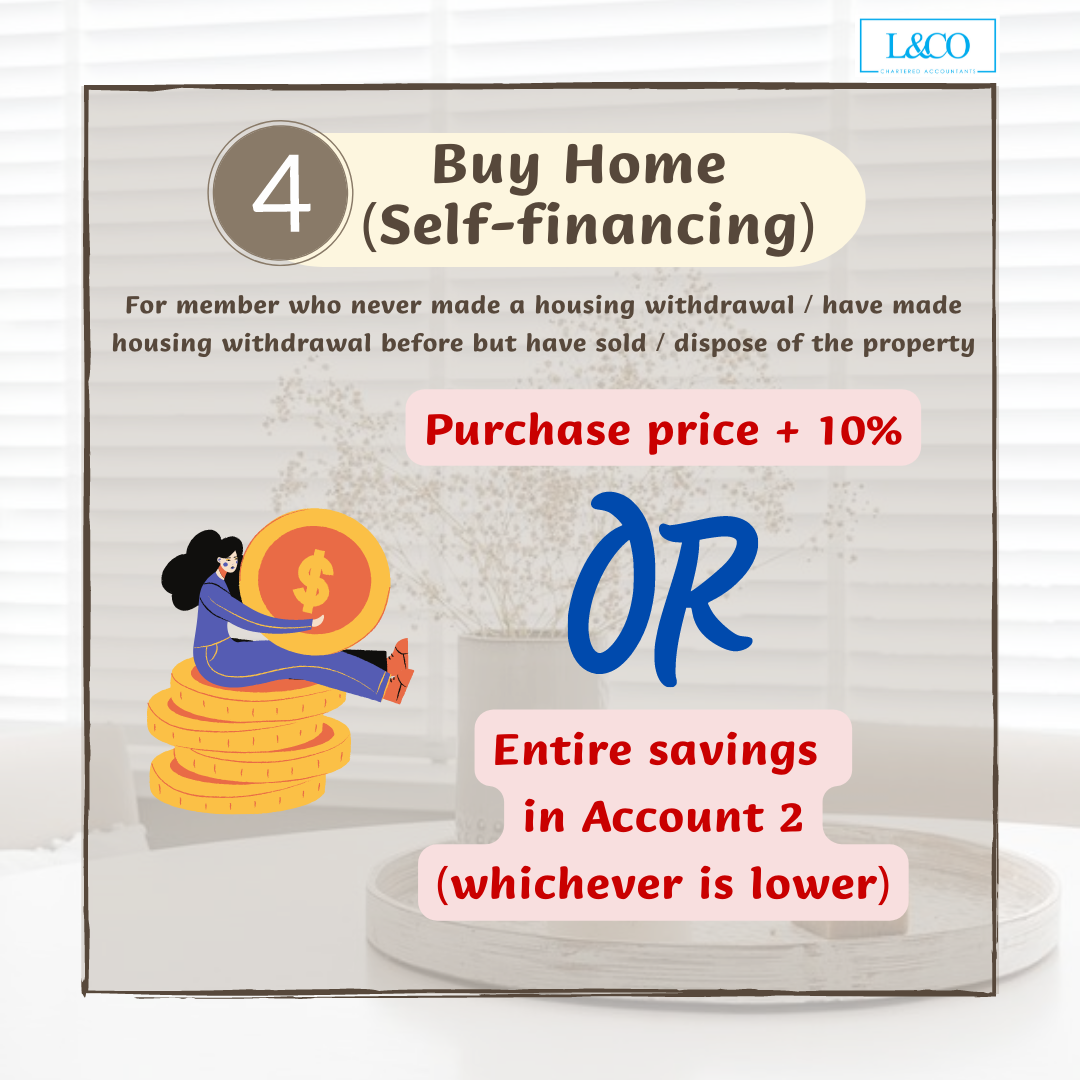

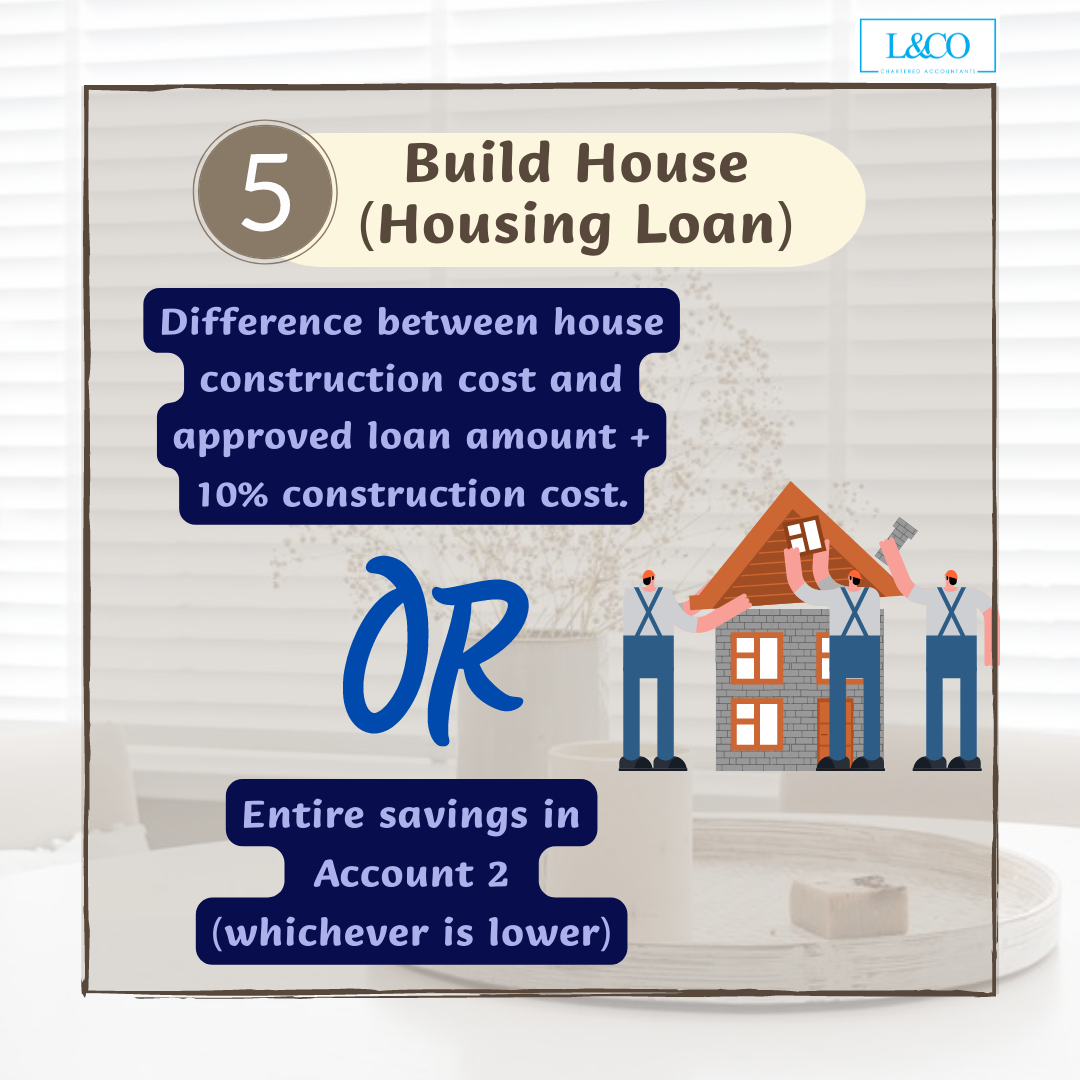

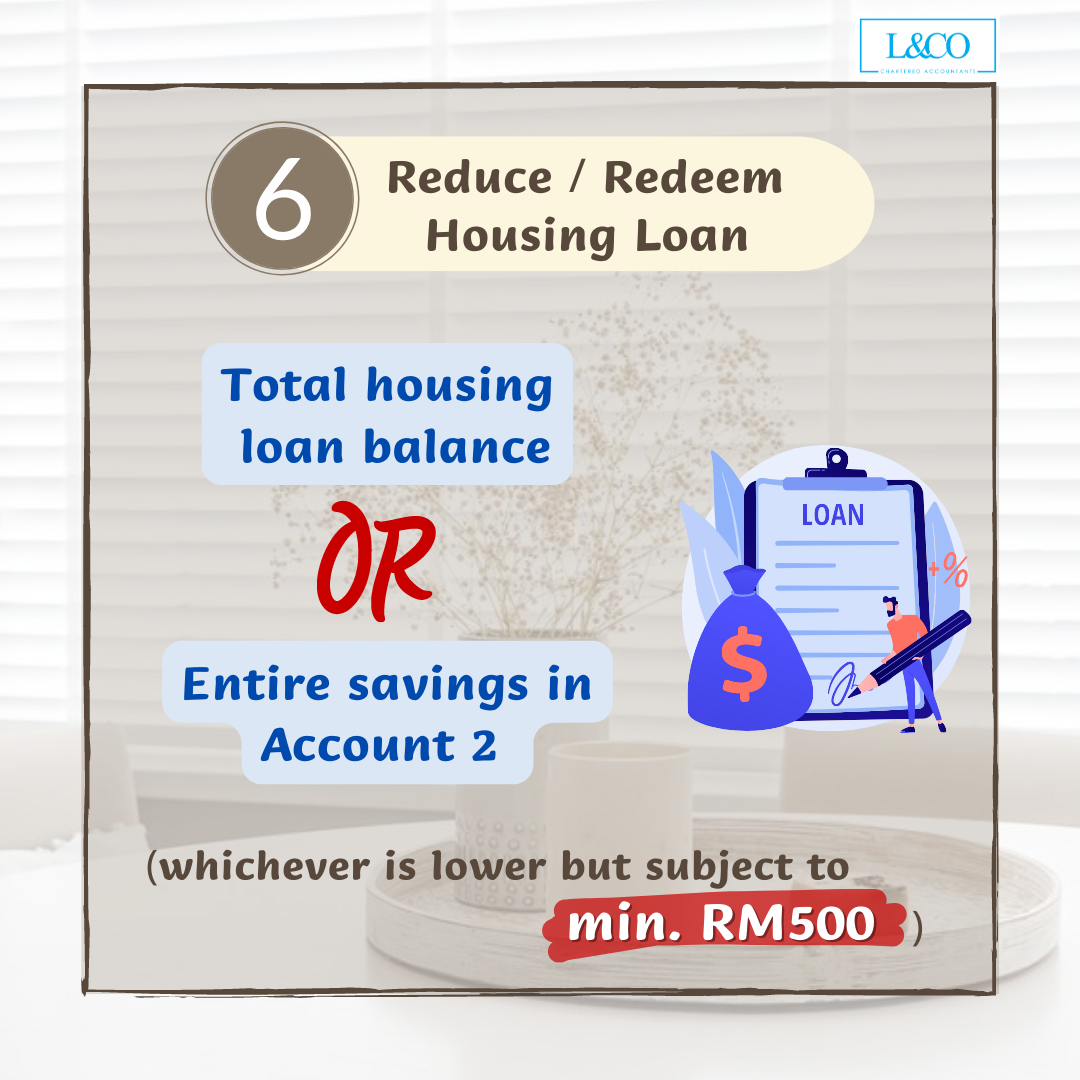

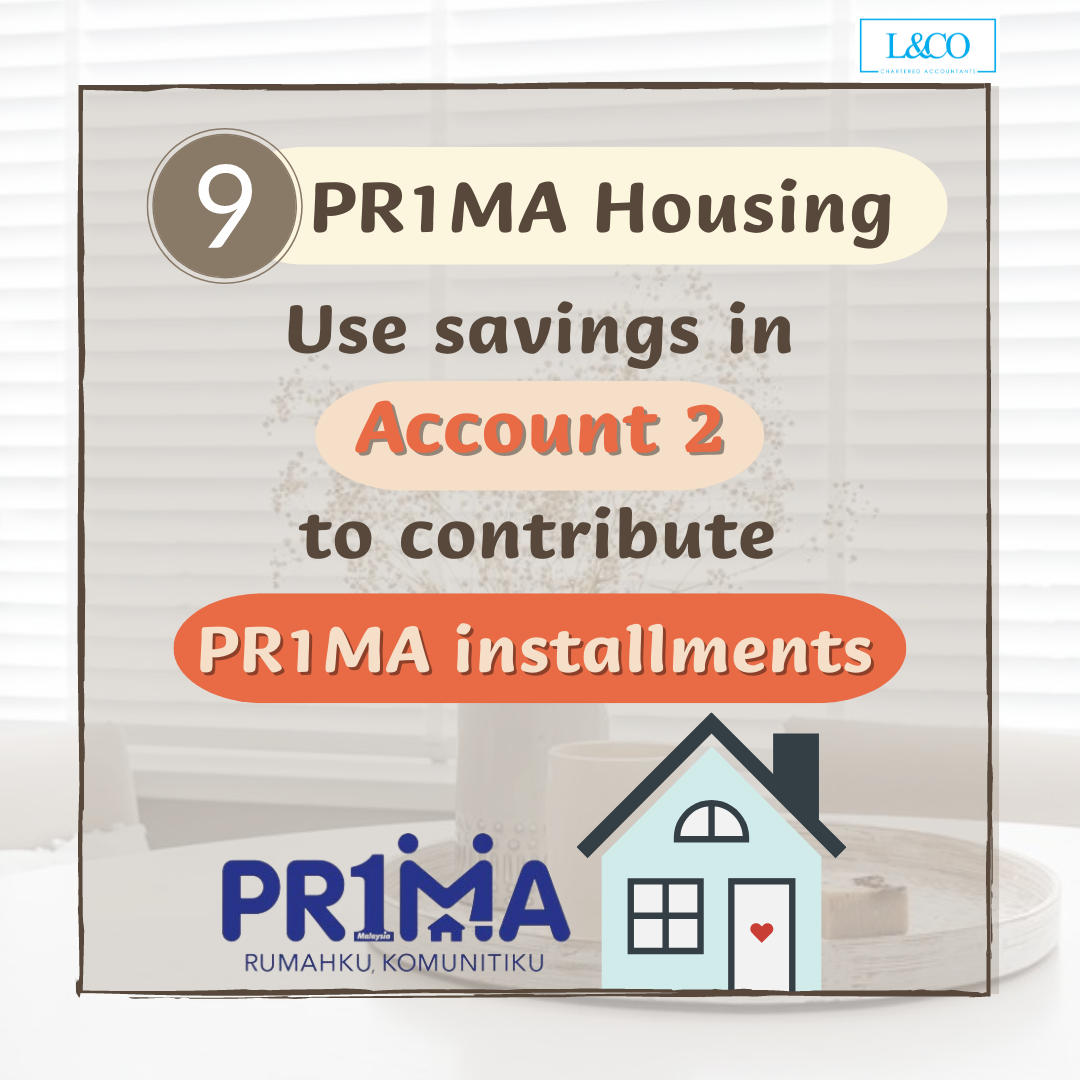

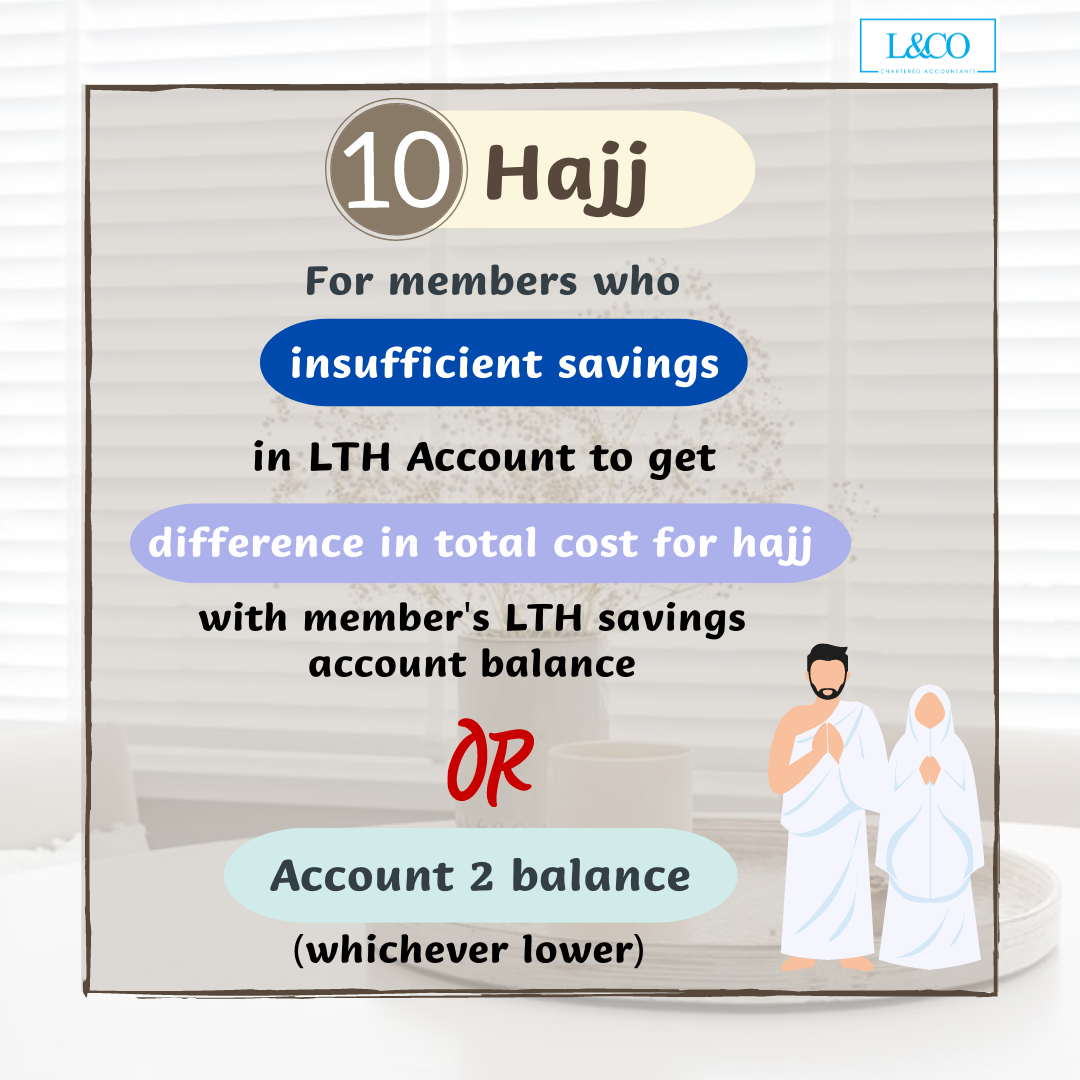

- Savings can withdraw under several situation

[Kindly refer to pictures for details]

How to check my saving balance?

- Members can check their saving balance via

https://secure.kwsp.gov.my/member/member/login

(??? ????? ???? ????, ???????????? ??? ?? ???? ?? ??? ?????ℎ??.)

(201706002678 & AF 002133)

(201706002678 & AF 002133)