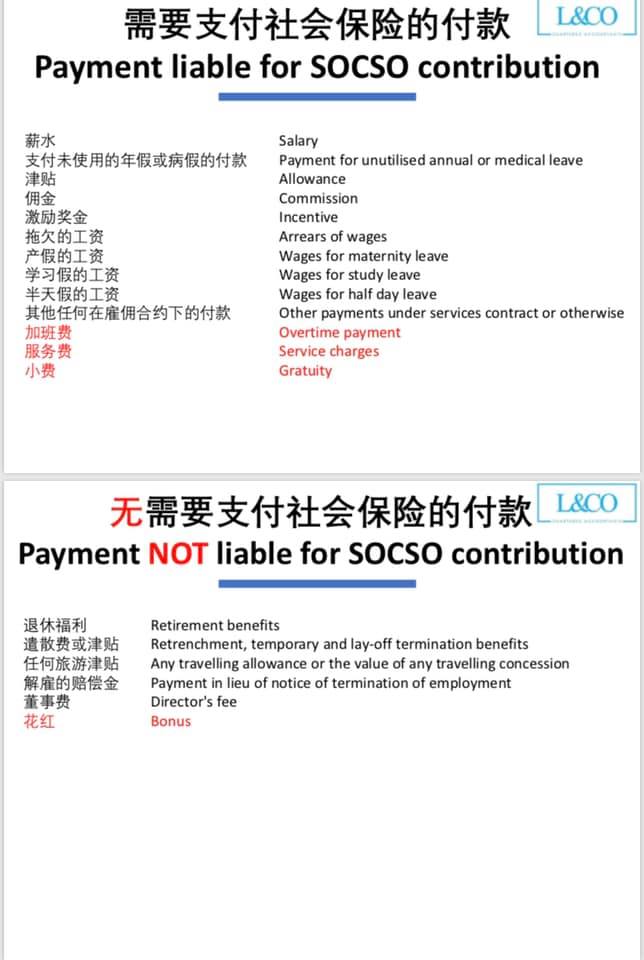

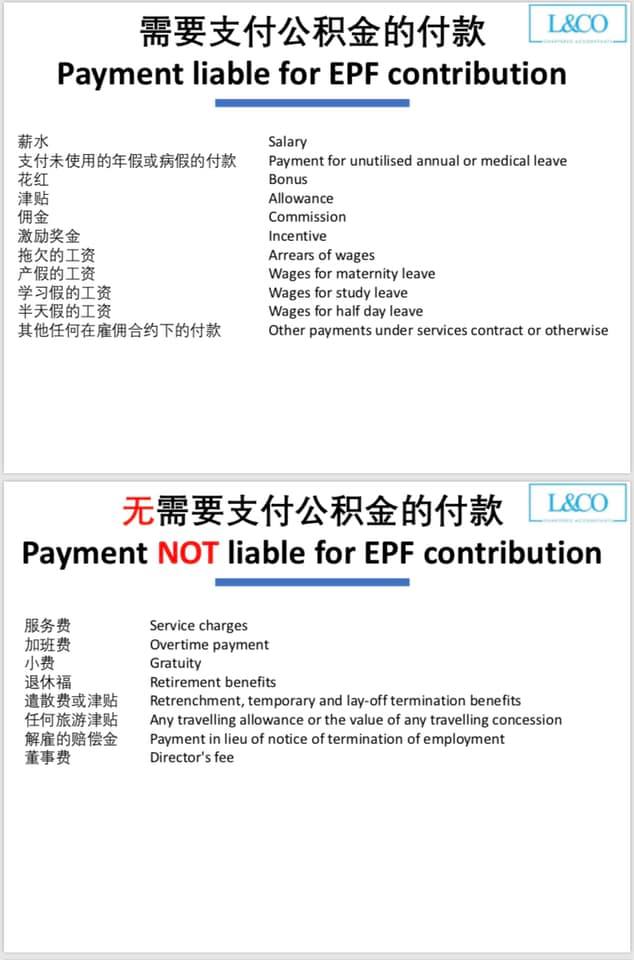

“Is Bonus subject to EPF & SOCSO?”

“Is Bonus subject to PCB?”

“Is Ang Pow better than Bonus”

FAQ for Bonus & Ang Pow

Yes, bonus is subject to EPF contribution of both employers and employees.

Yes, before issuing bonus, the required Monthly Tax Deduction (PCB) must be calculated and deducted. The remaining bonus amount is then paid to the employee

You may use PCB calculator to calculate PCB.

(http://calcpcb.hasil.gov.my/)

Bonus:

- Salary incentives for employees

- Will be recorded in the employee’s gross income

- Tax Deductible

- Subject to Employees Provident Fund (EPF) and Monthly Tax Deduction (PCB)

Ang Pow:

- Cash given on Festival or special occasions

- Not considered employee personal income

- Not subject to Tax, Unless the employer files Form EA

- Not subject to Employees Provident Fund (EPF) and Monthly Tax Deduction (PCB)

We do not recommend issuing year-end bonuses as Angpow because the EPF authority might review to ensure the employees’ benefit are given.

We do not recommend you to do so. If employer issued bonus, you could get extra 12%/13% EPF contribution from employers.

There are no specific rules, but it’s essential to ensure fairness among employees. If bonus are distributed based on performance,ensure that employees with the same performance rating receive equal bonuses.

If your Bonus was issued in January, the EPF & MTD contribution should pay on the subsequence month (before February 15th).

(201706002678 & AF 002133)

(201706002678 & AF 002133)