Are you always confused with type of tax return forms and the way to declare it? If you don’t have a business income, you should file Form BE for all your income!

FAQs about Form BE:

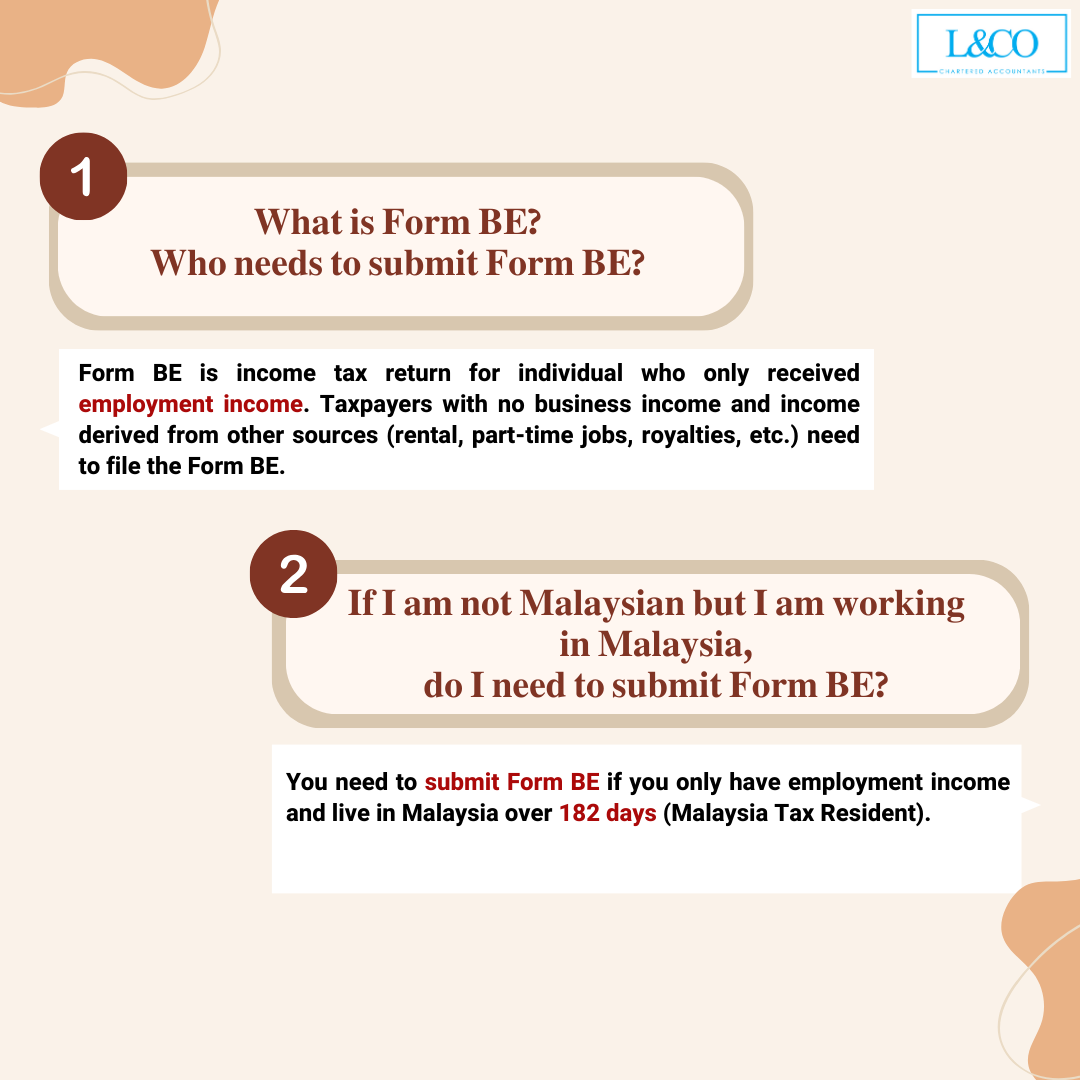

Form BE is income tax return for individual who only received employment income. Taxpayers with no business income and income derived from other sources (rental, part-time jobs, royalties, etc.) need to file the Form BE.

You need to submit Form BE if you only have employment income and live in Malaysia over 182 days (Malaysia Tax Resident).

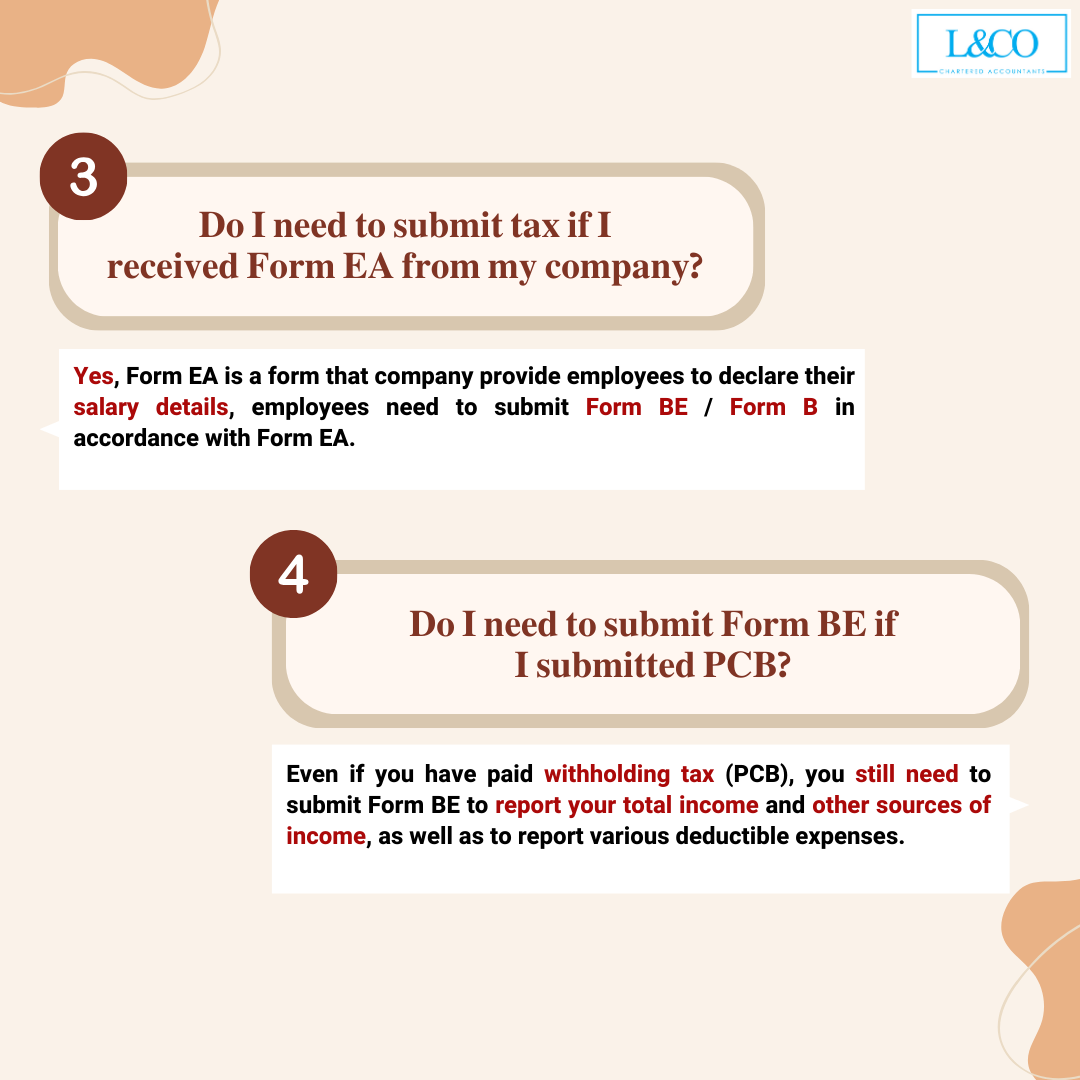

Yes, Form EA is a form that company provide employees to declare their salary details, employees need to submit Form BE / Form B in accordance with Form EA.

Even if you have paid withholding tax (PCB), you still need to submit Form BE to report your total income and other sources of income, as well as to report various deductible expenses.

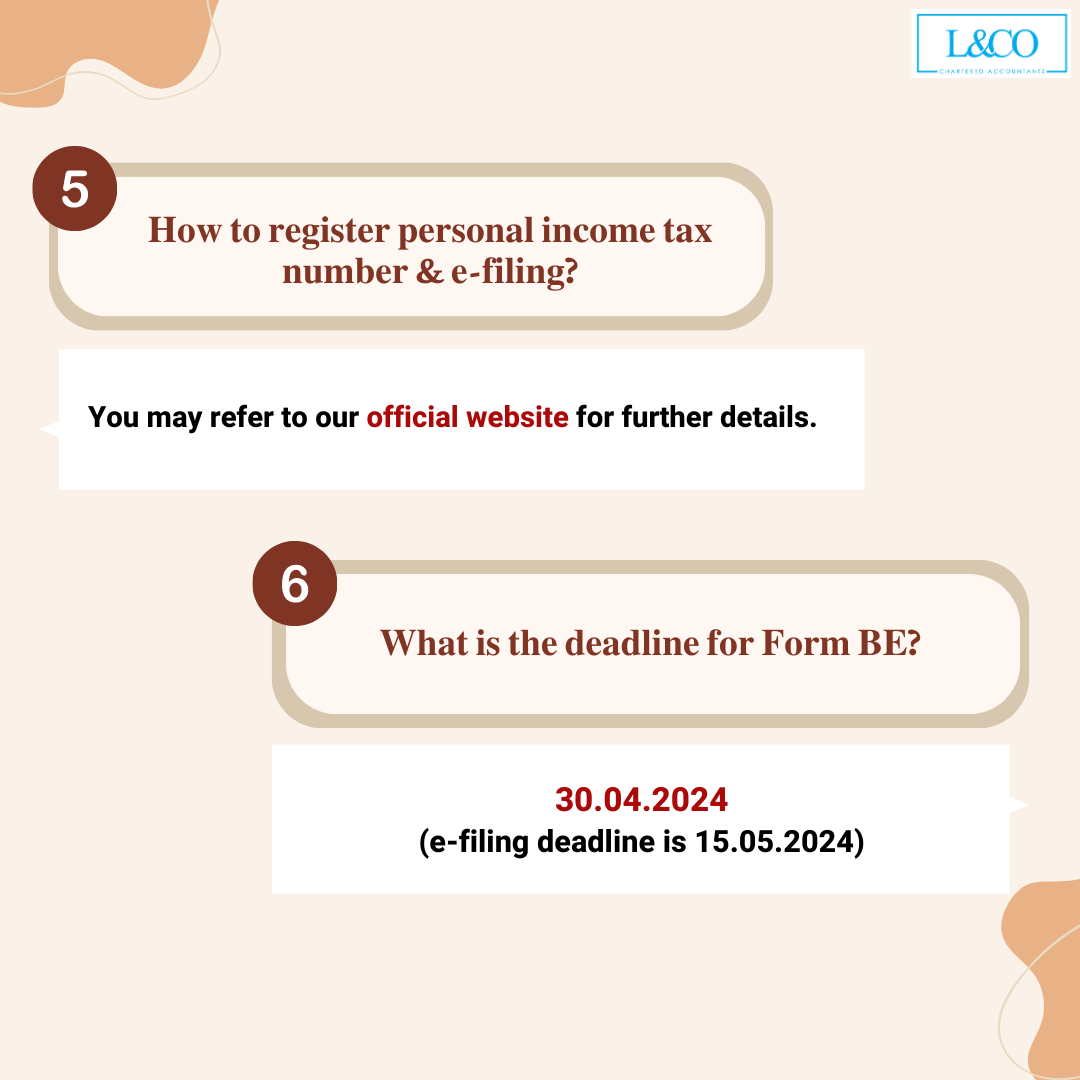

You may refer to https://landco.my/social/income-tax-number/for further details.

30.04.2024 (E-filing deadline is 15.05.2024)

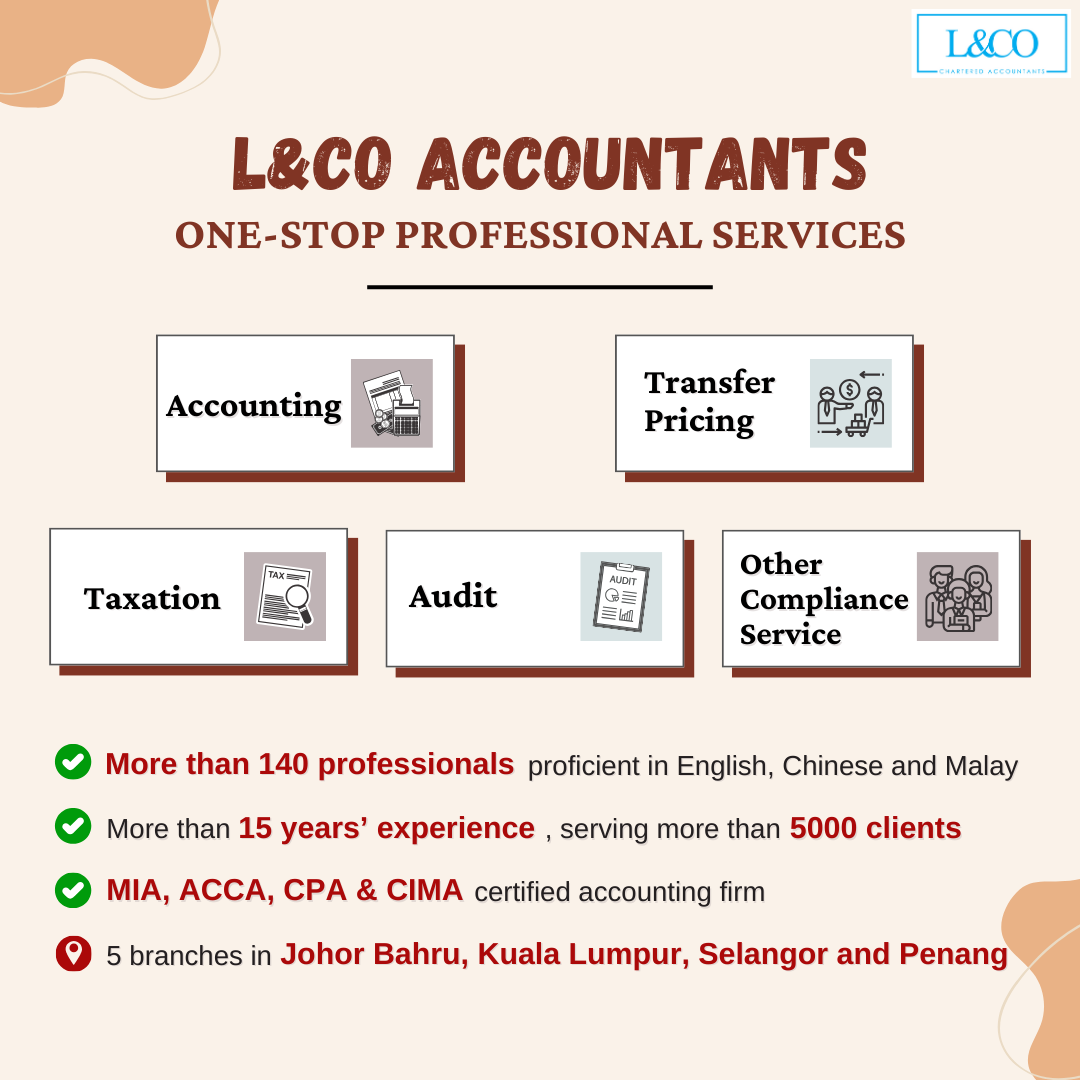

(201706002678 & AF 002133)

(201706002678 & AF 002133)