Starting from 1 July 2025, Malaysia’s Service Tax (SST) framework will be expanded to include certain leasing and rental services under Group K. This change is part of the government’s effort to widen the tax base while aligning tax policies with current commercial practices.

So how do you know if your rental service is subject to SST? Here’s a quick and clear breakdown to help you stay compliant.

The following types of leasing/rental services will be subject to 8% Service Tax starting July 2025:

1.Commercial Property Rentals

Includes office spaces, shop lots, warehouses, and other commercial buildings.

2. Movable Asset Leasing

Printers, vehicles, machinery, and other equipment provided under lease.

3. Special Assets Leasing

Yachts, helicopters, or even exhibition-use plants and animals.

4. Cross-Border Leasing

Assets located in Malaysia but leased by foreign companies.

5. Leases with Maintenance Services

Rental contracts that include bundled repair or maintenance work.

You must register for SST under Group K if your commercial rental income meets the following threshold:

- Commercial Rental Income ≥ RM500,000 (within past 12-month)

- SST registration is mandatory once this threshold is met

Registered businesses must:

- Charge 8% Service Tax

- Issue SST-compliant invoices

- Submit SST-02 returns regularly

- Keep records for 7 years

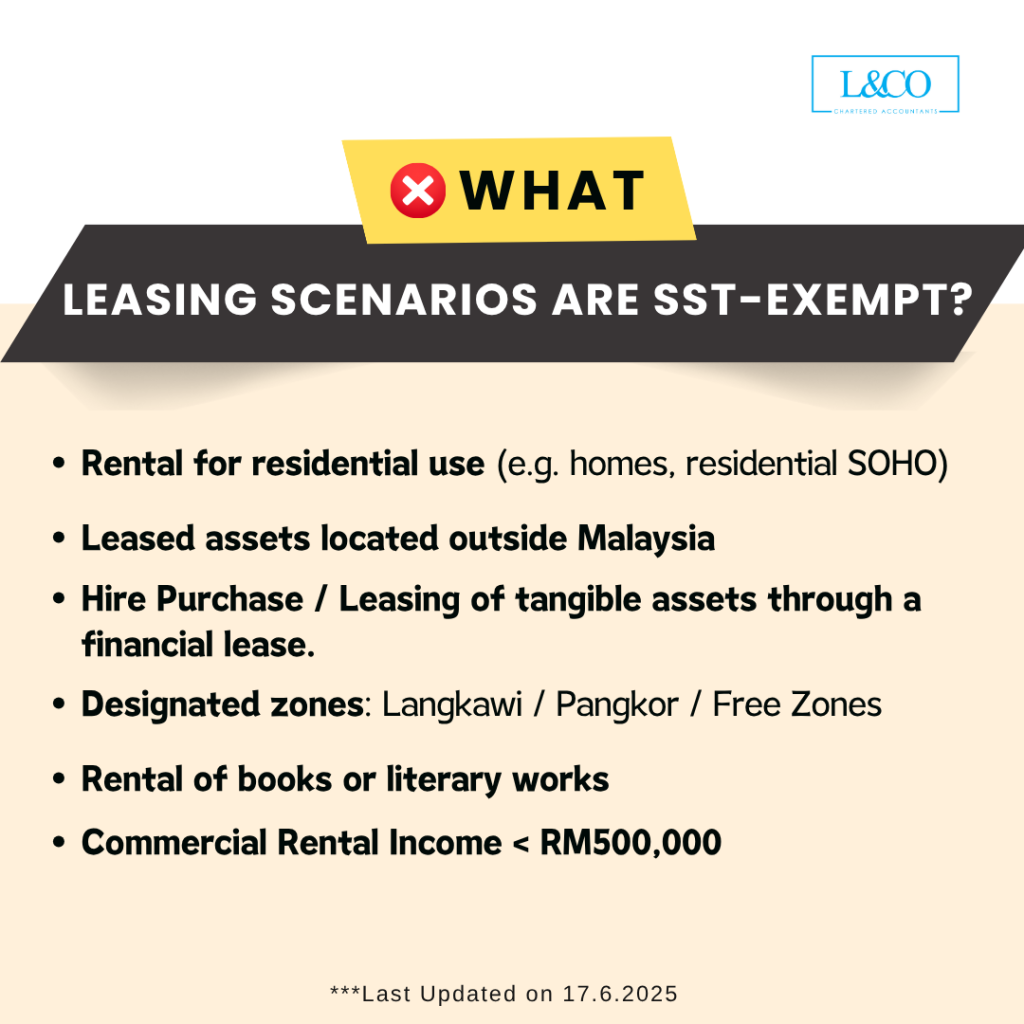

Some leasing activities are exempt from SST. These include:

- Residential property rentals (e.g., homes, residential SOHOs)

- Leases of assets located outside Malaysia

- Hire Purchase / Leasing of tangible assets through a financial lease.

- Special zones like Langkawi, Pangkor, and Free Zones

- Rental of books or literary works

- Commercial Rental Income below RM500,000

If you’ve signed a lease before 1 July 2025, and the agreement:

- Cannot be renewed, amended, or renegotiated,

- Then you may qualify for up to one year of tax exemption under the transitional rules.

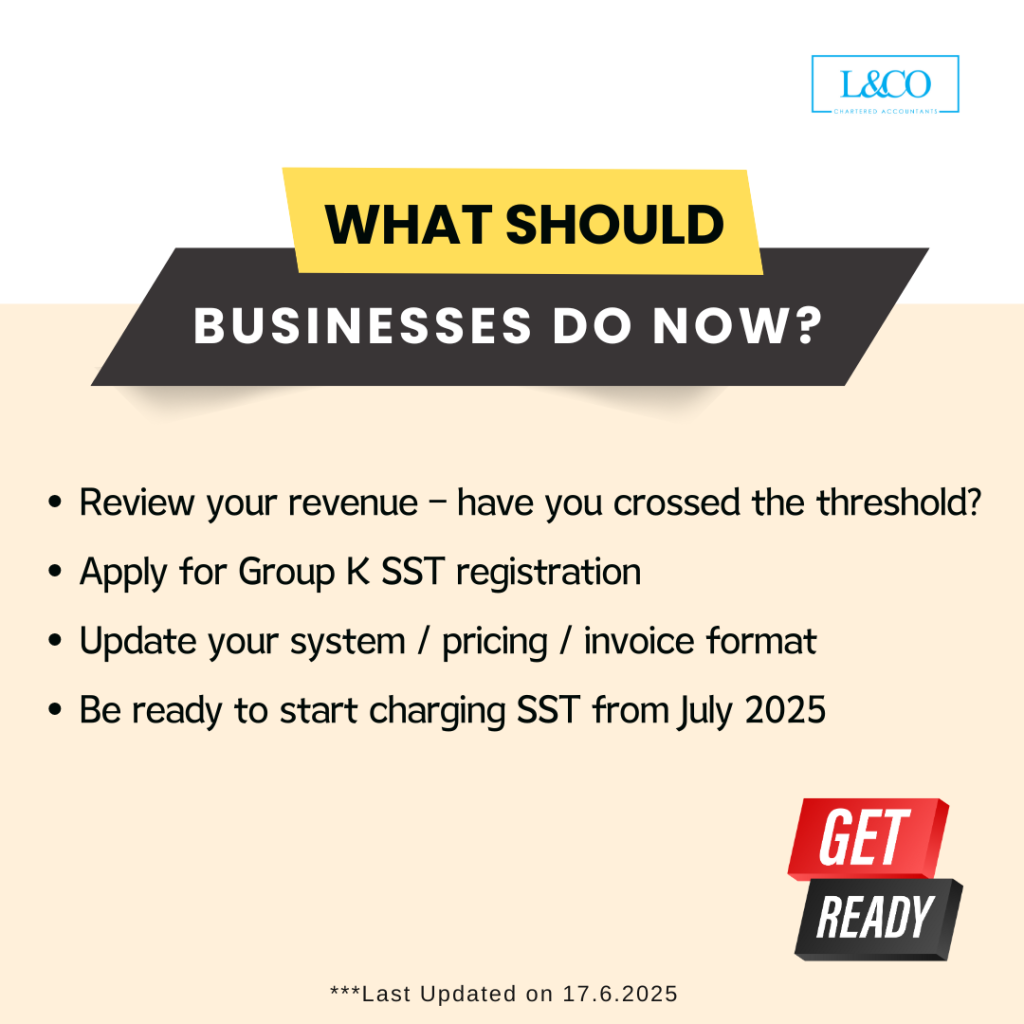

To prepare for this SST expansion, affected businesses should:

- Review their turnover over the past 12 months

- Apply for SST registration under Group K if threshold is met

- Update systems, pricing structures, and invoice formats

- Be ready to start charging SST from July 2025

**Last Updated on 17.6.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)