Comprehensive Analysis of Scope of Application, Filing Methods, Exemption Conditions, and Special Provisions for Digital Services FAQs: 1. Import Service Tax Explanation Under the First [...]

A comprehensive guide covering applicable entities, issuance procedures, exemptions, and verification methods FAQs: 1. Charitable organizations are REQUIRED to issue e-Invoices if they meet any [...]

Service Tax Exemptions for Construction ServicesThe Royal Malaysian Customs Department has issued Service Tax Policy No. 3/2025, introducing multiple exemptions and transitional arrangements for construction [...]

What is Gig Workers Bill 2025 (RUU PEKERJA GIG 2025) about? Malaysia has taken a decisive step in reshaping its labour landscape with the passing [...]

1.10 sen/kWh Rebate on September Electricity Bills Besides this news, what else is worth paying attention to this month? Let's take a look together! KWSP [...]

Here's a collection of government grants available in September 2025. Smart Tech Up Grant Services Export Fund (SEF) Madini Digital Grant Skim Khairat Kematian (SKK) [...]

A comprehensive guide outlining e-invoicing requirements for both local and overseas expenses, clearly distinguishing between different supplier types and invoicing obligations to help employees process [...]

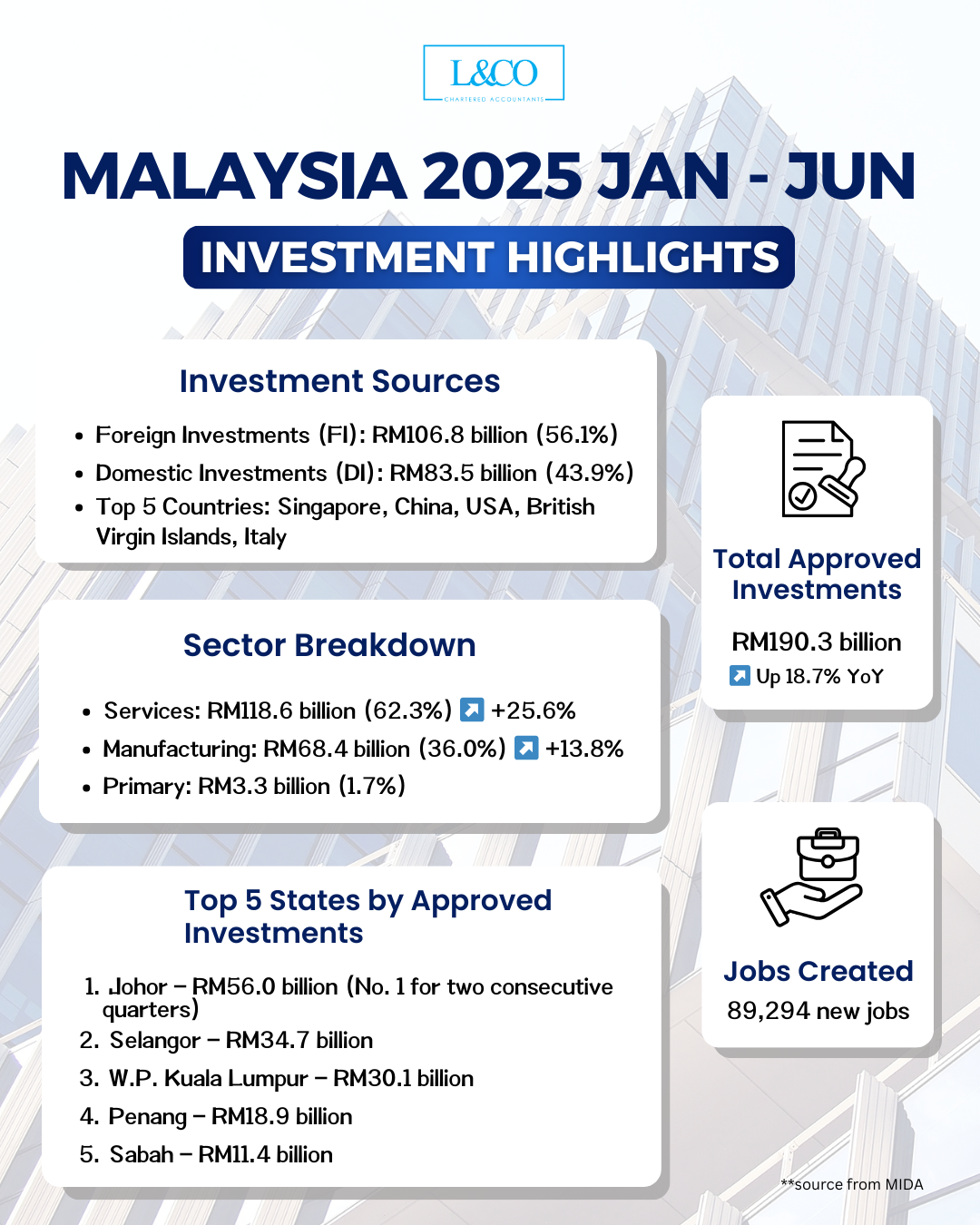

According to the latest data released by the Malaysian Investment Development Authority (MIDA), approved investments in the first half of 2025 grew 18.7% year-on-year, creating [...]

Establishment requirements, benefits, and compliance obligations—all in one! What is an Exempt Private Company (EPC)? An Exempt Private Company (EPC) is a type of private [...]

How should employers appropriately address cases of employee unauthorized absenteeism? The following sets out a compliant handling procedure and key considerations to guide you through [...]

(201706002678 & AF 002133)

(201706002678 & AF 002133)