Comprehensive Analysis of Scope of Application, Filing Methods, Exemption Conditions, and Special Provisions for Digital Services

FAQs:

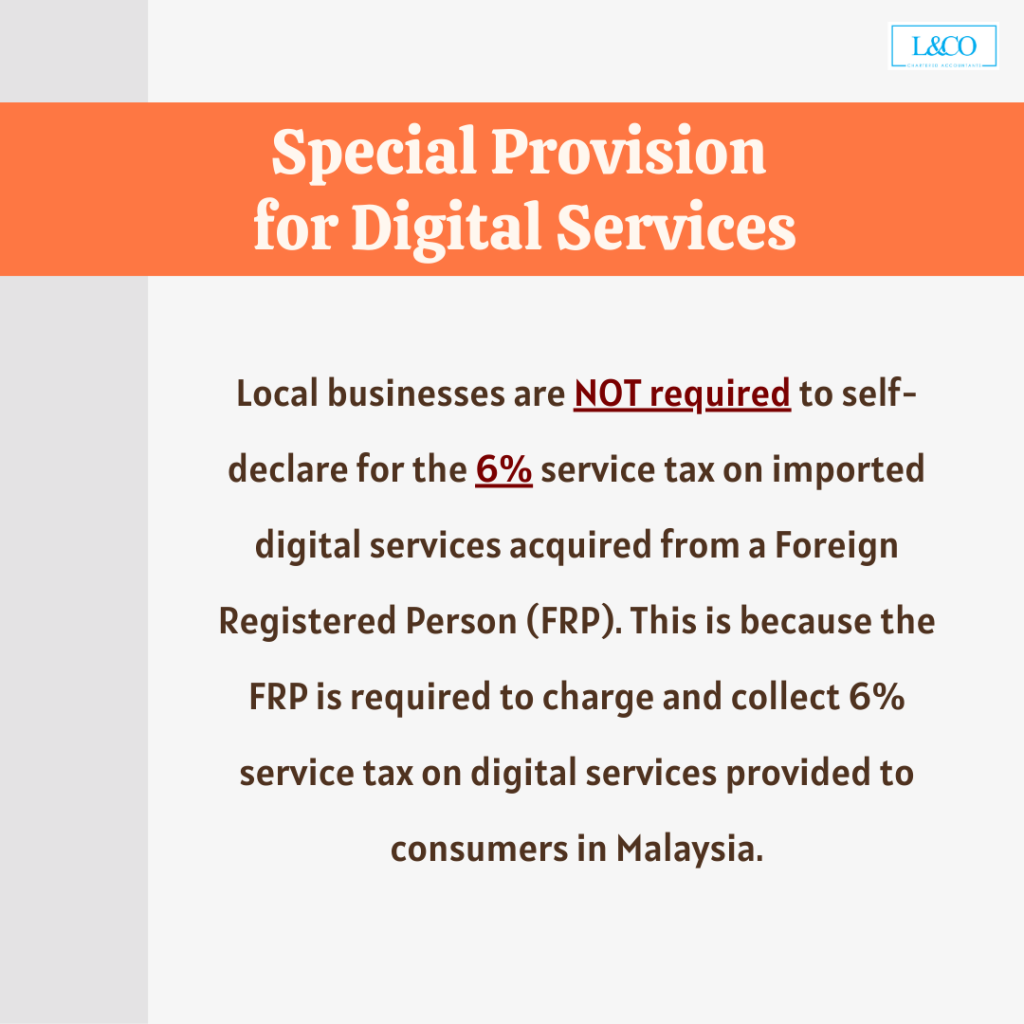

Local businesses are not required to self-account for the 6% service tax on imported digital services acquired from a Foreign Registered Person (FRP). This is because the FRP is required to charge and collect 6% service tax on digital services provided to consumers in Malaysia.

**Last Updated on 08.09.2025

(201706002678 & AF 002133)

(201706002678 & AF 002133)